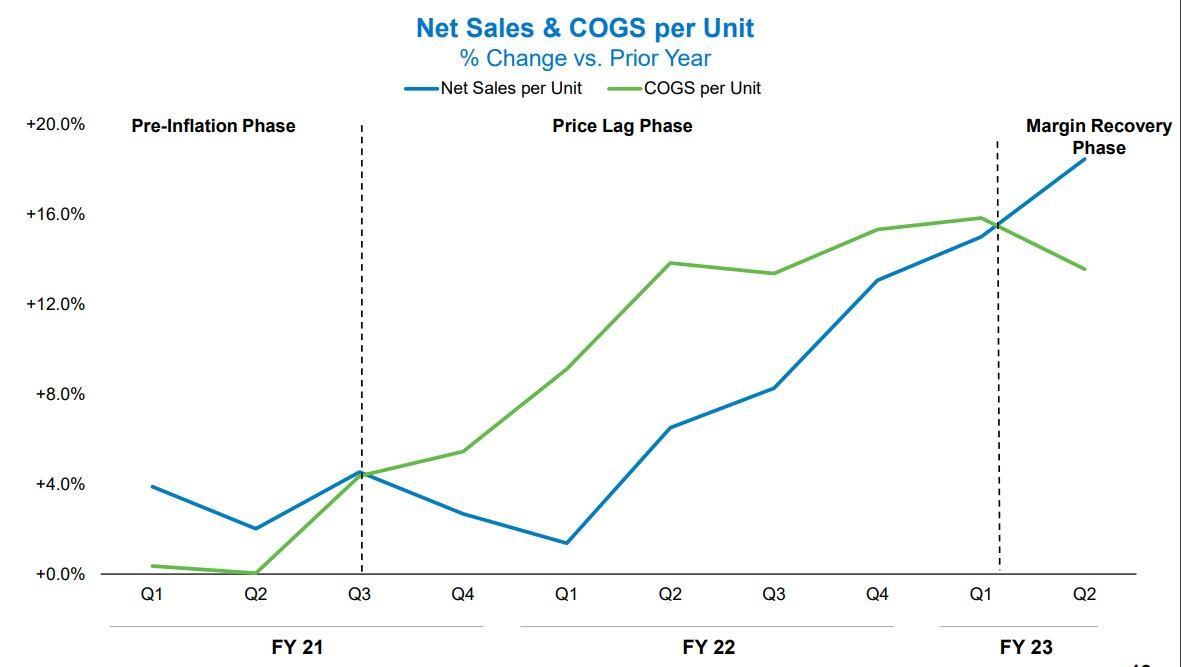

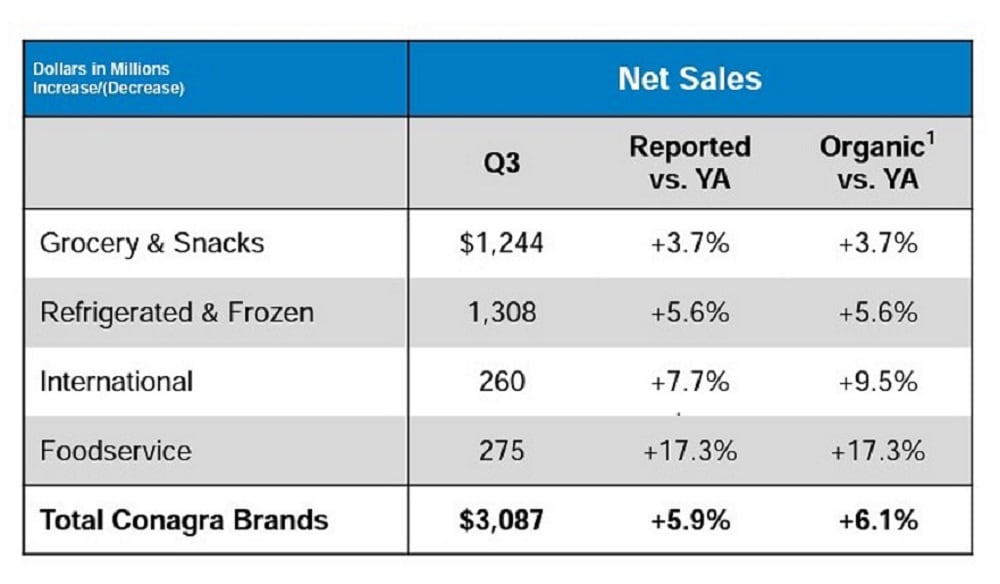

Building up from its Q2 earnings, Conagra Brands’ organic net sales increased 6.1% year over year to $3.1 billion, allowing the company to post nearly a 60% profit increase with a net income of $341.7 million compared to $218.4 million in Q3 FY 22. Elasticity remained relatively modest over the last eight quarters, CEO Sean Connelly explained, despite the increasing price per unit of products to offset inflation effects.

The company’s shares rose 3.15% to $38.75 following its early morning third quarter earnings call April 5, but tempered slightly to $38.28 when the market closed at 4 PM EST. Connelly reported the company’s adjusted gross margin grew 409 basis points to 28.1% and its adjusted operating margin 321 basis points to 16.9% ending Feb. 26, 2023.

Total retail sales grew 5.5% compared to 2022 Q3 and by 24.7% in 2020 Q3. Connelly attributed this to Omicron where consumers were eating at home more often and strong customer support for recently allocated products; as well as removing low-margin volume on value tier vegetables and canned products (Chef Boyardee and Hunt’s Tomatoes).

Conagra zeros in on margin recovery

Margin recovery was the company’s top priority as it moves forward with product innovation and brand building support, particularly in snacks and frozen categories.

“Our gross margin innovation has been the centerpiece of our playbook and success while driving sustained category growth in our two strategic focus areas: frozen and snacks,” Connelly added.

“We are pleased with the continued net sales growth across all four reporting segments,” CFO Dave Marberger said during the performance summary.

Frozen sees strong performance despite manufacturing disruptions

Frozen retail sales growth (4% and 23% growth on a one- and three-year basis, respectively) were primarily driven by the company’s key categories, including breakfast sausages (19.9% growth) and single serve meals (6.0% growth).

The frozen domain performed well over the last year primarily due to the Omicron outbreak when consumers were eating at home, where single serve meals increased by 12%.

Within the frozen category, disruptions in the fish business led to out-of-stocks during peak Lent season. Connelly cites this was due to a fire on the fish frying line (reported in Q2), although these root causes have been largely resolved.

Grocery and snacks maintain momentum

Grocery and snacks saw a similar story where retail sales grew by 7% driven by inflation pricing, compared to Q3 FY 22 and a 39% increase from Q3 FY 20. Snacks’ volumes declined by 10% although the company saw share gains in meat snacks, microwave popcorn and staple categories including refried beans, Asian sauce and marinades.

Despite discrete supply chain issues in the company’s canned meals and sides businesses, Connelly notes the staples portfolio saw a decrease in retail sales of 7% compared to 10% in Q2, but growth of 20% compared to Q3 FY 20.

The company experienced out-of-stocks in the quarter due to manufacturing disruptions, which most notably impacted canned meals such as canned pasta, beans, chili and meat in its grocery portfolio.

“While we’re making good progress in supply chain, it’s not back to normal and industry-wide challenges persist. However, we’re recovering as expected, and we see more room for improvement as we advance our productivity initiatives, and the macro environment continues to normalize,” he added.

ConAgra’s updated guidance sees strong growth ahead in moderately inflated economy

Overall, the company expects to raise its bottom-line estimates while delivering on its top gross and margin guidance for the rest of the year, Connelly said.

Updated guidance reflects a 7% to 7.5% expected organic net sales growth, a 15.5% to 15.6% adjusted operating margin and an adjusted EPS growth between $2.70 to $2.75.

Connelly stated, “When you take the noise out of the short-term view and compare our growth versus the stable baseline of three years ago, you see our performance has been strong on both the top and bottom lines. Dampening the results versus this time period normalizes for volatility across demand, inflation and supply chain throughout the pandemic.”

With an expected total gross inflation of approximately 10% for FY 23, the company intends to continue to implement pricing actions in response to inflation. Connelly reiterated that the path ahead will focus on productivity and value over volume and pushing past supply chain disruptions.