In response, its shares jumped 3.93% in less than 24 hours from $38.42 Wednesday evening to $39.92 Thursday afternoon following the company’s early morning second quarter earnings call Jan. 5 during which CEO Sean Connolly revealed that the company’s adjusted gross margin had risen 310 basis points to 28.2% and its adjusted operating margin 237 basis points to 17% in three months ending Nov. 27.

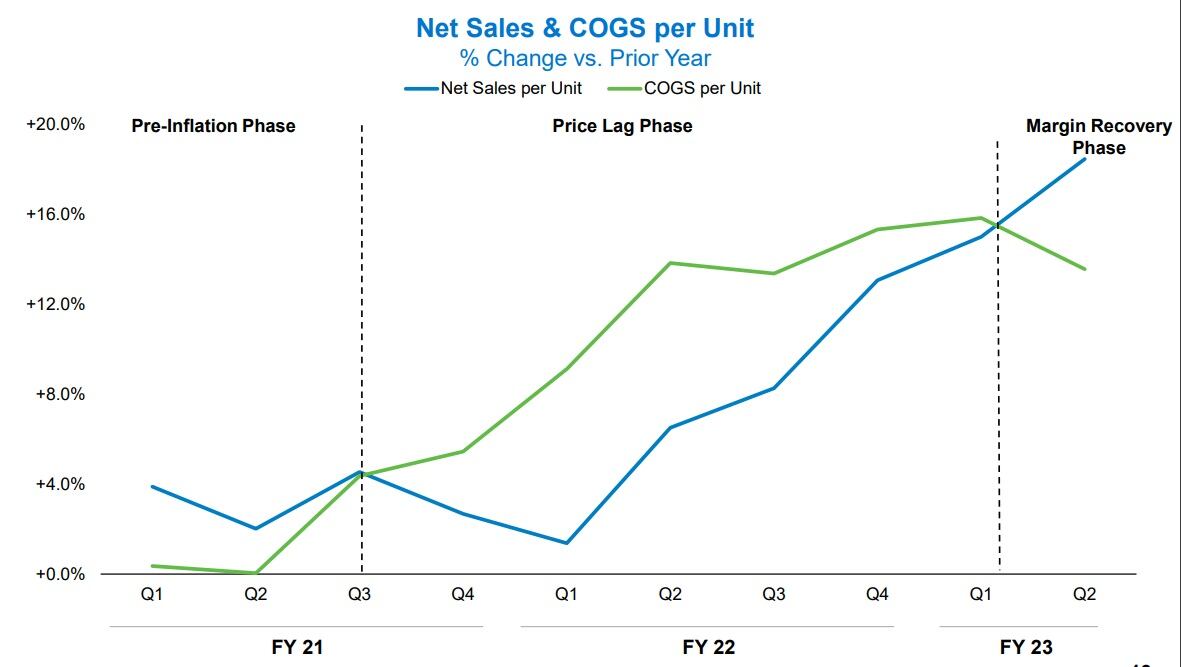

He explained that the dramatic shift represented “a significant inflection point in the relationship between net sales and [cost of goods] – marking the end of the temporary margin compression phase” in which the company had been stuck since the end of fiscal 2021, and “the beginning of the margin recovery phase.”

‘Continued inflation extended this period of margin compression’

Like many CPG companies, Conagra Brands has faced high inflation in the upper teens since late 2021, and while it – like others – has raised prices incrementally to offset higher costs, it struggled to fully close the gap, which at times hovered around a 6% difference in net sales and cost of goods per unit.

“When unprecedented inflation increased our cost of goods, we took strategic pricing actions to help offset the rising costs. However, there was an inherent lag between when we implemented pricing actions and when we realized the benefits of those actions in our top line results. This pricing lag resulted in a temporary margin compression,” Connolly said.

In the past two quarters, the company’s adjusted gross margin held between 24.8% and 24.9% -- a far cry from the 28.6% it enjoyed in fiscal 2021 and 28.1% in fiscal 2020.

Connolly explained, “Continued inflation extended this period of margin compression as new inflation justified pricing actions lead to additional lag effects. That is the dynamic we have experienced over the last several quarters as we continue to play catch up by increasing price incrementally to account for the extraordinary extended rise in inflation.”

Now that inflation has begun to moderate in certain areas, Conagra’s pricing “has finally caught up,” he said.

Supply chain, operational improvements support margin gains

But it wasn’t just strategic pricing and patience that helped Conagra flip the relationship between price and costs. Connolly also attributed the victory to improvements in its supply chain and operations.

“We made good progress on our supply chain during the second quarter, which benefited from improvements in the services we provided to our customers, continued headway on our ongoing productivity initiatives, which remained on track to achieve the targets we outlined at the most recent investor day,” he explained.

For example, he said, in the second quarter, Conagra’s fill rates were over 90% in some categories well above that and even back to normal in some categories.

Still, he cautioned about “pockets of friction” in the supply chain and ongoing labor challenges.

“On labor, we have filled more positions, we’re seeing less turnover, but because our labor force … is less experienced, it is still less efficient,” he explained, adding he expects it to improve as newer employees cross the learning curve.

Commodity prices moderate, but benefits will be delayed

Lower commodity prices also helped Conagra overcome the price lag, and prompted it to lower its projections for inflation in fiscal 2023 to about 10%, which is notably below the upper teens that many of its peers are predicting.

CFO Dave Marberger explained that while Conagra’s projections may be lower than competitors, they should not be trivialized because the company was hit with inflation earlier and at a “much higher level than most food companies,” and so any additional increase is off a higher base.

Likewise, Conagra may not benefit immediately from slowing inflation in areas where it locked in contracts – a strategy that served it well when costs were rising quickly but means it may now pay more than spot market prices.

Conagra will continue to pursue pricing actions as necessary to offset additional inflation and maintain its new position, added Marberger. This includes previously announced increases that will go into effect this quarter, but which he added are “smaller and more targeted” than previous hikes.

Additional margin improvements on the horizon

As the company pushes forward with this strategy and finally enjoys the benefits of earlier actions, Connolly predicted that Conagra’s margins this quarter will not be a “peak,” but rather the company will continue to benefit from its ‘playbook.’

Marberger agreed, noting that the company expects the gross margin change in the second half of the fiscal year to be “pretty consistent with what we saw in Q2 around that 300 basis points.’