Among the investments and changes shared by Walmart executives during the company’s fourth quarter earnings call on Feb. 20 that could impact manufacturers' bottom lines are improved supply chain efficiencies, additional price rollbacks, streamlined fulfillment capabilities and expedited delivery.

Food manufacturers that partner with Walmart also could benefit from the retailer’s expanding appeal among more affluent shoppers.

Walmart’s AI and automation may bolster margins for manufacturers

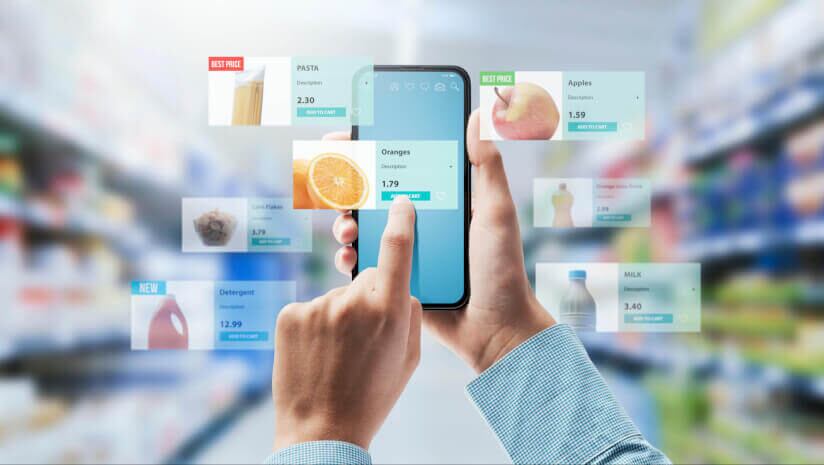

The company’s improved supply chain efficiencies (e.g. stocking accuracy, speed, etc.) are a result of its investment in automation and AI, which result in lower operational costs and better product availability, explained Doug Rainey, CFO, Walmart. The company’s technology capabilities adjust prices dynamically based on demand, competition and inventory levels – which could help brands optimize their margins and ensure their pricing is competitive.

Walmart announced 22,000 rollbacks across its inventory last year “to help people save money,” in addition to providing quicker delivery and accuracy for e-commerce shoppers, said Doug McMillan, CEO, Walmart.

Brands participating in Walmart Fulfillment Services (WFS) could benefit from streamlined logistics, speedier deliveries and customer satisfaction, as nearly 45% of orders are fulfilled from WFS, according to McMillan.

Walmart’s investment in developing its same day delivery strategy reached 3% of households, contributing an additional $36 billion in revenue year-over-year, Rainey said.

“The popularity of expedited delivery has resulted in more than 30% of orders coming from customers and members that elected to pay a convenience fee to receive their scheduled delivery in less than one hour or less than three hours,” Rainey elaborated.

In response to a question about the impact of tariffs and expedited orders Walmart’s e-commerce business, the executives maintained that the use of technology like generative AI to optimize costs and delivery will help manage the business for long-term growth.

Grocery business continue to thrive amid economic pressures

As food prices remain inflationary, consumers across all income levels shopping at Walmart as they prioritizing value amid ongoing economic pressures, explained Rainey. This including upper income households, which accounted for the majority of market share gains, Rainey said.

“We are strengthening our ability to serve people how they want to be served in the moment. That’s what’s driving our growth. Our prices are low and we’re becoming more convenient,” explained McMillan.

Grocery sales were a “standout category” with mid-single digit growth, with mid-teen growth in health and wellness categories resulting from GLP-1 sales, according to Rainey.

The retailer’s profits are also “growing faster than sales and we have runway to scale our higher margin businesses like membership, marketplace and advertising,” with a wider product assortment, Rainey said.