Kind explores minority stake sale: What does it mean for a company its size?

According to Reuters, this may attract large food companies such as Kellogg, General Mills, PepsiCo, or Campbell Soup, who want a slice of the action in the 13-year-old snack company, which Euromonitor data suggests generates $727m in annual sales.

Kind is not offering the right to buy out the entire company down the line as part of the deal, one of the sources told Reuters.

However, for a company at Kind’s stage, minority investments have been less frequent.

Kind and the investment banks cited by the sources (BDT Capital Partners and Centerview Partners Holdings) have remained tight-lipped about the issue, but the rumors have sparked a lot of discussion among food industry players about what will come next for one of the most recognizable, independent natural snack brands in North America.

“It makes sense,” opined Chicago-based transactional IP expert Mark Thomann of Spiral Sun Ventures, commenting independently on the issue. He has 15 years of experience in valuing, structuring, and consummating financial transactions involving trademarks and brands, and is on the board of directors of several early stage companies.

“The reason for them to do this, by allowing someone to put their toe in the water from an investment standpoint, will eventually lead to a higher valuation down the road,” he he told FoodNavigator-USA. “Ultimately, there will be a premium to acquire the company in full, so in my opinion this is more of a valuation play.”

Getting a slice of Kind’s share in the natural category

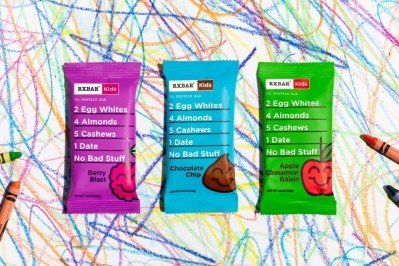

Kind’s mission has been to deliver ingredients consumers can pronounce, and as a highly recognizable brand, Thomann argued that the thought of a minority stake in Kind may make many big CPG companies’ mouths water.

“Obviously all the big CPG companies are looking for ways to grow and Kind has demonstrated the ability to get to a pretty significant, top-line revenue of $700 plus million dollars,” he said.

A minority stake in Kind may immediately give a positive boost to big brands such as Kellogg or General Mills, Thomann added. “Big CPG strategic buyers are well aware that the natural food category is growing, whereas some of the other categories are in decline or just flat."

According to Thomann, any big CPG firm that may end up buying a minority stake in Kind would be wise to keep the brand 'exactly how it is,' referring to Kind's portfolio of products, recipes, branding, and marketing strategies, which have helped it take a sizable market share in the decade of its existence.

He added that consumers today are less likely to view any ‘Big Food’ stake in Kind as a ‘sell-out’ for Kind, or a negative or desperate move on the part of the big CPG firms.

"In fact, there will be a halo effect for [a Big Food company]," he argued. "Consumers can see it as their investment in health and wellness.”