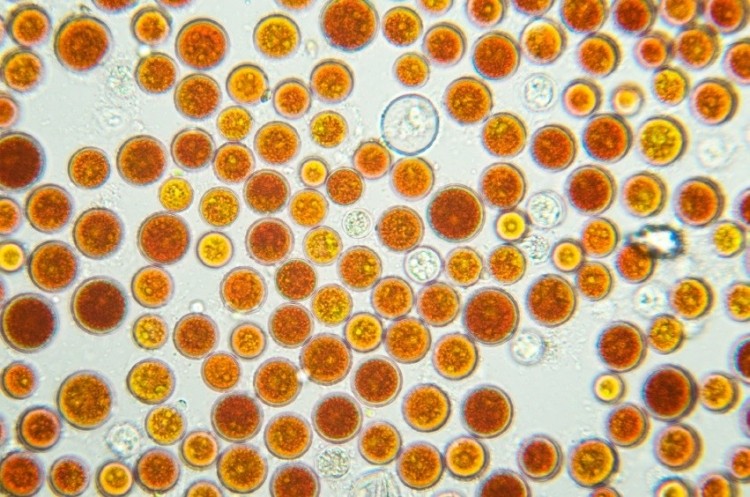

Special edition: Algae

Expert says algae's promise still huge despite disappointments in ingredient development

Algae’s promise is there for anyone to see—the stuff grows faster than any other plant and is present in the environment in myriad forms with different chemical compositions. But harnessing that power has proven much more difficult than many entrepreneurs realized, according to Mark Edwards, an emeritus agribusiness professor at Arizona State University who has devoted his career to fostering algae development.

Edwards said his interest in algae started from the bottom—or better put, keel—up. As a student at the US Naval Academy in 1966, where he had enrolled in a nascent oceanography program initiated by Jacques Cousteau, Edwards was assigned to scrape the bottom of boats. The next day, the algae had repopulated a scraped section, and Edwards said he had an epiphany.

“I was greeted with a thick layer of algae that had regrown on the keel. I said, why grow corn for food when algae grows more than 30 times faster?” Edwards told NutraIngredients-USA.

Algae has a history of use in the food supply that potentially stretches back as long as organized human activity. Edwards, who is active in the Algae Biomass Organization, has in the past postulated that dried algae harvested from ponds may have formed the first on the go, convenience food, as well as being a source of fertilizer and medicine. But it was the organized farming of cereal grains that led to the development of the first cities in the Middle East and in China, and terrestrial agriculture has predominated since.

Near term promise

Edwards believes that is about to change. In his view, algae-derived foods and ingredients will at some point in the coming decade do the following:

- Algae-based medicines are likely to replace many of the 80% of medicines currently derived from plants and animals, because algae-based medicines grow faster and deliver more of the target compounds. The same goes for algae as a source of many dietary ingredients and ingredients for cosmetics.

- Algae-based nutrients will become the primary input source for functional foods that deliver immediately bioavailable vitamins, minerals and nutraceuticals in natural foods.

- Algae derived omega-3’s, astaxanthin and other antioxidants will replace fish oil with a healthy, vegan alternative to harvesting massive amounts of fish for minute amounts of oil

- Several algae species will replace soybeans and corn with higher-quality, gluten-free, higher protein power drinks, bars and texturized vegetable protein products.

- Macro and micro algae snack products will provide a low calorie, high taste, texture and protein alternative that will continue to take market share from potato, corn, soya and other snack forms.

- Algae-based alternative meats including: beef, poultry, pork and fish will become market leaders far before consumers seriously consider insect-based protein products.

So the promise is there, and Edwards is far from the only proponent. But reality falls far short of that promise. Omega-3s, especially DHA from fermentation organisms, have a solid position and EPA from photosynthetic algae is starting to show up on the market. The market for astaxanthin from algae continues to thrive, and there is solid demand for whole spirulina and chlorella products. But as for the rest of this vast promise, the wayside is littered with broken algae dreams, with the corpses of companies that touted newly identified, exciting organisms or growing technologies and harvesting and extraction techniques. Why, given this glittering potential, has it proven to be so hard for developers to bring algal ingredients to market?

Biofuel detour

One underlying issue in Edwards’ opinion is the way in which Defense Department funding was used to jumpstart the sector in past decades. Before fracking came on the scene to greatly boost domestic hydrocarbon production, there was a great deal more angst in military planning circles about fuel stockpiles in the event of a protracted conflict that might interrupt oil deliveries. Several government funded programs successfully achieved the endpoint of deriving jet fuel and other fuels from algae (at great cost, it should be noted), and injected a technological jumpstart into the sector as a bonus. But that benefit didn’t spread very far, Edwards said.

“Military investments for liquid transportation fuels have been highly beneficial to the algae industry. Unfortunately, in spite of the federal grant requirements to share the findings of as well as the promises by the executives of the federally funded firms, few of the innovations funded by federal monies have trickled down to other members of the industry. Most of the intellectual property developed with federal money remains locked in corporate files, which benefits few firms but not the algae industry or academic and institutional scientists,” he said.

The algal biofuel boom faded as it became clear that the fuels would not be able to compete on the open market in a sector so rigidly locked in to commodity pricing and in which the underlying metric—the price of crude oil—had declined so precipitously. After all, most fuel consumers don’t care where the stuff comes from; they only care if it burns properly and it’s the right price.

Difficult pivot

So algal firms that got their start in fuels tried to pivot to deriving dietary ingredients from their organisms. Most failed, because they did not appreciate how different the requirements were, Edwards said.

“The demands for nutraceutical purity and production reliability are very different from the quality requirements for liquid transportation fuels. The production of high quality algae bioproducts has surprised many companies due to the high requirements for biotechnology skills and investment,” Edwards said.

Among the main reasons for these failures, Edwards put forward the following:

- Mission drift, as firms start with a focus on the production of one target compounds such as oil for energy and then change to foods, feeds, fertilizers, nutraceuticals, cosmeceuticals or medicines.

- Economics, as executives or scientists over promise productivity or yield metrics that are not achievable short-term.

- Technical reality, as challenges occurred in species selection, cultivation, harvesting, compound extraction or processing.

- Scale, as the requirements for production size may require scale up beyond the financial means of many startup organizations.

Believing in the promise

Despite all of the potential downsides, Edwards said he still firmly believes in algae’s potential.

“The algae industry has a long history of over promising and under delivering because it’s so easy to grow weed algae yet relatively difficult to grow high-quality algae with precisely the target compounds desired,” Edwards said.

“In summary, Mother Nature has not given up her algae secrets easily. I remain enthusiastically optimistic about the algae industry. Within five years, consumers will have algae bioproduct choices in nearly every food category. Algae foods can be produced as ‘freedom foods,’ free of consumption of fertile soil, freshwater, fossil fuels, inorganic fertilizers or agricultural pesticides or poisons. These foods will deliver superior nutrition and taste without pollution or waste,” he said.