What the cost-of-living crisis is doing to the sweet bakery category

Jane Hales, director of Sapio Research, opens the report with the word ‘permacrisis’, chosen as Collins’s 2022 word of the year and defined as an ‘extended period of instability and insecurity’.

“No area of society currently remains untouched by the permacrisis, both consumers and businesses alike,” she writes.

Sapio Research’s International Business Barometer found that 69% of businesses reported employees have asked for more financial support, 95% are concerned about a recession, 72% believe they will feel the impact of the recession by the summer, and 24% are already feeling the pinch.

“As a consequence of both the cost-of-living crisis and the recession, businesses are having to make difficult decisions including reviewing working hours and deciding whether to stick or twist with sales and marketing activities and budgets.”

Not such a merry Christmas

The research – undertaken in Q4 2022 by the London-based research agency – revealed that 84% of the 1,000 Brits surveyed have had their income reduced by the crisis, meaning that it can no longer be business as usual for suppliers of that sweet bakery treat.

Hale continues, “It is not surprising to see that the majority of consumers have seen their budget for sweet-baked goods reduced and, as a result, are purchasing their favourite sweet treats less often.”

The sector did not have such a merry Christmas when it came to sweet bakery sales. In fact, the report reveals the number of consumers purchasing a sweet treat several times a week dropped from 36% pre-crisis to 22%.

Instead of buying from a variety of places (pre-crisis), 64% now tend to limit their choice to a single type of business, the top three being supermarkets (80%), chain bakeries (27%) and convenience stores/independent bakeries (both 16%).

The crisis has placed price ahead of taste in the list of consumer priorities when making the decision to dive into a treat or not, with many turning to discount stores, buying non-branded goods or passing a premium option for a standard tier item when the craving hits.

“The research brought up some interesting findings,” said Helen Sinclair, UK marketing manager at Baker & Baker.

“While price is a major factor on purchasing decisions as disposable income is squeezed, the research highlights that people are responding in different ways – indicating ‘value for money’ is very much a consumer priority, but this does not necessarily mean they are looking for cheaper, lower quality goods.”

How to remain competitive

The report - the second in a series of reports to be published by Baker & Baker - is not all doom and gloom, though, and recommends tips for businesses to remain competitive during these challenges times without compromising on quality.

These include demand-led baking, getting creative to reduce SKUs and sticking to familiar flavours. Reducing portion sizes is another way of maintaining quality while addressing the current price situation.

Criteria like sustainability, calories and brand loyalty might have taken a bit of a backseat for some consumers, however, smart businesses will keep these front of mind as they remain priorities among the younger generation.

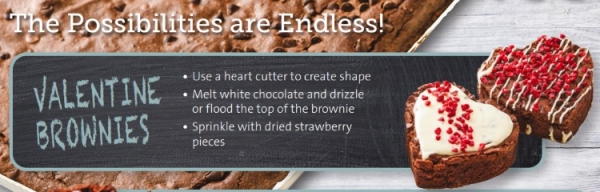

Bakery Bites even includes recipes to give businesses inspiration on how they can turn ‘waste into wow’ with Baker & Baker’s Fudge Brownie Sheet Cake.

“The standout finding from the research is that it can no longer be business as usual for bakeries, food service operators and retailers, with only 1 in 5 consumers feeling their spending hasn’t changed because of the cost-of-living crisis. And while price is a major factor on purchasing decisions as disposable income is squeezed, the research highlights that people are responding in different ways – indicating ‘value for money’ is very much a consumer priority but this does not necessarily mean they are looking for cheaper, lower quality goods,” added Sinclair.

Baker & Baker is one of Europe’s leading suppliers of bakery goods, supplying the retail, food service and the artisan channels with brands like Baker & Baker American Bakery, Goldfrost, Concadoro and Molco. It also has licensing brand agreements with Mondelez and Disney.

The ‘Rising cost of living crisis’ report is Baker & Baker’s second Bakery Bites report, with more in the pipeline for 2023 looking at other key issues impacting the bakery industry.