Kellogg predicts its US cereals will grow 'a couple of percent' in 2016

Announcing a 1.5% year-on-year increase in fourth-quarter sales of the company’s US Morning Goods division – which includes its breakfast cereals – Kellogg chairman and CEO John Bryant said he would expect cereals to grow “a couple of percent” in 2016.

Although 2015 full-year sales of US Morning Goods were down 1.6% year-on-year, the decline was shallower than the 5.7% drop reported by the business a year ago.

IRI data shows the total US cold cereal market fell 1.2% by value in 2015 on volumes down 1.7%.

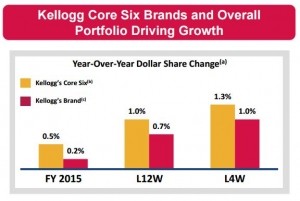

Core brands lead the way

Kellogg said its improved performance had been led by its core brands, with growth in consumption of Raisin Bran, Rice Krispies, Frosted Flakes, Mini Wheats and Special K up in the past quarter.

The company said Special K had been in “high single-digit growth” driven primarily by changes to brand messaging, and renovation work done last year on the Red Berries variant. Kellogg added that Raisin Bran had been in good growth following the launch of Raisin Bran with Cranberries.

“We also put fun back in the box with Avengers and Disney Frozen-themed cereals and have quickly taken these learnings to other regions in the world,” said Bryant.

Sales team investment

Additional investment in the sales organization as part of the company’s four-year Project K efficiency program had also benefitted the cereals business, added Bryant.

“We invested where we needed to and improved the fundamentals,” he said. “In-store execution has been significantly better than in the past and I think the US sales team has done a terrific job of driving the performance of that business.”

“Because of these changes, and because of the momentum we are seeing in the US cereal business, we are quite optimistic about 2016.”

Bryant added that he would have previously considered flat sales in 2016 a success but, now, “given the strength of US cereal over 2015 we would expect our US cereal to grow a couple of percent in 2016.”

New product launches

Kellogg said on-trend products such as Special K Nourish and Harvest Delight Mini Wheats would continue to drive sales, and that it also had “fun additions” including Smorz, Disney Dory-themed cereal and orange crush Pop Tarts.

“We are excited about the plans for 2016 and expect continued improvement,” added Bryant.

Kellogg reported a 10.6% drop in overall sales in the last quarter of 2015 to $3.1bn. The company also announced full-year sales down 7.2% year on year to $13.5bn, although currency-neutral comparable net sales increased 1.2%. Currency-neutral comparable operating profit increased 2.8% in Q4, but was down 2.3% across the year to just over $2bn.

For full results see here.

Analysts' view: industry experts on challenge Kellogg faces

Pinar Hosafci, senior food analyst, Euromonitor International:

According to our projections, the US cereal market is expected to contract through to 2017, however, the rate of the decline will not be as high as it was two years ago.

In other words, we see signs of recovery and Kellogg is definitely going to benefit from that.

Kellogg’s recent shift from a management focus towards a pure naturalness/naturally healthy focus has helped the company to slow down the decline in its cereal business and improve profitability in the category.

The messaging change in Special K was particularly useful and Kellogg is seeing some return of its efforts given the solid performance of its recently launched Special K Nourish brand.

However, the majority of Kellogg’s portfolio still stems for RTE flakes and high-calorie children breakfast cereals which continue facing structural challenges.

Marcia Mogelonsky, director of insight, food and drink, Mintel

A return to full-year growth for Kellogg’s US cereals is going to be a challenge. The cereal category already has deep penetration in the US, with 96% of adults eating it [Mintel 2015], and a similar percentage of kids and teens.

The key is how to get them to eat it more frequently and to choose Kellogg's...

Kellogg's has launched innovations/renovations of note, and one of the keys was repositioning Special K as a wellness cereal rather than a diet product. This may encourage more consumption - or retain consumption - among core users who may feel ready to transition away from ‘dieting’ as a lifestyle to ‘healthy/better-for-you’. It may also encourage non-users to try it because it is no longer a "diet food"

Issues Kellogg has to contend with include sugar content and protein content – consumers still think there is too much sugar in cereal and believe they need to increase the protein in their diets [31% of those who are eating less cereal are eating other breakfast items with more protein - Mintel 2015]. Kellogg will have to find ways of better communicating the protein content of specific cereals.

There is also the convenience factor - while consumers agree that cereal can be eaten at any time of day and that it makes a great snack, there are still issues around portability (40% think it should be more portable) and ease of use. That’s where cereal bars come in - and cereal is still missing out

Kellogg has a tough road ahead but since the company views cereal as part of its broader ‘morning foods’ portfolio it is possible that the cliche "a rising tide lifts all boats" means the success Kellogg is seeing in other morning foods such as its bars, and health and wellness business will help push forward cereal sales

Sales may move up a little more in the next year. But it is not going to be easy as there are still inherent issues in the category as a whole to deal with.