Special edition: Oils & Fats

Chewing the fat with Columbus Vegetable Oils: ‘We had a lot of phone calls after FDA dropped the PHO bomb…’

“A lot of people in packaged foods took action when the FDA trans fat labeling requirements came in [in 2006], but some companies that were selling products that didn’t have a particularly healthy profile anyway just carried on using PHOs because they didn’t want to lose performance,” he told FoodNavigator-USA.

“PHOs just work really well in many applications, and having trans fat on the label wasn’t seen as a deal breaker.”

The challenge with PHO replacement is that what works for customer A doesn’t necessarily work for customer B

In the foodservice & snacks sector, meanwhile, although large companies in the media glare started to reduce or eliminate PHOs years back, some smaller companies have carried on using them in their fryers because they like the performance, they don’t want to switch to high oleic canola, and the new high oleic soybean oil is not quite yet available in large quantities, he said.

”So when the FDA came out with the tentative determination on PHOs in November, we had a lot of calls and have been working with a lot of customers to find the right solutions for them.

“The challenge with PHO replacement is that what works for customer A doesn’t necessarily work for customer B because they all have different processes and formulations. No pie crust is exactly the same; you can’t just drop in one shortening that will work for everyone.

“So we went from say 10-12 products that would cover every application, to more than 60, and some are unique to particular customers."

We went from say 10-12 products that would cover every application, to more than 60

He added: “Some applications are more difficult than others but for us, our palm oil business has probably increased about 1,000% in the last few years, although we’re also using a lot more interesterified oils [where the structure of liquid oils is altered via chemicals or enzymes to make them more stable or/and more solid], high oleic canola and sunflower.

“But if you want to use the high oleic oils in bakery you need to blend them with harder fats like palm or mix them with fully hydrogenated soy and go through an interesterification process, and not everyone wants to put the word ‘hydrogenated’ on the label.”

Asked whether the FDA’s approach is the right one, given the level of anxiety its proposed de facto PHO ban has caused in the industry, he said: “I can see both sides.

“Some customers don’t want to be reliant on foreign vegetable oils [such as palm, which is widely used to help firms replace PHOs, especially in baking applications where hard fats are needed] because they are worried about sustainability or saturated fat.

“But I can also see why the FDA wanted to do this, to help consumers help themselves.”

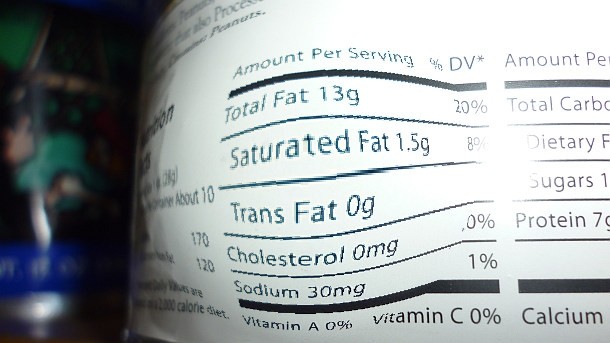

Saturated fat attitudes: ‘It’s very customer specific.’

As for saturated fats, some customers are more focused on reducing them than others, with much depending on the end products and markets, he said. “It’s very customer specific.”

But people are also confused about what their priorities should be in this area given that the discussion over whether saturated fats are really the enemy keeps raging, he said. “It keeps coming and going.”

As for emerging trends clocked by the family-owned business, which is growing in the double digits and offers everything from olive and coconut oil to customized bakery shortenings, non-GMO is starting to make some headway, he said.

“We can supply organic and non-GMO identity preserved canola and soy and we’ve got several products that have gone through the non-GMO project certification process. There is huge demand for that, although you could argue it’s kind of redundant for oils that were never genetically engineered in the first place such as coconut, palm and olive.”

Sustainable palm oil could potentially really take off

While there are huge challenges around building the infrastructure to support identity preservation through the palm oil industry, things could change following firmer commitments from retailers, he said.

“I think sustainable palm oil could potentially really take off. We’ll have to see what the markets do.”

Insights from IFT: Click HERE to see what Dow Agrosciences thinks about the PHO crackdown and click HERE to see what the American Bakers Association had to say at the IFT show...