Kanbo International bets big on sucralose with new factory in China and intl HQ near Chicago

The firm, which opened an international HQ in Oak Terrace near Chicago in the spring, said the new plant – opening late summer - will produce granular and powdered sucralose using proprietary crystal formation technology developed in partnership with Nanjing University that it claims can produce a consistent product more efficiently.

But what gives Kanbo the confidence to invest given Tate & Lyle CEO Javed Ahmed's recent observation that supply remained “well in excess of demand”?

VP Fernando Gonzalez – a sweetener industry veteran who has worked at McNeil Nutritionals (sucralose), PureCircle (stevia), and NutraSweet (aspartame) and joined Kanbo in 2014 – told FoodNavigator-USA:

“There might be overcapacity in the market today but everyone agrees that demand for sucralose will continue to rise. Stevia has taste issues and aspartame degrades with heat and pH. We’re seeing demand from companies all over North and South America, Europe and Asia, although I think in terms of volumes the main growth will be in China.”

Not everyone in the sucralose market is in it for the long haul

As for industry capacity, he said, “Not everyone in the market is in it for the long haul; a lot of players only got into the market to fill a void, but they have had legal problems and pollution problems or they just don’t have the scale to compete, and some have already closed down.”

Similarly, with the price of sucralose now at near-parity with aspartame – which historically has been significantly cheaper than sucralose - more manufacturers “will go with sucralose” he predicted.

While still an ‘artificial’ sweetener, sucralose has some technical advantages over aspartame and is also viewed more favorably on product labels, he claimed, citing PepsiCo’s well-publicized decision to use sucralose rather than aspartame in Diet Pepsi from August onwards (click HERE) as a case in point.

When Tate & Lyle raised prices by 20%, a lot of buyers were not prepared to pay more

As for Tate & Lyle, he added: “I believe it closed its plant in Singapore because it couldn’t compete, not because of overcapacity. I don’t believe that there was ever a point when they were running both factories [in Singapore and Alabama] at full capacity.

“When they announced [in March 2015] that they were raising prices by 20%, a lot of buyers were not prepared to pay more. Sucralose is a commodity ingredient, and while you have to be able to provide a reliable supply and consistent quality, price is very important, and we are a lower cost producer.”

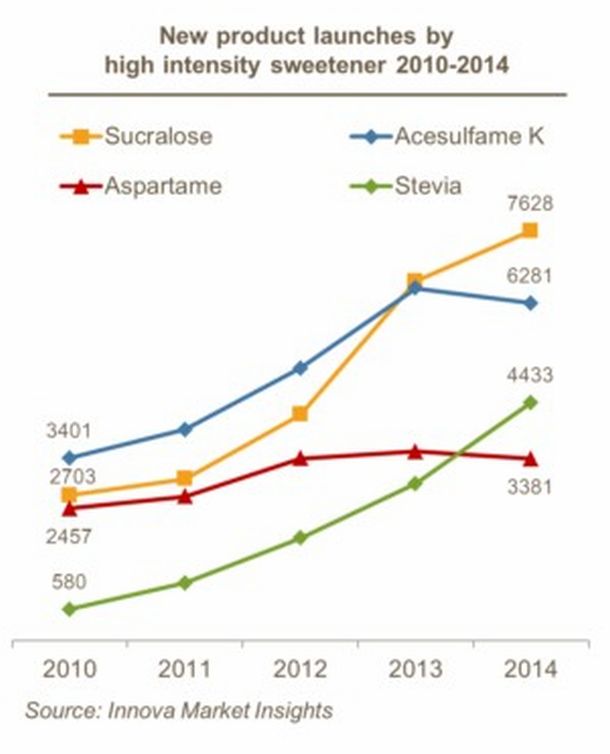

In a call with analysts in late April, Tate & Lyle CEO Javed Ahmed said that sucralose “continues to the most incorporated high-intensity sweetener used in new products launched globally” owing to its “superior taste and functionality”, but said things would get worse before they got better when it came to market pricing.

Gonzalez agreed that market prices would probably continue to fall but said they had probably neared the bottom now, adding that Kanbo was well-positioned vs rivals as it had lower overheads, a more environmentally friendly plant and a more efficient process.

Niutang: Tate & Lyle was caught sleeping at the wheel

Speaking to FoodNavigator-USA in April, Nancy Hughes, VP sales & marketing at the US division of Chinese manufacturer Niutang, said Tate & Lyle no longer dominated the market in the way it once did, adding: “It is unfortunate that Tate and Lyle continues to mislead the market in believing that their sucralose is superior to all China based competitors...

"They know and we know, this is their last chance for survival. T&L was caught sleeping at the wheel while we captured their market share.”

Kanbo will be exhibiting at the IFT show in Chicago next month at booth #2677.