General Mills revamps product development, marketing to mirror start-ups, small brands

“Over the last half dozen years, we have been looking very closely at the entrepreneurs that we compete with … and we have studied in detail how those kinds of small companies develop and bring their products to market,” Kendall Powell, CEO of General Mills, said during the firm’s third quarter earnings report March 18.

“We’ve learned a lot from doing that … [and] have changed quite a bit the approach that we take to new product development,” he added.

The first key lesson General Mills learned is that small brands are “very, very, very close to the ultimate consumer who will buy the product,” which means they have a lot of “consumer empathy” and know what consumers think is important, Powell said.

General Mills is trying to get closer to its end users by replacing its “big and broad-scale tests” in favor of placing its marketers and research specialists in the homes of the people who are buying the products, Powell said, adding the old research methods placed marketers too far from consumers.

The second strategy used by small brands that General Mills is emulating is rapid prototyping, he said.

The idea is “we can get a tangible representation of a new product in front of consumers very early in the process and learn directly from the consumers very rapidly,” he explained.

When these lessons are applied right, “the result is you go fast, you make decisions rapidly. You’re very connected to the consumers and so you’re more on target more often,” Powell said.

Put the consumer first

The other key to delivering new growth and ensuring new products succeed is to put the consumer first, Powell said.

He explained that General Mills is doing this “by renovating our established brands to meet current consumer needs, by innovating to create new products that consumers love and by investing in strong consumer marketing messages delivered with the right vehicles to meet consumers where they are.”

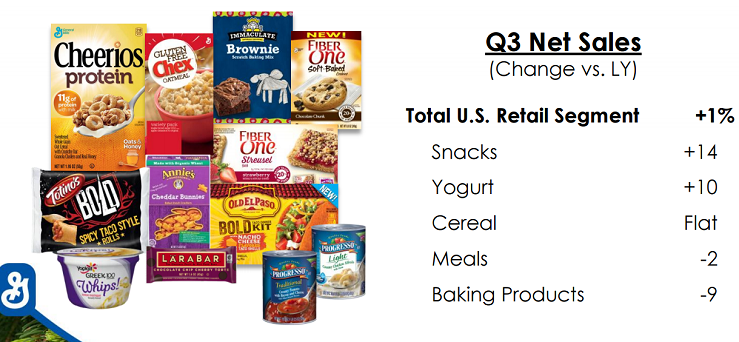

Nowhere is this more successful than in the company’s U.S. yogurt business, which saw a 43% increase in sales of Greek yogurt in the quarter, a 17% increase in original style yogurt sales and a 7% increase in sales of children’s yogurt products, he said.

He attributes this growth to the recent launch of Greek 100 Whips! And the continued success of Yoplait Greek 100. In addition, the company responded to consumers concerns and requests and removed all artificial colors and flavors from its children’s yogurts. It also is rolling out a 25% sugar reduction across the Yoplait original line.

General Mills also is “bringing innovation to convenience stores, where 60% of all food purchased is eaten right in the car,” Powell said. To meet this reality, the company is launching new snacks that are easy to eat on the go, including Chex Mix Popped salty snacks and gluten-free Nature Valley nut bars.

Keeping cereal relevant

Finally, the company is using this same strategy to keep its cereals “relevant with evolving consumer preferences” at a time when cereals are struggling, Powell said.

He pointed to the 26% increase in retail sales of its granola last quarter and the success of the firm’s protein cereals, which more than doubled from last year’s level, as responses to consumer demands. The processing change for Cheerios to make them gluten free also is in line with consumer desires.

Likewise, “great taste will always be a driver of growth for cereal,” which is why Cinnamon Toast Crunch and French Toast Crunch experienced a combined 13% sales increase in the quarter.

These efforts kept the firm’s total cereal net sales at the same level as last year, which is good, “but our goal is to grow our cereal sales so we have more work to do,” Powell said.

Looking across the company, net sales were $4.4 billion for the quarter, down 1% due to foreign currency effects, General Mills reported. Net earnings also were down 16% to $343 million. Segment operating profits, however, were up 1% to $698 million for the third quarter, the firm said.