Four strategies for overcoming diminishing returns on trade promotions

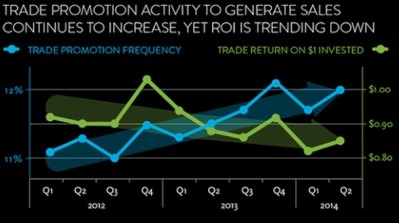

“For many years, trade promotion has been one of the key factors that has been leveraged to drive trial and repeat purchases. For a variety of reasons, the returns on trade promotion spending has diminished” – dropping 15.5 points from 2011 to 75.4%, according to a new report from Acosta, a sales and marketing company.

It adds that the lift from trade promotions also has fallen 3.1% from 2014 to 2015, painting an even grimmer picture.

Given that most CPG manufacturers allocate 15-20% of gross sales to trade promotion and, yet, the sales it generates are often unprofitable compared to shelf volume, many companies are dedicating “disproportionate resources of time and money … on trade promotions,” Acosta says in the report.

With this in mind, Acosta argues, “It is time for a new playbook.”

But to identify the best path forward, companies need to understand what went wrong with such a tried and true strategy.

Why trade promotion is less effective now

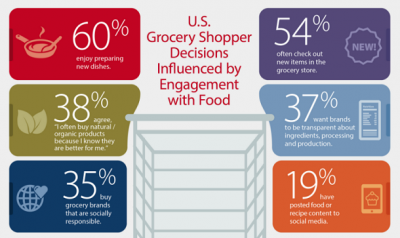

Shifting consumer shopping habits and general desensitization to promotions are at the core of the trade promotion struggle, according to Acosta’s report.

“After years of buy one get one (BOGO) offers, frequent sales and aggressive discounting” during and immediately following the recession, “shoppers often expect to find their favorite items on promotion,” Acosta reports.

And when they don’t, 64% of shoppers say they will wait to buy them when they are back on sale or will go to another retailer to find more competitive prices, according to Acosta’s Shopper Community report from May 2015.

That report also reveals half of the products in 39% of shoppers’ carts are on sale, and three-quarters of the intended purchases by 26% of shoppers are sale items.

The impact on trade promotions also is lower because the “sheer volume of advertising and proliferation of ad vehicles appears to be diluting the impact of promotions,” Acosta writes.

Whereas paper circulars used to be the main way sales were communicated, the rise of loyalty programs, digital promotions, fuel perks and other programs are increasingly cutting into the investment of paper circulars, the report reveals. In fact, insert-paper’s share of ads dropped from 70.5% in 2013 to 61.7% in 2015, Acosta reports.

The drop could be a disservice to manufacturers given that paper circulars are still the most effective vehicle with 36% of shoppers saying they most influence what they buy, according to the report.

Rising base prices, which in turn drive up promotion prices also is negatively impacting the strategy’s effectiveness, Acosta reports.

It notes that in the past five years the base price of products has increased about 30 cents per dollar, while promotional prices are up about 20 cents per dollar, based on data from IRI.

As a result, the sales consumers see are not as deep and, therefore, attention grabbing.

Four strategies to improve ROI

To maximize return on investment for trade promotions, Acosta recommends firms focus on their most profitable sales and leverage the following four strategies:

- Collaboratively plan with retailers to align shoppers’ needs with those of the branding, distribution, pricing and shelving components, Acosta suggests. It adds manufacturers should add value for the retailer by providing shopper insights and category growth strategies that will create win-win opportunities. To ensure strategies are effective for all parties, Acosta reminds partners to track the results and make adjustments as necessary.

- Make shoppers feel special through promotions by communicating with them about their personal purchases. “Creating a flow of purchase-related emails, coupons or other digital promotion generates excitement and brand loyalty,” Acosta notes.

- Monitor and optimize trade spending by identifying key time periods for incremental volume, increases and improving promotion performance, Acosta recommends. It adds: “The goal of successful trade dollars should be a 10-15% increase of profit due directly to the spend.”

- Integrate sales and marketing to better identify shoppers’ perception of value from purchases through monitoring long- and short-term promotion impact on the bottom line.