“Let’s not mince words here. Yes, they’ve got better, but some of these products are still terrible,” claimed Dr Renninger, who said there was a reason that plant-based products had captured 9.3% of the fluid milk market, while plant-based products (up 56% to $112m in the 52 weeks to August 12, 2017, Nielsen AOC data) had captured only around 1.5% of the $7.7bn yogurt market.

“You want [a plant-based yogurt] to taste good, look and feel like the real thing, and to be nutritionally equivalent and they fail in all three,” he told FoodNavigator-USA.

“[Some of the products on the market] are kind of gelatinous and weird. We were testing our yogurts with a major grocery retailer last week and I took a spoonful of the leading competitor and turned it on its side and it was kind of gross. The difference between that and our product is night and day. Ours actually looks like yogurt.

“The feedback we’ve had has been really strong; buyers see the same deficit in this category that we do. And if you go to our consumers and ask them what else do you want to see from us, the #1 answer is yogurt.

“Our product has 12g of protein and that’s a huge part of the difference. [As a comparison, Coconut Dream and So Delicious coconut yogurt has <1g protein/150g serving; Almond Dream has 1g; Forager Project Cashewgurt has 2-4g; Daiya has 8g and Kite Hill has 6-10g depending on the variety.]

“The protein starts to cross links with itself essentially, that forms a network that gels up and creates some of that viscosity [which he claims many other players are creating primarily from gums and starches]. Yes, we use some fats and some gums, but the core technology is what makes a plant-based fermentation run like a dairy fermentation, and that’s what missing from the competitive set,” added Dr Renninger, who co-founded industrial biotech company Amyris, which specialized in microbial fermentation.

Cheese, ice cream…

So what else is in the Ripple Foods pipeline? (To date the brand has commercialized plant-based ‘milk’ in 48oz and 12 oz bottles and 8oz TetraPaks for kids; and half and half in 16oz bottles.)

“Cheese is something we’ve been working on for a while,” said Dr Renninger, who said Ripple Foods had filed patent applications covering its protein purification technology and the use of the purified proteins in multiple food and beverage applications.

“And we’ve got some really good ice cream prototypes in our test kitchen that have really blown people away, so there’s going to be further new products launching next year, although we’re not saying at this stage what the order [of these launches] will be.”

Fermentation-based proteins

So what does Dr Renninger make of ‘next-generation’ proteins manufactured via a fermentation process, from cellular agriculture players such as Perfect Day (which uses genetically engineered microbes to convert sugars into dairy proteins) and Geltor (making gelatin via a microbial fermentation process) to fungi-fueled start-up MycoTechnology, which uses shiitake mushrooms’ filament-like roots (mycelium) to transform pea and rice protein into a better tasting ‘fermented shiitake vegetable protein’ via a fermentation process?

“When it comes to how consumers feel about these proteins, I think a lot will depend on whether there is genetic engineering involved,” said Dr Renninger, noting that Perfect Day and Geltor both use synthetic biology to drive their technology – effectively engineering microbes to produce the proteins they want; whereas MycoTech uses naturally-occurring mycelium from an heirloom variety of mushrooms for its fermentation process.

“If you’re using anything genetically modified you’re going to be up against some strong headwinds, which is one of the reasons we didn’t go down this route,” added Dr Renninger. “It’s unfortunate, but that’s where consumers are right now.”

The other factor is cost and scalability, said Dr Renninger, who uses ‘physical’ processes – “not fermentation” - to strip out unwanted components (color/flavor) from commercially available plant protein isolates to yield a neutral-tasting protein that can be incorporated into foods and beverages in high quantities, and says the technology has been tested on a wide array of proteins as well as yellow peas.

“Fermentation technologies are not inexpensive; I speak about that from experience.”

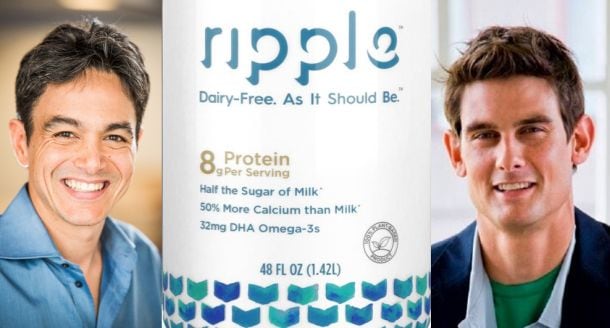

The brainchild of serial entrepreneurs Neil Renninger, PhD and Adam Lowry , Ripple utilizes novel technology that strips out unwanted components (color/flavor) from commercially available plant protein isolates to yield a neutral-tasting protein that can be incorporated into foods and beverages in high quantities.

By overcoming the sensory barriers (“most plant proteins taste truly awful,” says Dr Renninger), Emeryville, CA-based Ripple has been able to dial up the protein (8g per 8oz serving, original flavor) and dial down the sugar (6g per 8oz serving, original flavor) to create an allergen-friendly (soy-, dairy-, nut-free) beverage with 20% fewer calories, a sixth of the saturated fat and half the sugar of 2% dairy milk, and eight times the protein of almond milk.*

A serving of Ripple contains 32mg of the long-chain omega-3 fatty acid DHA (from microalgae), 45% of the DV for calcium, 30% of the DV for vitamin D, 10% of the DV for vitamin A and 13% of the DV for iron.

The ingredients in the original (sweetened) version include water, pea protein, sunflower oil, organic cane sugar, algal oil [for the long-chain omega-e fatty acid DHA], vitamins A and D, calcium phosphate, potassium phosphate, sunflower lecithin, natural flavors, sea salt, organic guar gum, and gellan gum.

Incremental growth

So how is Ripple Foods’ flagship plant-based ‘milk’ performing, and where is the category going?

Dr Renninger won’t share revenue data, but says the brand – which only launched in 2016 – is already in 6,500 US stores – and recently entered the Canadian market via a deal with UNFI - and is “growing very, very fast. For one of our major customers, we account for 10% of the alternative dairy category for that customer alone, and that is not unusual.”

But it’s also bringing new shoppers to the dairy alternatives category, and thus incremental growth, he claimed, noting that retailers also get a better margin from Ripple than from more mainstream brands such as Almond Breeze and Silk.

“According to shopper insights data from our customers, over 40% of our volume is coming from dairy drinkers, so that’s significant, right, we’re expanding the category for our retail customers.

“We punch above our weight in terms of retailer margins, which is very important. Right now there’s massive price competition between Blue Diamond and Whitewave Foods [part of DanoneWave], whereas we haven’t seen that pressure and along with brands like Califia Farms, we have been able to keep out prices and still grow.”

Ripple plant-based milk is made by blending purified yellow pea protein isolate with water, sunflower oil, and organic cane sugar, while the vitamins and DHA are added following homogenization and sterilization.

Financing

Ripple raised $13.6m in its Series A funding round led by Prelude Ventures in late 2015 and a further $30m in a Series B round in summer 2016 backed by high-profile investors including Google (GV), and Khosla Ventures, and is looking to raise additional cash over the next six months, he said.

US retail sales of plant-based foods and beverages rose 8.1% to $3.1bn in the 52 weeks to August 12, according to Nielsen data compiled for the Plant Based Foods Association and The Good Food Institute.

WHERE IS THE PLANT-BASED MOVEMENT HEADING?

Join Hampton Creek, Miyoko's Kitchen, CircleUp, The Good Food Institute and Good Karma Foods at FOOD VISION USA in Chicago this November, when we'll explore what's cooking in the plant-based food arena...