Mindshare is created by values which connect, explained Saunders, who is managing director and retail analyst at GlobalData. Mindshare requires creativity, newness and innovation, he added.

And this is how brands should approach the retail space, which has obviously changed massively over the last 50 years: Modern consumers are much less brand-loyal and are increasingly omnichannel shoppers. In the late 1960s, for example, the average consumer used 2.1 stores, and shopped 1.3 times per week. “It was a simple market to understand and people were predictable in their patterns,” Saunders told attendees at an event hosted by the Chicagoland Food and Beverage Network, in partnership with The Hatchery Chicago.

Fast forward to today, and the average consumer uses 4.6 stores and averages 3.8 trips per week. The main reasons they visit grocery stores are also changing, with fewer people going to simply replenish their pantries, and more people seeing it as a place for inspiration and ideas, or to buy specialty items.

Innovation in the retail space

In addition, people are spending less time and money in the center of the store where the staple products are.

In response, retailers are changing, moving towards smaller formats, like Target’s new small format stores, and experimenting with ‘lifestyle ranges’, grouping together snacks and drinks, for example - quick fixes that people want here and now, not willing to wait around for an online order. Retailers are also positioning stores as places for inspiration, with an emphasis on the store perimeter. An example of this are the new Market 32 stores by Price Chopper, where menu ideas are posted around produce fixtures. “This store format has much better sales numbers versus older Price Chopper stores,” said Saunders.

Market 32 is also innovating in the center of the store, he said. Instead of a pasta aisles with box and bag after box and bag of pasta, and then lines and lines of pasta sauce, the store is mixing these to provide clear meal solutions to consumers. The downside for food brands is this reduces the number of products stocked as the store curates the brands on display.

Opportunities (and challenges) for brands

“Consumers are much less brand loyal,” noted Saunders. “It is also much easier for consumers to discover new brands, which also means it’s easier to overlook old brands. Control on what the consumer sees has been lost.”

Saunders explored four different trends that brands should be thinking about to remain relevant in a digital grocery environment.

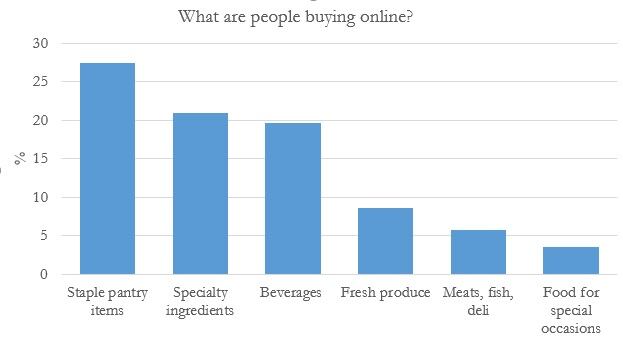

While many are talking about the rise of online shopping, the data shows that the majority of shoppers are not shopping online. In 2007, 3.9% of grocery shoppers claimed to have shopped online for food at least once. By 2017, that had unsurprisingly increased, but only to 23.4%.

Before Amazon acquired Whole Foods, Amazon Fresh reached about 69 million people centered around major urban areas. The Whole Foods acquisition means Amazon could now use those additional stores as hubs for delivery, he said.

The key questions that brands need to ask about the online space, according to Saunders, are:

1. How do consumers discover you online?

2. How do you optimize search?

3. How do you communicate values?

4. Is the information detail optimized? (for example, a large and small package can often look the same online)

5. How do you justify your presence in the store? (There are examples from the UK where retailers have de-listed brands because they’re not delivering sufficient sales in store)

Autopilot consumption, buying in bulk, and the rise of the dollar store

The second big trend revolves around subscription. The percentage of shoppers using subscription services for grocery is increasing (from 1.9% in 2010: to just under 10% last year), and the main reasons are that it is convenient and saves time.

However, for brands, evidence from pet foods suggests that there is very little switching between brands if people are on subscription services. The big questions for food and beverages brands therefore are:

1. How do you become the subscription brand?

2. How do stimulate switching?

Brands also need to consider the wholesale channel, and not just physical stores like CostCo or Sam’s Club, but also online services like Boxed or Jet.com. This is increasingly important for younger consumers, with 17% of 18-24 year olds using those online wholesale services, which increases to 20% for 25-34 year olds. It then declines in older age groups.

The fourth trend focuses on the quest for value. Dollar General, for example, is adding 900 new stores this year. “Dollar stores have shaken up grocery,” noted Saunders. “In 2010, they represented $30 billion of consumer spend and by 2020 that’s expect to be almost $52bn.”

The growth opportunities are increasingly becoming clear

Following Suanders’ presentation, Alan Reed, executive director of the Chicagoland Food and Beverage Network, told FoodNavigator-USA: “The growth in digital grocery and the resultant changes in brick-and-mortar stores are a further indication of the changes in consumer needs and preferences that are driving a revolution in the food and beverage industry.

“As consumers demand more convenience, greater selection, products and companies that share their values, and increased transparency, this is a unique opportunity to deliver on consumer desires in a way many larger companies — especially traditional food manufacturers and grocers— have not yet mastered. And yet the growth opportunities are increasingly becoming clear.”