(For readers familiar with a SPINS report pegging the market at $4.9bn in mid-2016, the Nielsen figure is significantly lower because it does not include most non-dairy creamers. Meanwhile, neither data set includes sales from retailers such as ALDI and Trader Joe’s, so the actual market size is likely somewhat larger.)

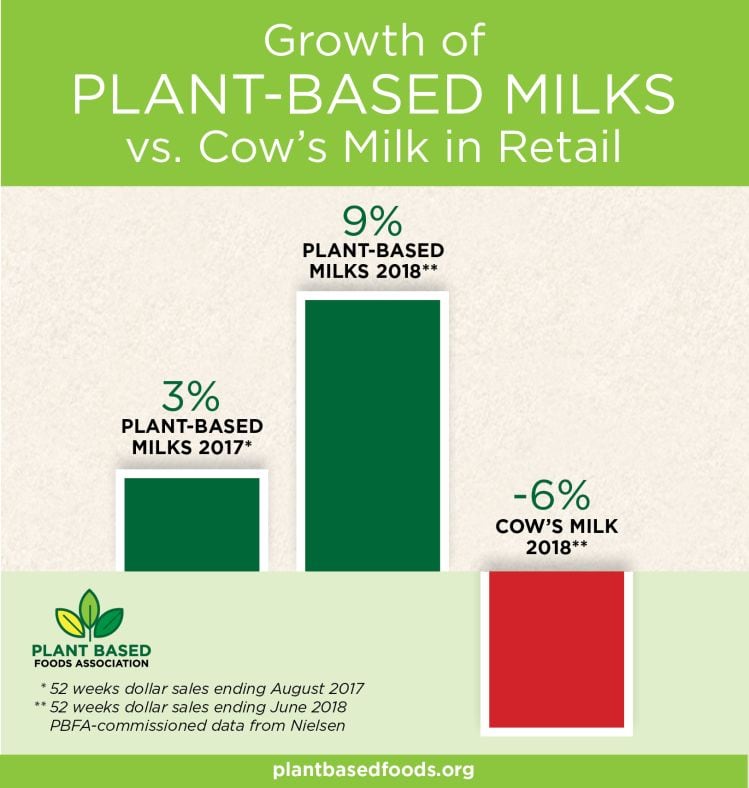

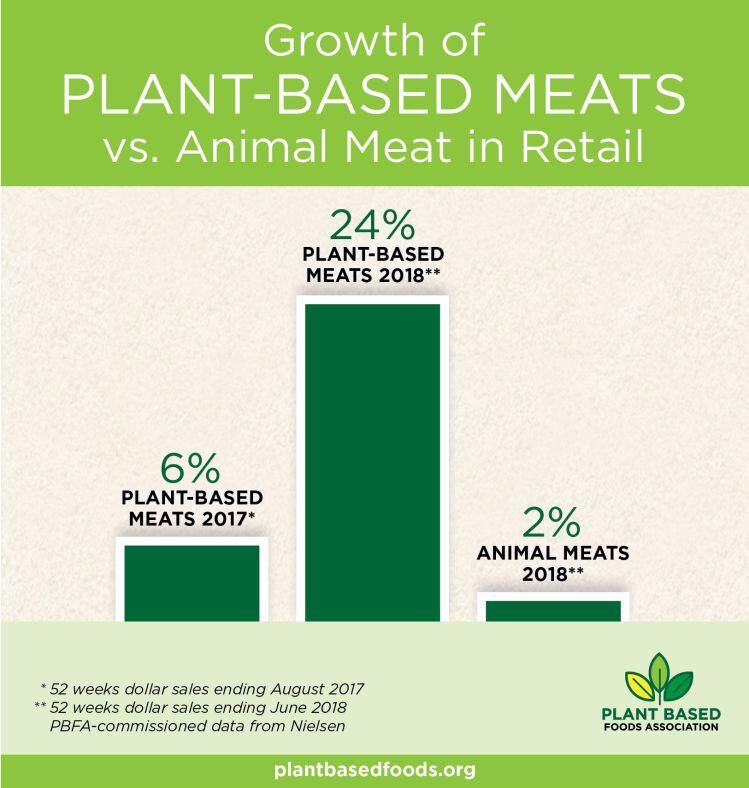

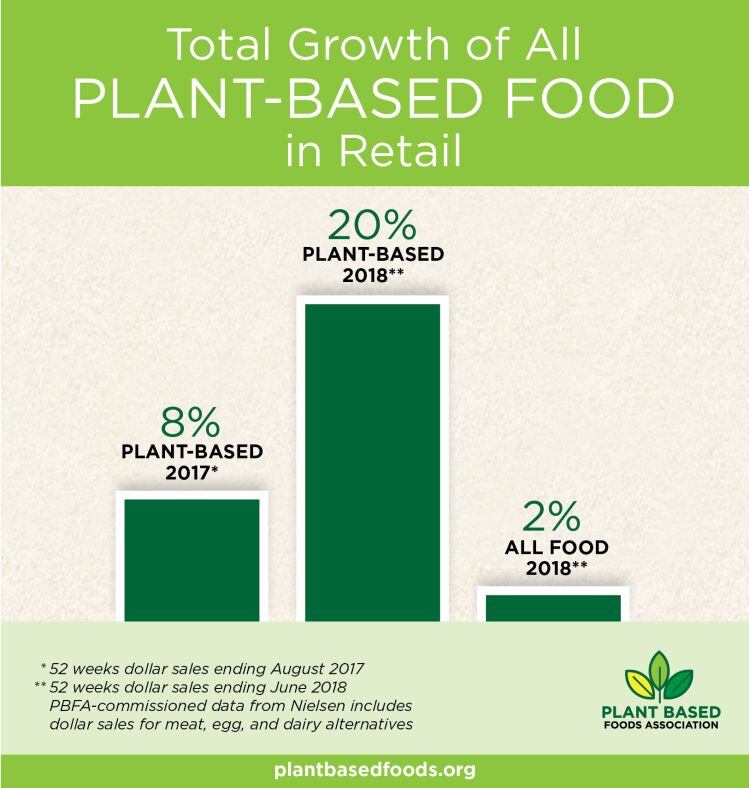

The Nielsen data* - covering plant-based foods that directly replace animal products, including meat, seafood, eggs, and dairy, as well as meals that contain direct replacements for these animal products – shows overall sales of plant-based foods grew 20% (vs growth of 8% in the previous year), significantly outpacing overall food industry sales growth at retail of around 2% over the same period.

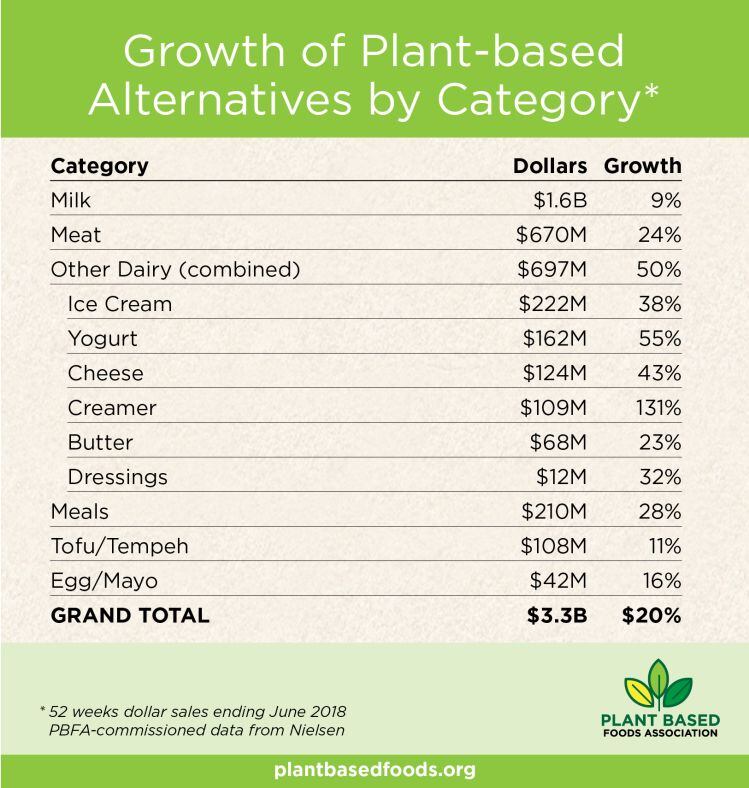

Sales of plant-based ‘milk’ were up 9% to $1.6bn (whereas cow’s milk sales were down 6%) and now comprise 13% of total milk sales; sales of plant-based cheese were up 43% to $124m, yogurt sales were up 55% to $162m, meat sales were up 24% to $670m, and egg/mayo up 16% to $42m.

“The plant-based foods industry has gone from being a relatively niche market to fully mainstream,” said PBFA executive director Michele Simon.

“Plant-based meat and dairy alternatives are not just for vegetarians or vegans anymore; now even mainstream consumers are enjoying these delicious and innovative options in the market today."

* The data covers sales in Nielsen’s expanded All Outlets Combined (AOC) channel, which include grocery stores, drug stores, mass merchandisers, club stores, dollar stores, and military stores, plus Whole Foods. Butter alternatives were defined as vegan products marketed using the terms 'butter,' 'buttery spread,' or 'vegan spread.' Margarines that are not specifically marketed to function as butter replacements were not included.

Sales of refrigerated almondmilk grew 9.8% in the year to April 22, while sales of shelf-stable almond milk rose 4%, offsetting sharp declines in sales of refrigerated and shelf-stable soymilk over the same period (down 10.5% and 9.6% respectively), according to data from SPINS.

Coconut milk sales rose 5.2% in the refrigerated case and 3.3% in the shelf-stable aisles, while rice milk sales were down 5.6% in the refrigerated case and down 3.7% in the shelf stable aisles.

However, the strongest growth came from ‘other’ plant-based milks (which spans everything from more recent entrants such as cashew and walnut milk to pea, hemp, quinoa, oat and flaxmilk) and ‘blends,’ which includes products such as almond-and oat-milk blends (but excludes things such as almondmilk and cold brew coffee blends).

SPINS' Jill Failla said: "Almond milk is still selling well, but it’s certainly not immune from other plant-based milks stealing share in the coming years... I think there’s great opportunity for coffee and plant-based milk blends, which allow consumers to purchase one item instead of two in many cases."