RangeMe - which is used by retailers including Ahold, Albertsons, Whole Foods, Target, CVS, Dollar General, HEB, Hy-Vee, Publix, Safeway, Sam's Club, and Wegmans – seeks to become the first port of call for buyers researching new products and suppliers, enabling them to rapidly compare data from thousands of suppliers in one place.

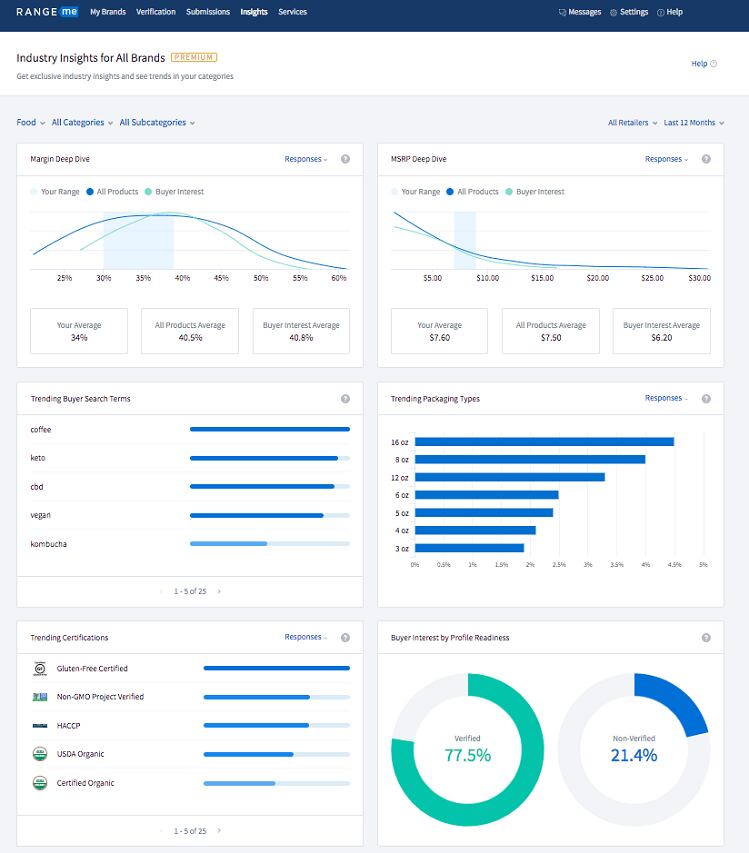

Industry Insights – a new tool available to users of RangeMe’s premium service (annual cost: $1,400) – enables suppliers, in turn, to see what search terms buyers are entering in their categories, which pack sizes and certifications they are looking for, plus how their gross margins and MSRPs compare with rivals’ (and which range attracts the most buyer interest in a given category), providing a unique insight into where the market is going, claims RangeMe.

What criteria are buyers using to evaluate new products and suppliers?

While larger suppliers that have built relationships with retailers over many years may have more insight into their vision for any given category, said Chad Bonner, director of product management at RangeMe, many start-ups and emerging brands don’t have this kind of access, may not have a broker, and can’t afford to buy industry data.

“A lot of the suppliers using RangeMe are new to retail and don’t know what criteria buyers are using to evaluate products, so they want to know what they can do to get more buyers to view them, and how to convert those views into buyers making a follow-on action, such as requesting a sample, saving the product for later, or asking a question,” Bonner told FoodNavigator-USA.

He added: “Are buyers actively seeking products with gluten-free certification in a given category, and if not, are there other certifications that are more important to spend money on such as Non-GMO? Which ones really matter to buyers? What margin are buyers interested in in the baking ingredients category? If you are outside the range of interest, are you being filtered out and not even being looked at?

“Are buyers in your category searching for keto, or CBD? And if your product has the attributes buyers are searching for, can you accentuate them more in your marketing?”

The industry insights tool will grow and evolve as RangeMe gets more supplier feedback, predicted Bonner. "We know suppliers are very interested in things like what flavors or trending ingredients buyers are most interested in. They are also interested in what ingredients buyers seek to avoid."

The quality of images you use is very important

As anyone that has spent any time trying to improve their profile on Amazon or other online shopping platforms will probably appreciate, the quality of product images is also of critical importance on the RangeMe platform, said Bonner.

"We have data that suggests that the quality of the image is very important. We have 160,000 suppliers representing well over 300,000 brands and millions of products and the image is one of the first things buyers see. Yes, they are searching by attributes and other criteria, but the image is very important and increasingly suppliers are adding video content to tell a more emotionally resonant story."

“As we think about how we’re going to position ourselves while we’re pitching our product, I look at Industry Insights as part of my process before I meet with buyers. I especially pay attention to the trending buyer search terms and certifications, because those can shift frequently. I want to make sure we are engaging those terms thoughtfully when meeting with buyers, because we know they’re already on buyers’ minds.”

Danielle DeWolf, director of sales and marketing, SprinJene Natural Toothpastes

RangeMe offers retail buyers - who are inundated with approaches from suppliers via online forms, email, social media, phone calls, and trade shows - a more efficient way to manage inbound approaches and compare what suppliers have to offer, says the company, which has attracted 125,000+ suppliers onto its platform in three years.

Retailers are not charged for using RangeMe, and any supplier can also sign up and populate the platform for free. However, suppliers paying for the premium offer [$1,400/year] get increased exposure on the site, access to industry data, sharing tools and analytics, plus access to RangeMe’s customer support teams to help ensure their profiles on the platform are optimized.

While all suppliers on the platform are required to enter basic product information, product images, descriptions and key metrics such as gross margin, MSRP, full year sales, current retail customers, and certifications, RangeMe verified suppliers [a feature only available to premium customers] have high-quality product images, insurance, barcodes, packaging dimensions, nutritional labels, ingredients lists and more, all verified by the RangeMe team.

And it pays off, says RangeMe, as brands from suppliers with the 'verified' logo achieve up to seven times more views on the platform.