According to Nielsen Homescan panel custom survey data, meal kit users have increased 36% over the past year, with in-store meal kit users accounting for 60% of that growth.

While some high-profile brands in the online meal kit subscription space have struggled with customer retention, Nielsen panel data shows that 14.3 million households purchased meal kits in the last six months of 2018, up from 3.8 million households at the end of 2017.

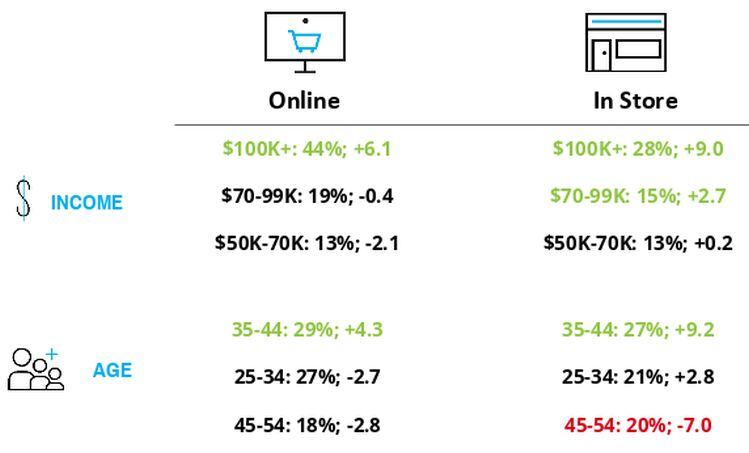

However, given the premium prices, growth both online and instore is being driven by affluent consumers aged 35-44 earning an income of more than $100k, according to Nielsen data.

The shelf-life challenge

While retail meal kits appear to be resonating with consumers, however, shelf-life has proved a challenge for companies in the space, with high shrink levels denting profitability, said Meagan Nelson, associate director of fresh growth and srategy at Nielsen.

"One of the key aspects of the meal kits category is fresh. Fresh inherently is an area where shrink will always be a concern and critical to profitability, particularly in retail. As kits increasingly move in-store, the model shifts. Online players don't have to keep shelves full to entice the consumer; they ship directly to customers who pre-ordered. Extending shelf life is important for continued success."

In its Q4 earnings call, Blue Apron noted that that it had learned a lot from a pilot with Costco last year, and had used those learnings to develop its Knick Knacks range, which comprises pre-portioned spices, sauces, grains, and dairy ingredients that shoppers then pair with meat/protein and fresh produce.

President Brad Dickerson explained: "Some of the challenges that we talked about in the November earnings call were around shelf life and in shrink and so forth in that [retail] business model. The great thing about Knick Knacks is it gives us a much more shelf-stable product, a longer shelf life, and it really focuses on what I call the backbone of the recipe. It’s the taste profile of the recipe, it’s the sauces, it’s the grains, it’s the spices, and obviously the most important thing is the recipe itself and the step-by-step recipe."

He added: "We are in active discussions with additional perspective partners as we focus on expanding our selection of individualized two and four-serving meals and our new Knick Knack offering in the retail environment."

High pressure processing (HPP)

True Food Innovations - which acquired the troubled Chef'd meal kit brand last year - meanwhile, has re-launched the Chef'd brand at retail with a range of kits boasting a 55-day shelf life thanks to high pressure processing (HPP).

Nielsen: 43% of meal kits users think that meal kits are healthier than the prepared foods in retail

But what about price? Are consumers willing to pay $20 for a meal kit for two in store when they can buy two prepared meals in the same store for less than half that price?

"As the meal kit category develops, we are starting to see more diversity that we traditionally saw with the online only players," said Nelson.

"When you look at the competition in the form of prepared meals, these two categories meet different consumer needs and wants. Prepared foods fill the need for immediate consumption, while a meal kit offers time saving and a new experience for those who want to cook. While competitive, they can both be attractive to the consumer based on their needs that day or week. Additionally we do see that 43% of meal kits users think that meal kits are healthier than the prepared foods in retail."

So does Nielsen predict strong growth for retail meal kits in 2019, and what will differentiate the winners from the losers in this space?

"Absolutely," said Nelson. "Products that provide convenience are a key need and demand from consumers. There isn't one set way to win in this space. The difference between the winners and the losers will be those that understand their consumer the best. Do they value health, variety, customization, and price? Understanding that is critical to how a retailer builds their strategy in this category."