Speaking as the El Segundo, CA-based company increased the size of its offering and raised its price range earlier this week, GFI executive director Bruce Friedrich said: “The only known exit of this kind was WhiteWave Foods’ initial public offering in 2012. This strategy raised $391m for the plant-based food company and positioned it for a $12.5bn acquisition by Danone five years later.

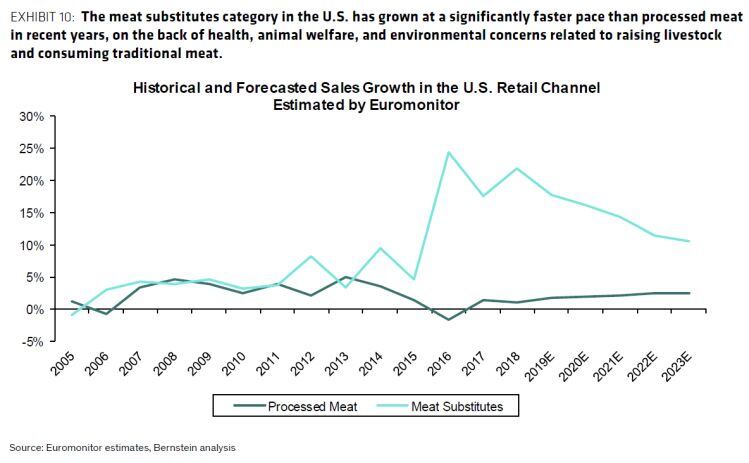

“This is a movement that goes beyond one company and it is accelerating rapidly, buoyed by surging investor support during recent years… Investors recognize that this is not a niche but a mainstream movement and a huge business opportunity.”

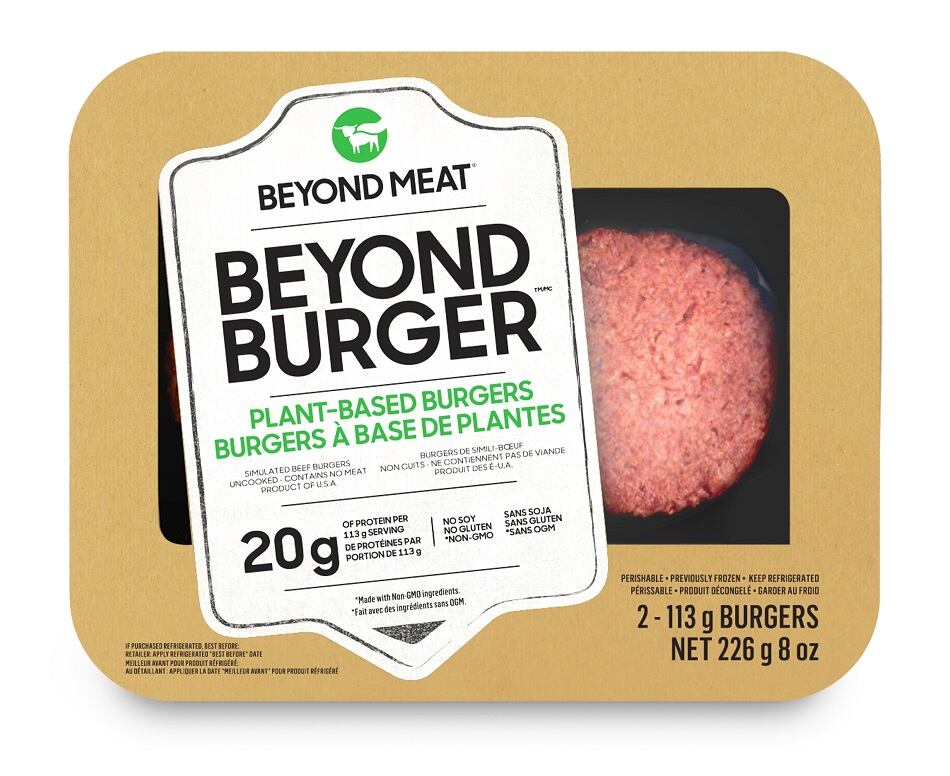

Beyond Meat – which is best known for its pea protein-fueled Beyond Burger, which sits in retailers’ chilled meat cases alongside conventional meat - is expected to start trading today on the Nasdaq under the ticker BYND.

The IPO (initial public offering) priced shares late Wednesday at $25, after heavy demand prompted the firm to offer 9.625m shares at an expected price range of $23-$25 per share, up from a previous estimate for 8.75m shares at a range of $19-$21. That would put proceeds from the IPO at about $241m, valuing the company at $1.49bn.

Bernstein: Beyond Meat could potentially generate annual sales of $2bn in 2033

According to Beyond Meat’s April 22 SEC filing, the total market size of the US meat industry across retail and foodservice channels is $270bn.

If plant- and cell-based alternatives can take a 15% share in 15 years (an estimate based on dynamics in the plant-based ‘milk’ category), the total addressable market for the US alternative meat category alone could be $40.5bn, noted analysts at Bernstein in a pre-IPO report released earlier this week.

“According to Euromonitor, Beyond Meat has ~2% market share in the US meat substitutes category in the retail channel today. Assuming it grows its market share to 5% and assuming the alternative meat market grows to the $40.5bn total addressable market in 15 years, Beyond Meat could potentially generate annual sales of $2bn in 2033 compared with $88m in 2018.

“Our steady-state market share estimate of 5% could be conservative as Beyond Meat has developed considerable moats in the plant-based meat category, and it could prove challenging for new entrants to play catch-up to develop products with similar taste and texture.”

According to Nielsen data in measured US retail channels examining LTM (last 12 months) dollar sales per item per store in the chilled meat patties category, Beyond Meat is ranked #3 out of 114 chilled meat patties brands, noted Bernstein.

“This strong, early set of results will likely encourage more retailers to introduce Beyond Meat and other plant-based alternatives to consumers in their meat aisles.”

How will Impossible Foods’ retail launch impact Beyond Meat?

That being said, the category has become more competitive with major companies such as Nestle and potentially Tyson entering the market, added Bernstein.

“It will also be worth monitoring Impossible Foods' launch into the retail channel later this year and its potential impact on Beyond Meat.... [although] we believe both companies will be supported by the growth of the plant-based meat category and the market opportunity appears to be large enough for there to be more than one winner."

Cell-based meat could also present meaningful competition over time, it added: "While plant-based meat appears to be leading the growth of the overall alternative market today, lab-grown meat or other types of alternative meat could potentially gain traction and take share from plant-based meat over time."

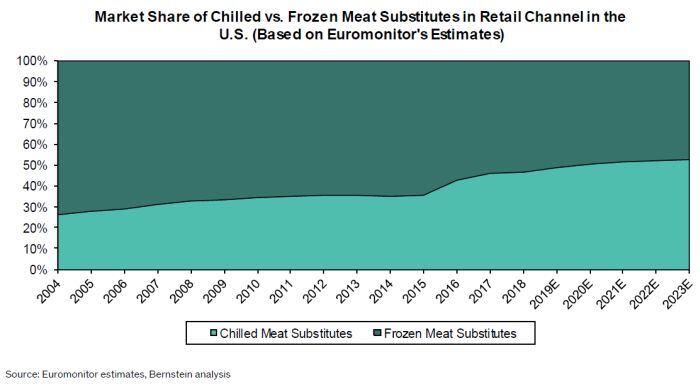

Beyond Meat's margins are better on chilled products

As for Beyond Meat’s financials (it generated net losses of $29.9m on net revenues of $87.9m in 2018), it improved its gross margin from negative -39% in 2016 to positive 20% in 2018 and expects gross margin to reach ~26% in the first quarter of 2019, noted Bernstein.

“The improvement has largely been driven by a greater proportion of sales coming from fresh products such as the Beyond Burger and Beyond Sausage which are sold at a higher price per pound and now represent ~76% of Beyond Meat's retail sales in Nielsen's measured channels compared with only around 15% in 2017.”

(Fresh Beyond Meat patties and sausages are sold at ~$10-12/16oz, whereas its frozen crumbles and the recently discontinued chicken strips are sold at $7-9/16oz.)

‘A highly speculative investment?’

Writing in Forbes yesterday, David Trainer, CEO of New Constructs, LLC, an independent research firm in Nashville, said: “More than any of the other recent IPOs I’ve covered, BYND looks to be a highly speculative investment.

“The company’s market cap looks unrealistic based on its $88m in annual revenue and mounting losses. On the flip side, the opportunity could be large, given the $1.4tr size of the global meat industry and the $22bn market cap of major meat producer Tyson Foods.”

Beyond Meat extracts protein mainly from yellow peas, weaves it into a fibrous structure by applying heating, cooling, and pressure at varied intervals, and then adds additional ingredients such as water, lipids, flavor, color, trace minerals, and vitamins to replicate the taste and texture of animal-based meat.

The chilled segment of the meat alternatives category has gained share at the expense of the frozen segment in retail in recent years, representing 47% of the meat substitutes market in 2018 compared with 26% in 2004 based on Euromonitor data analyzed by Bernstein.

The big winners in recent years have been Beyond Meat, Gardein and Field Roast, while legacy products such as Kellogg's MorningStar Farms and Kraft Heinz's Boca that targeted the vegetarian and vegan population have lost meaningful share in recent years according to Euromonitor data.

“In addition to products that are already in the market, Nestle recently announced the launch of its new plant-based Garden Gourmet Incredible Burger in Europe in April 2019 and the rollout of a slightly different variation called the Awesome Burger in the U.S. later this year,” said Bernstein.

“Further, major meat producers could also choose to enter the plant-based space to diversify their exposures. Most recently, Tyson was reported to have sold its stake in Beyond Meat on April 24, 2019, a week before Beyond Meat's planned IPO, due to tensions between the two companies as Tyson looks to launch its own plant-based meat products.

“While these large players are likely years behind Beyond Meat, Impossible Foods, and select others from a product development perspective, they could still pose a meaningful challenge given their manufacturing capabilities and retailer relationships.”