Speaking on the firm’s Q3 earnings call, Cahillane said the brand was “benefiting from some very creative social media, exciting new products and distribution growth at major retailers,” with a new refrigerated ready-to-cook line ‘Incogmeato’ coming up in Q1 2020, and new packaging hitting shelves in December.

“We are also excited about the momentum in prospects in the frozen aisle and not just in burgers but in all meat alternative types," he said.

"One of our advantages is that we have a very complete portfolio. In Q3 for instance, MorningStar Farms grew consumption by 20% in poultry alternatives, almost 6% in breakfast meat alternatives, and more than 30% in hotdog alternatives."

He added: “We even grew 2% in frozen burger alternatives, the segment that has seen the most competition from new refrigerated entries."

His comments came as Beyond Meat CEO Ethan Brown noted in his firm’s Q3 earnings call on Monday that for the 12-week period ending October 6, Beyond Meat was "outpacing the leading brand [ie. MorningStar Farms] in terms of sales growth by a factor of nearly 20x according to SPINS data for total US multi-outlet, natural and specialty channels.”

‘I think we've got a real gem in our portfolio’

While MorningStar Farms has lost share to brands such as Gardein in recent years, it has a “competitive advantage for several reasons,” claimed Cahillane.

“Number one, we've got a very complete portfolio. We've got frozen. We're going to introduce refrigerated in the first quarter of 2020 and we even have an ambient offering in our Leaf jerky that we’re in test right now that we're optimistic about the potential there. So a full-on complete portfolio we have the scale that is Kellogg from a manufacturing standpoint, from a sales standpoint, from an R&D standpoint.”

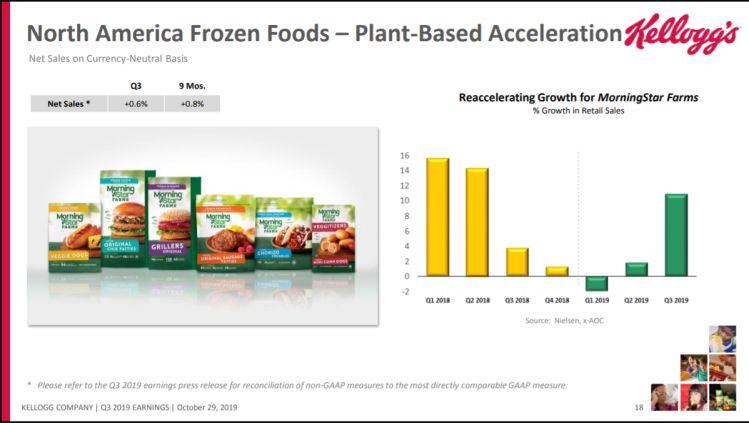

He added: “I think we've got a real gem in our portfolio… even without the refrigerated offering being in the market yet you're seeing a real acceleration. MorningStar consumption was up nearly 11% in quarter three, gaining 120 basis points a share. So we're very pleased with the team and what they've accomplished and believe that the best days for that business are clearly in front of us.”

Q3 results: ‘We continue to do exactly what we said we do’

Q3 net sales decreased by c.3% year on year to $3.37bn owing to the recent divestiture of Kellogg’s cookies, fruit snacks, pie crusts, and ice cream cones businesses coupled with adverse currency translation. However, on an organic basis, net sales increased by more than 2%.

In North America, Cahillane reported “consumption growth momentum in key brands such as Pringles, Cheez-It, Rice Krispies Treats, and Pop-Tarts.” However, cereal net sales and consumption declined on category softness and only a gradual return to brand building activity following a pack size harmonization in the first half of the year.

He added: “We are not where we need to be yet in North America cereal but we're on it… We continue to do exactly what we said we do. In other words, we remained on strategy and it’s another quarter in which we delivered the results we said we would, in short we remained on plan.”

Kids and the plant-based trend

How are parents incorporating plant-based alternatives into their children’s diets? And what are the nutritional implications? Hear from Michele DeKinder-Smith at Linkage Research & Consulting at the 2019 FoodNavigator-USA FOOD FOR KIDS summit in Chicago. November 18-20.

Checkout the latest speakers and register HERE.