Foods, beverages and supplements are projected to account for $2.2bn in sales (around 47% of the total market) in 2020, with formulators increasingly combining CBD with other bioactive ingredients from elderberry and melatonin to lesser-known cannabinoids such as CBG and CBN.

Should the FDA create a legal pathway for ingestible CBD - which is not currently considered a legal dietary ingredient in foods, beverages or supplements (although several states explicitly permit sales) – Brightfield Group* estimates that the total hemp-derived CBD market will reach $16.8bn by 2025.

This figure is considerably lower than estimates outlined last fall (which were made pre-COVID-19, and based on the assumption that the FDA would give ingestible CBD the green light in mid-2020), when Brightfield predicted the US market would reach $23.7bn by 2023.

“With Americans facing high unemployment levels, 2020 retail sales are not expected to reach levels anticipated prior to the emergence of the COVID-19 pandemic. In addition to the economic pressures faced by consumers and temporary store closures, inaction by the US FDA is constraining growth of the US CBD market,” notes the latest report.

However, many consumers are turning to CBD to deal with the anxiety generated by COVID-19, while lower retail prices (reflecting a sharp drop in hemp biomass prices), are helping to drive demand, it adds.

“In a Brightfield Group survey of 5,000 CBD consumers fielded online from June 2 to 24, 2020, 39% stated that they are using more CBD as a result of the COVID-19 crisis. This sentiment was even higher among Millennials and Gen Z consumers – 47% plan on using more CBD in the months to come.”

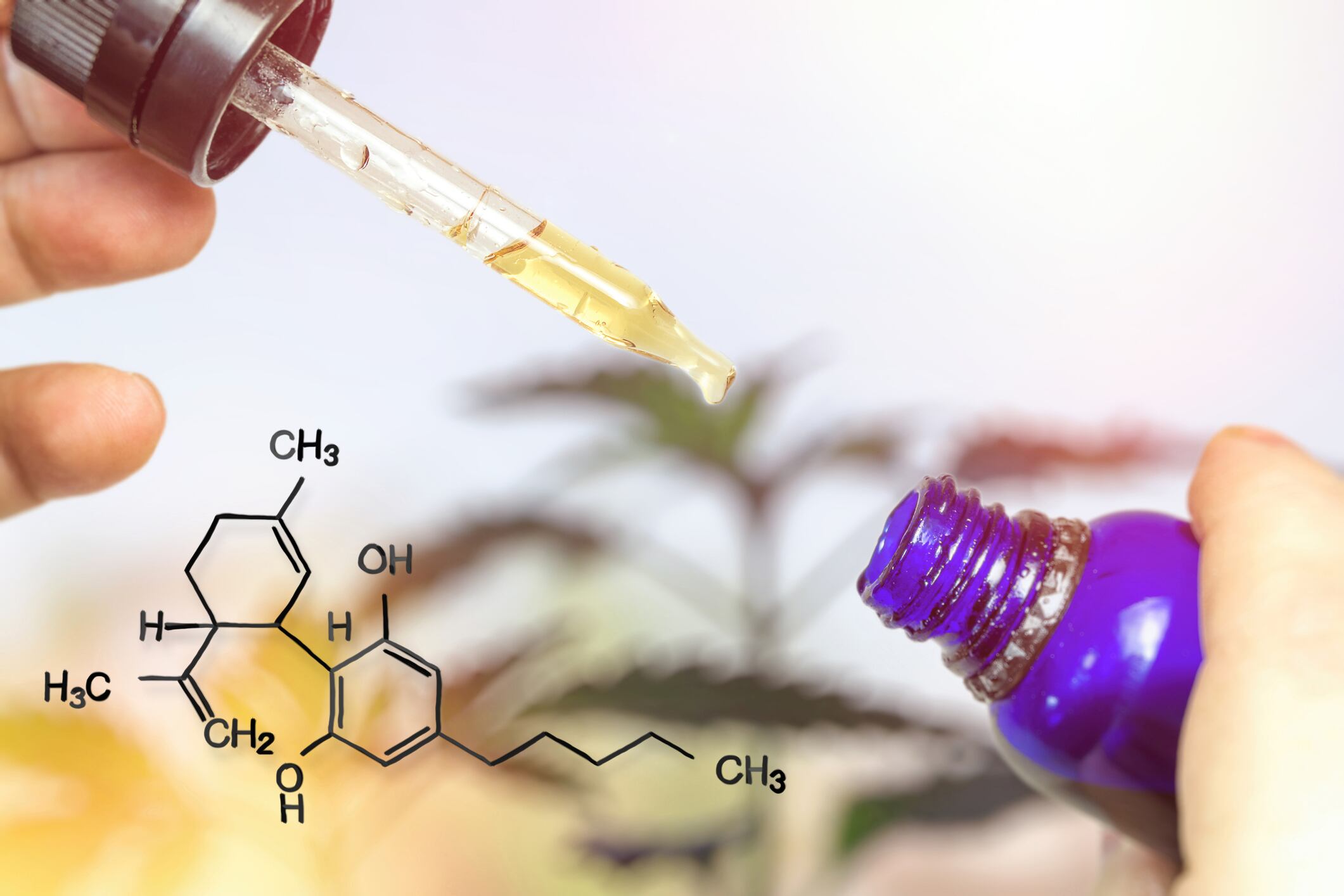

Tinctures still dominate, but will lose share

While tinctures still dominate the ingestible market, they will likely continue to lose share as more consumer-friendly delivery formats such as beverages gain traction, predicts Brightfield, which estimates that CBD-infused beverage sales will approach $194m in 2020, with a 65% CAGR between 2020 and 2025.

“[CBD beverage] users lean younger, with Millennials as the largest consumer group… In contrast, vapes are seeing a decline during the [COVID-19] crisis.”

Currently, tinctures dominate the category, but that will likely change as more foods and beverages hit the market, predicts Brightfield, which says that based on Q1, 2020 sales, Charlotte's Web maintains the largest market share among hemp CBD companies followed by Medterra, Green Roads, CBD American Shaman, CBDfx, Irwin Naturals, Sagely Naturals, Ananda Hemp, Global Widget, Lazarus Naturals, Garden of Life and CV Sciences (Plus CBD).

E-commerce the primary distribution channel for CBD products

When it comes to retail channels, e-commerce is the largest distribution channel for CBD products with a 39% share in 2020, growing from 32% in 2019 as consumers shop online to avoid visiting stores during the pandemic (and in part because many leading bricks & mortar retailers are waiting until they get the green light from the FDA before stocking ingestibles), notes Brightfield.

“Nearly half (45%) of CBD consumers surveyed in June 2020 have moved their CBD purchases online because of the coronavirus crisis.”

Leading CBD brands have reduced prices as costs have come down

Hemp farmers have seen the price of hemp biomass drop precipitously in recent months due to an oversupply of hemp biomass. According to data from Hemp Benchmarks, the aggregate assessed price for hemp CBD biomass plummeted by 79% from April 2019 to April 2020, from $38/lb to $8.10/lb.

As companies have installed more efficient hemp extraction equipment and expanded manufacturing facilities, production costs have also gone down, notes Brightfield.

“In turn, leading CBD companies including Charlotte’s Web, Global Widget, Green Roads, and Lazarus Naturals decided to pass on the cost savings of the raw material by reducing prices in the first half of 2020 to reach middle-income consumers and help drive trial.”

Innovation: CBD Plus…

As for formulation trends, CBD brands are continuing to introduce new products and incorporating functional ingredients such as elderberry, melatonin and turmeric as well as minor cannabinoids CBG and CBN into CBD product formulations, says Brightfield.

“Immunity support is a key area of focus in 2020 for CBD companies as consumers seek out ingredients that support immune health such as elderberry, echinacea, and vitamin C during the coronavirus pandemic.”

With the regulatory path forward for hemp-derived CBD in foods and supplements no clearer a year after the FDA’s May 2019 public meeting, trade association The Council for Responsible Nutrition (CRN) has filed a citizen’s petition urging the FDA to regulate CBD as a legal dietary supplement. Read more HERE.

The legal status of ingestible CBD

According to the FDA, CBD is illegal in foods, beverages and supplements, although it is focusing enforcement action on companies making “egregious” claims while it explores the regulatory pathway ahead.

In the meantime, several states allow the general sale of hemp-derived CBD products including Alabama, Illinois, Kentucky, Colorado, Arkansas, Florida, Oklahoma, Oregon, Pennsylvania, Rhode Island, Wyoming, Utah, Indiana, New Jersey, Michigan, Kansas, Maine (if they are produced in-state), Missouri, Nevada,* Oregon, Vermont, Washington DC, and Alaska.

Several other states such as Maryland only permit its sale from licensed medical cannabis dispensaries for patients with a qualifying medical condition.

Some states such as Louisiana and North Carolina prohibit the sale of foods or beverages containing CBD unless the FDA approves it.

Right now, California defers to the FDA regarding CBD as a dietary ingredient, although its legislature is considering Assembly Bill 228, which would permit for the retail sales of compliant CBD-infused food, beverages and supplements. Right now, the Bill remains in committee.

*In June, the Nevada Department of Health and Human Services published draft rules and regulations regarding the sale of consumable hemp and CBD products. If these become law, the state will explicitly permit the sale of hemp-derived CBD as a dietary supplement, food

additive and cosmetic.

*Brightfield Group provides data and strategic insights into the CBD and cannabis industries. Download its latest report HERE.