According to SPINS data, US retail sales of soymilk declined 0.9% to $201.4m in the year to Jan, 24, 2021, a startling drop from a decade or so ago, when they topped $1bn. To put this into perspective, almondmilk sales were up 16.9% to $1.59bn over the same 52-week period, while sales of relative newcomer oatmilk surged 219.3% to $264.1m, catapulting it into the #2 spot in the plant-based milk category behind almondmilk.

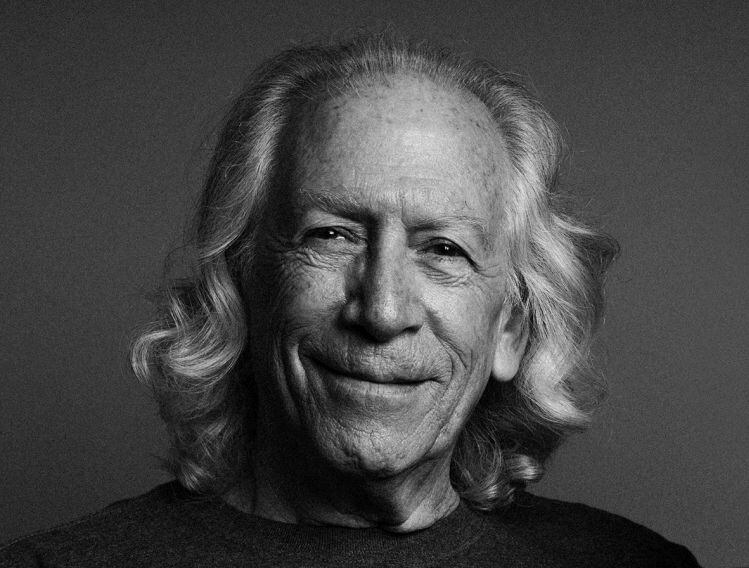

However, in the 12 weeks to Jan. 24, 2021, soymilk sales rose 2.1%, putting the category back into growth for the first time in a decade, said Danone North America CEO Shane Grant, who was speaking to FoodNavigator-USA after announcing the acquisition of plant-based cheese and mayo firm Follow Your Heart.

Silk Soymilk returned to growth in 2020, pulling off a “+16pt turnaround vs. 2019,” while had a dramatic effect on the whole category, he said.

“We have a strong conviction that we can grow that [soymilk] segment where we have clear leadership, and over the last 18 months we have put a lot of emphasis on re-accelerating that segment.”

SPINS: Soymilk sales +2.1% in 12 weeks to Jan 24, 2021

A key part of the turnaround strategy for Silk soymilk has been emphasizing performance and functionality, with high-profile partnerships with athletes such as Michael Phelps and Aly Raisman that highlight soy – a complete protein - as the ‘original nutrition powerhouse’ with a similar level of protein to dairy milk, and 50% more calcium, he added.

The new no added sugar Silk ULTRA beverages - which feature 20g soy protein, 450mg calcium (vs 300-350mg for many 2% dairymilk brands) and are an excellent source of vitamins D, A, B2 and B12 – have further played into the performance and functionality theme, said Grant.

“It’s very early days, but we are really pleased with the initial velocities of Silk ULTRA and we’re encouraged by its impact on the brand and also the category.”

Silk’s foray into the fast-growing oatmilk category (via Oat Yeah!), meanwhile, would also be followed by additional oat-based launches in other categories, hinted Grant. “Oatmilk is clearly a leading growth platform within plant-based beverages with triple digit growth last year, and a growth space for us as a business, and we plan to be assertive in this space, so there’s more to come in oat under the Silk brand.”

He added: “We’re immensely proud of the Silk brand overall; it grew at close to 10% over the past 12 months.”

‘Our plant-based business in North America grew by 17% [in 2020]’

The So Delicious brand, meanwhile, is “continuing to go from strength to strength,” growing more than 20% year on year in frozen desserts, “so I’m very excited about its growth potential,” said Grant, who added:

“Our plant-based business in North America grew by 17% [in 2020] and we were the #1 retail dollar growth contributor across all plant-based food and beverage across retail in the last 12 months, so we’re coming from a position of real growth and scale."

Plant-based milk by numbers, 52 weeks to Jan 24, 2021 (SPINS)

US retail sales of plant-based milk rose 21.9% to $2.542bn in measured channels in the year to Jan. 24, 2021, according to new data shared with FoodNavigator-USA from SPINS.

The key segments are: (figures below exclude included blended products)

- #1 Almondmilk (+16.9% to $1.59bn): Refrigerated +17%, Shelf-stable +15.8%

- #2 Oatmilk (+219.3% to $264.1m): Refrigerated +218.6%, Shelf-stable +85.9%

- #3 Soymilk (-0.9% to $201.4m): Refrigerated -0.2%, Shelf-stable +11.3%

- #4 Coconutmilk (+25.9% to $134.6m): Refrigerated +8.3%, Shelf-stable +68.6%

- #5 Peamilk (+15.8% to $45.2m): Refrigerated +16.4%, Shelf-stable -2.1%

- #6 Ricemilk (+4.2% to $44.68m): Refrigerated -8.5%, Shelf-stable +12.2%

Good Plants plant-based yogurt alternatives: Withdrawn

However, not everything that Danone has tested in the plant-based space has been a hit, acknowledged Grant, who said the Good Plants almondmilk yogurt line – launched in early 2019 - had been withdrawn in the back half of 2020 as the company chose to “refocus resources in other places,” while Oikos dairy-free yogurt alternatives also failed to take off.

But he added: “Plant-based yogurt is central to our strategy [he highlighted the recent launch of almondmilk-based line Silk Kids], and we are the clear market leader; the strategy we’re pursuing now is centered on Silk and So Delicious, our two big power brands… [We’re] focusing our portfolio and rationalizing SKUs to focus the business on key scaled brands for growth.”

‘Plant-based cheese is an area we feel particularly bullish about’

Follow Your Heart, a pioneering brand in the plant-based space, meanwhile, would provide a strong foothold in the rapidly-growing plant-based cheese market for Danone, which recently entered the space via the So Delicious brand, said Grant.

“Plant-based cheese is an area we feel particularly bullish about, as cheese is a $20bn market in retail alone and plant-based currently accounts for less than 1% of that, so there’s huge runway ahead.

“Follow Your Heart is a leading player in plant-based cheese and the #1 player in plant-based mayo, but it also has some very interesting capabilities around new adjacencies like eggs, dressings and beyond."

Follow Your Heart has broad distribution in North America, but there is considerable opportunity to expand its footprint internationally, said Grant, who said plant-based foods currently account for around 10% of Danone’s group revenues and were growing 15% year-on-year.

Danone – which aims to increase plant-based sales from €2.2bn in 2020 to €5bn by 2025 - has invested in plant-based brands such as Forager Project, Hälsa, and Harmless Harvest, and alternative protein companies such as Nature’s Fynd via its ventures arm, said Grant.

However, the €5bn target isn’t necessarily dependent on acquisitions, implied Grant, noting that there are significant opportunities to expand with existing brands, especially in parts of the world “that are not yet anywhere near the rate of penetration and trial [for plant-based products vs the US and Europe].”

Danone Manifesto Ventures is a vehicle for placing early entrepreneurial bets in plant based CPG brands (among others), “but also potentially technology that could apply to the plant-based market,” he added.

Click HERE to read our interview with Follow Your Heart co-founder and CEO Bob Goldberg.