Kroger – which experienced a modest 1.5% year-over-year increase in sales of plant-based foods in 2021 after a bumper pandemic-fueled year in 2020 (when sales surged 24% vs 2019) - evaluated purchases by nearly 8m households over two years and categorized plant-based shoppers into five segments: New, Increasing, Maintaining, Decreasing, and Leaving.

Asked what would make them more likely to consume plant-based, 64% of ‘decreasers’ - shoppers who decreased purchases of these products in 2021 - said lower pricing and/or more frequent sales and coupons, while 58% said better taste and/or texture.

For plant-based ‘increasers,’ 61% said price promotions would inspire greater consumption, while 29% said more recipes would be helpful.

Displacement theory: ‘Consumers who engage with plant-based food categories are gradually lessening their spending on animal-based products’

While sales of animal meat – which dwarf those of plant-based meat - are still rising (see box below), migration analysis shows that when you look at “actual shopper data," there is clear evidence of displacement, which is important to companies with a mission to reduce reliance on animal agriculture for ethical or environmental reasons, said Julie Emmett, senior director of marketplace development for the Plant Based Foods Institute (a nonprofit created by the PBFA earlier this year).

According to 84.51° data, the average household that maintained its plant-based spend in 2021 reduced its animal-based spend by an average of $28.21, while even ‘decreasing’ households that reduced spending on plant-based products by $41.71 in 2021 reduced their animal-based spending even more (by $60.48) over the same period, Emmett told FoodNavigator-USA.

“The finding that plant-based foods are displacing animal-based foods is very significant as this research is based on actual shopper spending patterns. A shift is happening. Consumers who engage with plant-based food categories are gradually lessening their spending on animal-based products in related categories.”

She added: “This data combined with insights gleaned from the consumer survey around stated reasons for purchasing plant-based foods instead of animal-based foods helps to create a full and robust picture of the plant-based shopper that has yet to be studied at this level by a major retailer.”

MEAT ALTERNATIVES - US retail sales: October 2022 vs October 2021

- Frozen and refrigerated meat alternatives combined: $ sales -4.7%, volume -11.6%

- Frozen meat alternatives (2/3 of category sales): $ sales +10.2%, volumes -4.6%

- Refrigerated meat alternatives: $ sales -18.2%, volumes -18.4%

- Fresh and processed conventional meat: $ sales +2.5%, volume -2.6%

- Frozen meat & poultry conventional: $ sales +5.9%, units -7.6%

- Total food & beverage: $ sales +9.1%, units -4%

Source: IRI data crunched by 210 Analytics.

PLANT-BASED CHEESE US retail sales 52 weeks to Sept 4, 2022

Total refrigerated plant-based cheese: $ sales -2.3% to $218.94m, units -3.5%

- Shredded and grated: dollars +1.8% to $104.79m, units +0.7% (within this segment, Cheddar and Mozzarella declined double digits, but Parmesan and Mexican blends were up significantly).

- Sliced and snack: dollars -5.8% to $86.73m, units -7% (within this segment, Cheddar, American and Provolone declined, but Gouda was up).

- Blocks, tubs, wheels etc: dollars -6.1% to $27.43m, units -10.3% (within this segment, Cheddar declined, but soft flavored cheese, feta, and mozzarella were up).

Source: SPINS - combines multi-outlet (MULO) channel data powered by IRI covering food, drug and mass stores; and SPINS natural enhanced channel data, which includes co-ops, associations, independents, and large regional chains, but excludes some key players such as Whole Foods & Trader Joe’s. Figures do not cover convenience stores or foodservice sales.

‘Consumers associate chronic illness with animal-based foods’

So what is driving purchase behavior in plant-based categories?

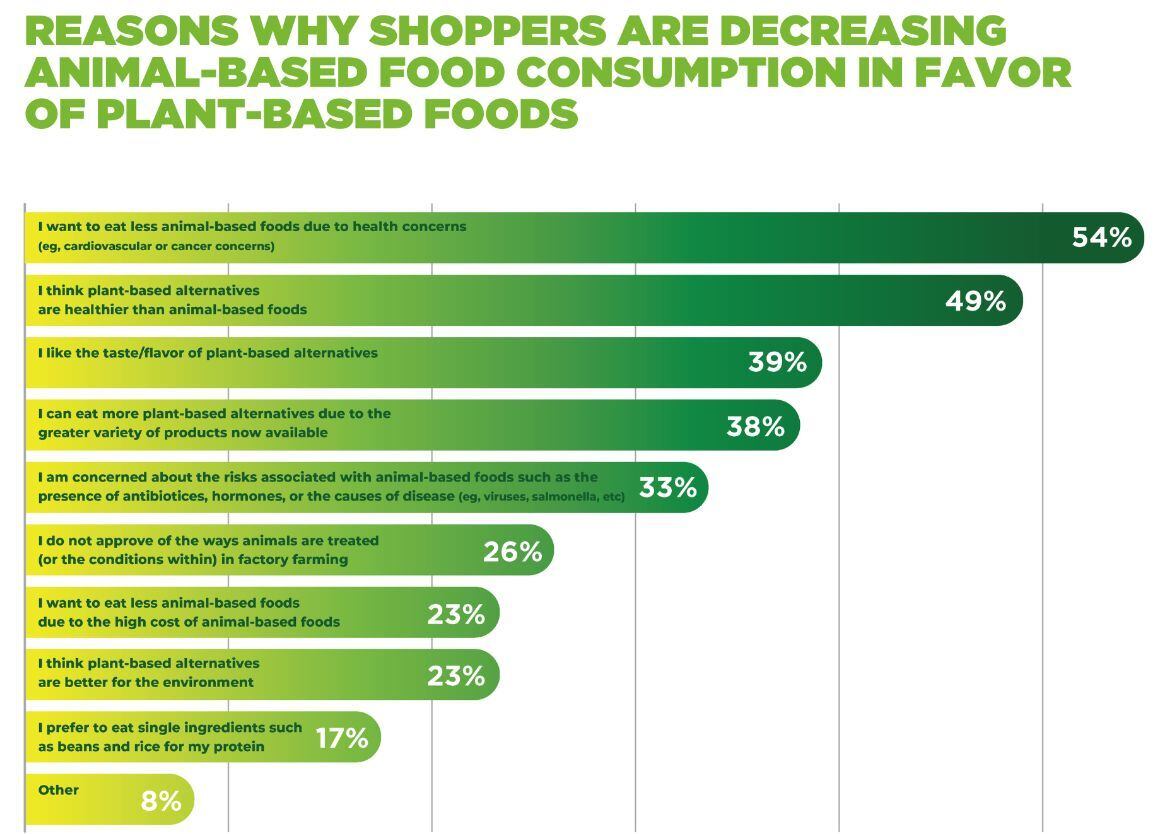

According to consumer survey data from the PBFA and 84.51° (see main chart) the #1 motivator for shoppers that say they are reducing their consumption of animal products is ‘health concerns (eg. cardiovascular, cancer concerns)’ at 54% followed by 49% that believe plant-based alternatives are healthier, and 39% that like the taste/flavor of plant-based.

Just 26% referenced animal welfare, while only 23% cited concerns about the environment.

According to Emmett: “For now, all of the research PBFA and PBFI have conducted this year, combined with retailer expert input from their own research, makes it abundantly clear that health is the primary reason shoppers consume plant-based foods.

“What is unique about this research, in terms of health, is that we learned specifically that consumers associate chronic illness with animal-based foods versus simply improving their overall health. Additionally, consumers acknowledge that animal-based foods have risks associated with them and stated this is a reason they choose plant-based foods instead for their health.

“Also, it was great to see that taste and variety ranked so high demonstrating the continued progress of the plant-based foods industry.

“We also learned that shoppers are consuming single-ingredient foods for their protein such as beans and rice for example, which is something that has not been tracked before to our knowledge.”

But she added: “Sustainability as a reason to buy plant-based foods will continue to grow as awareness of the connection between our food system and the climate crisis grows and more information becomes available to help educate consumers about the benefits of plant-based foods.”

Plant-based evolution 2019-2021

2020 was an unusual year, with pandemic-fueled disruption to the conventional meat case, a flurry of new plant-based products hitting shelves, and a large increase in trial and awareness for plant-based, particularly for meat alternatives, said the report.

“Plant-based meat had the largest portion of new households in 2020, with 63% of households classified as new. Plant-based cheese was the second highest with 40% of households classified as new. Most categories witnessed double-digit growth, with plant-based refrigerated meat seeing increases of over 200%.”

Unsurprisingly, there was a slowdown in 2021, although Kroger’s data showed that “new households continued to grow in 2021 and made up 18% of the migration segment across the total plant-based categories,” according to the report.

“Following a year of record sales growth, a slowdown in category sales was expected; however, a majority of plant-based categories continued to grow.”

More than a third (37%) of households buying plant-based yogurt in 2021 were new households, which “suggests there were successful new items and/or innovations in this space that brought new households in and notably, increased sales,” claimed Emmett.

That said, the report does not cover 2022 sales, which have been slowing across most categories, although they are still mostly in positive territory with the exception of meat alternatives.

Plant-based cheese

While plant-based milk remains the biggest category of plant-based products with the highest household penetration, plant-based cheese buyers are the biggest spenders, according to the report.

“In both 2020 and 2021, Increasers of plant-based cheese spent the most on plant-based foods in total compared to all other product groups by $66.97, with other categories seeing a change in spend ranging from $30-60, suggesting that these households are the most loyal and engaged in plant-based overall out of all the target groups. According to 84.51°, once you get households into plant-based cheese, you can assume that this group will be more loyal to and engaged with plant-based foods overall.”

Click HERE to download the report.