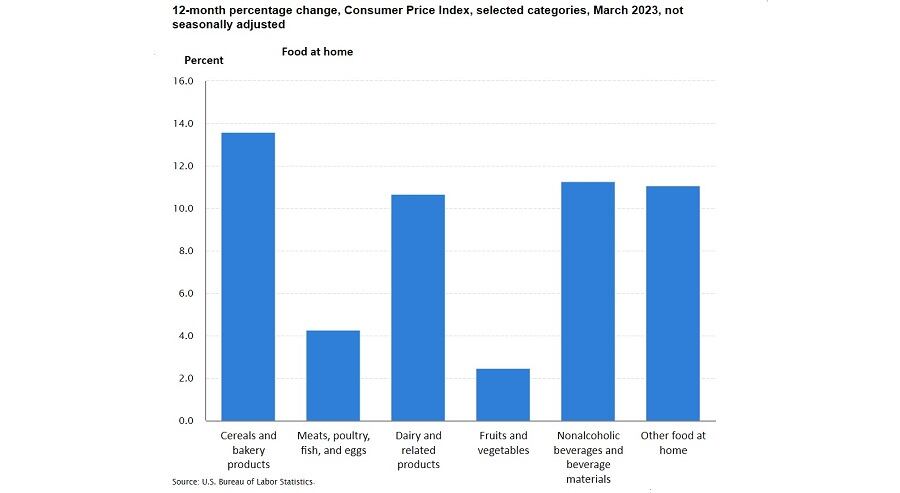

Discount retailers are benefiting from a shift in consumer behavior, as grocery prices have increased by 12.4% year over year based on Bureau of Labor Statistics data.

“There’s a lot of growth for value chains at this point,” RJ Hottovy, head of analytical research at Placer.ai, explained during a recent Future of Food Retail webinar.

For example, in FY 2023, Dollar General opened more 1,000 new stores, 120 new locations and 2,000 store remodels to include more refrigeration units and grocery. As food prices remain high, the company has repositioned itself to bring value to grocery shoppers and include kitchen staples as well as more shelf-stable produce.

The rising popularity of these stores reflect the growing price sensitivities of consumers. Yet, discount stores are not immune to shifts in consumer behavior and should keep a close eye on pricing strategies to remain competitive, Hottovy explained.

Consumer response to price increases has been quick and evident in the case of Dollar General and Family Dollar.

“What was interesting here is Dollar General raise prices in October and Family Dollar kept their price tag. We saw kind of divergent trends on that almost immediately there, too. So it's interesting to see how quick consumers are responding to price increases,” Hottovy added.

Based on Coresight research data reported by CNBC, one in five consumers buy groceries at dollar stores due to competitive pricing, coupled with convenience (particularly for consumers in rural areas with limited retail variety) and product variety, which appeal to consumers who are still looking to wrap up their grocery shopping in one store.

“It’s not just low prices, but also doing something that consumers haven’t seen before”

As value is front and center for consumers, it’s an opportunity for brands to strategize on “innovative value,” which is primarily seen through private label products.

“It’s not just low prices, but also doing something that consumers haven’t seen before,” which are driving visitation in food retail, Hottovy said. Stores like Trader Joe’s and Aldi are examples of retailers offering innovative value through unique private label offerings specific to both stores.

According to FMI- The Food Industry Association’s 2022 Power of Private Brands report, 55% of consumers buy private brands because of affordability, as well as other reasons including quality, taste, perceived health benefits and sustainability. This suggests that private brands have become an attractive option for consumers who are looking for affordable yet high-quality products that meet their diverse needs and preferences.

While value is important, merchandizing also matters when it comes to appealing to consumers, Hottovy explained. This is particularly evident when looking at companies like Five Below, which have successfully prioritized merchandizing in addition to value, albeit less so in the food sector.

“Merchandising is still very much key,” Hottovy concluded. “It’s not just about value [and innovative value], but it’s a nice sweet spot between the two.”

This underscores the importance of balancing affordability with other factors such as product displays and product differentiation to stand out in a saturated retail landscape.