Pointing to new economic impact studies from Trade Partnerships Worldwide and Juday Group commissioned by CBA, the trade group argues a petition by flat-rolled steel producer Cleveland-Cliffs to tax tinplate steel imports up to 300% is a “bad business decision” that threatens a vast number of manufacturing workers and would be “utterly devastating” to consumers who already are pulling back on purchases to balance higher prices across the board due to inflation.

Cleveland-Cliffs teamed with the United Steelworkers in January to petition the US International Trade Commission to impose anti-dumping and countervailing duties on tin mill products from Cananda, China, Germany, the Netherlands, South Korea, Taiwan, Turkey and the UK.

At the time, the groups said they “welcome competition with any and all imported steel as long as our US trade laws are respected,” but that in the past two years ‘there has been a significant surge in unfairly priced tinplate imports flooding the United States,” and each of the countries cited were selling tin mill products at less than normal value in the US.

“Dumped and subsidized imports from the subject countries have taken sales from the domestic industry and made it impossible to obtain a fair rate of return on domestic operations, putting the future of American made tin mill products at risk,” Cleveland-Cliffs argued in a statement.

But CBA counters the petition simply shifts the threat to the tin mill industry to product manufacturers and consumers and will deter domestic production of essential goods.

‘For every steel worker who gains from the duties, more than 600’ others are threatened

According to the research by the Trade Partnership Worldwide, while the tariff may have “a small positive impact on US steel manufacturers and workers,” it will have an “outsized negative impact on downstream manufacturing workers,” including US food producers.

It explains that if the tariffs go into effect, manufacturers already managing record high inflation and intermittent packaging supply chain challenges, including for cans, will need to raise the price o their products, which could cause a drop in domestic output of tin cans – placing nearly 2,800 manufacturing jobs at risk.

An additional 37,000 jobs at US food manufacturers would be “under pressure” if the tariff drove up the cost of US-made tin cans so that they were less competitive – leading to a reduction in output and increase in consumer substitution to imports.

“It total while an estimated 66 workers will ultimately benefit from the imposition of the … duties, nearly 40,000 manufacturing jobs will be placed at risk by those same duties. In short, for every steel worker who gains from the duties, more than 600 other manufacturing jobs in downstream industries will be threatened,” it concluded.

Canned food could increase upwards of 58 cents per product

Given many food manufacturers already have squeezed as much cost-savings as possible from their systems to offset record-high inflation over the past two years, any additional increase in the cost of steel likely would be passed on to consumers, explains research by The Juday Group.

“At the 2022 average price per unit for canned goods, the ultimate pass through of marginal costs from duties on tin mill products ultimately to be borne by consumers of $0.36 to $0.58 would be an increase in canned food prices of a minimum of 19% up to a potential 30%,” the group reported.

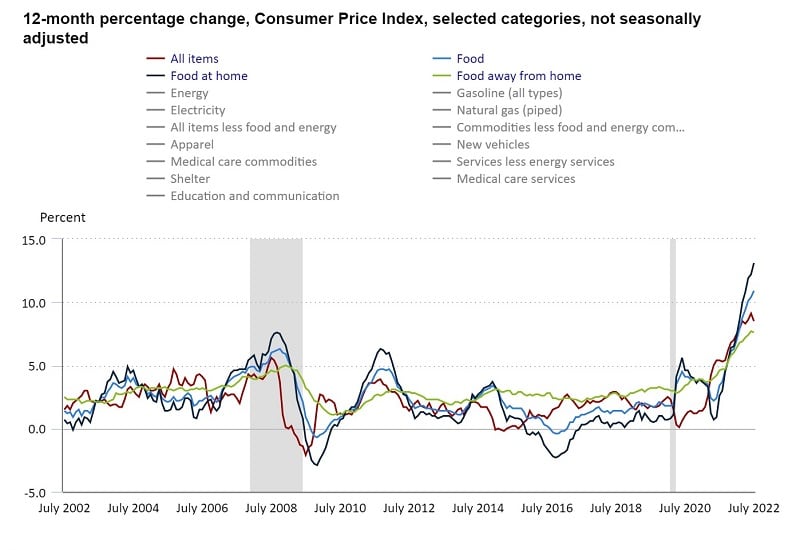

This is on top of the double digit increases in food prices due to inflation in recent years that have already pushed many US shoppers to either reduce the number of items they buy or trade down to less expensive items to keep their overall bill down.

The Juday Group estimates that the tariff would push lower income consumers who buy on average six canned items per week to buy only four or five items per week instead.

Likewise, The Juday Group, argues “charitable organizations such as food banks would also bear the burden of higher costs passed through from the new duties on tin mill products” forcing them to potentially reduce how much they buy to give away.

Based on these studies, CBA’s Chavern concluded, “Cleveland-Cliffs is abusing trade lawas and attempting to artificially inflate prices to increase its profits at the expense of grocery shoppers,” including those who can least afford it.