Plant-based foods such as meat and dairy alternatives have been around for many years, but they're becoming more popular and of higher quality than ever.

Supermarkets and restaurants are increasing their stocks of plant-based products, driven by the growing number of vegans, vegetarians, and flexitarians in Europe, North America, and now even in Asia, where plant-based foods are traditionally common.

Smaller companies and brands started the plant-based revolution with meat alternatives for vegans and vegetarians. However, globally active major food companies are now investing heavily in this market. Due to these investments, they see significant potential in targeting not solely vegans and vegetarians but the rising number of flexitarians who have now become the major group consuming plant-based meat alternatives.1

Along with the plant-based meat trends, plant-based dairy alternatives made from bases beyond soy - such as oat, almond, and potato - are making their way into the spotlight. After their success in EU and US markets, the demand in Asia has also continued to grow in recent years. (TAKASAGO Global Trend Book 2022). Market research firm Euromonitor International expects sales of dairy alternatives in Asia to grow 8% through 2022, compared with just 4% for traditional dairy.2 The company attributes this increase to growing consumer awareness around health benefits and environmental concerns surrounding conventional dairy products.

Indications suggest that plant-based alternatives will continue to be a global megatrend and that innovative product development is vital for future success. However, in order to guarantee success, identifying what consumers expect and want when purchasing plant-based alternatives is critical.

From veggie burgers to plant-based meat alternatives

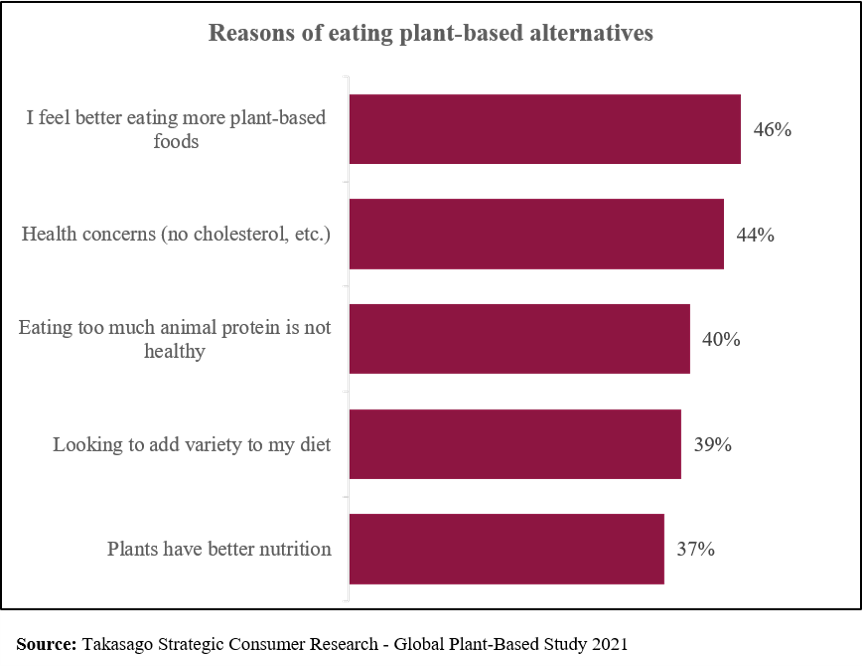

Traditionally in the west, when consumers considered plant-based alternatives, they thought about soy milk and ‘veggie’ burgers. Often consumers felt these products were only for vegan/vegetarians or those on diets and wanted to eat more healthily. A study by Takasago confirmed there are 'multiple reasons consumers choose plant-based products', such as feeling better about eating more plant-based foods and health concerns.3 This consumer belief reinforced to manufacturers that 'plant-based meat' could be a consumer success.

Brands like Beyond Meat, and Impossible Foods are current players in the plant-based alternative sector and have been instrumental in helping to change the consumer mindset from vegetarian burgers to burgers made from plant-based protein.

Beyond Meat and Impossible Foods dramatically impacted the food landscape when they first launched their signature burgers. These burgers were different from the plant-based products consumers were used to; instead, they mimicked the taste and texture of real meat. In 2016, celebrity chef David Chang was the first to add the Impossible Burger – which was said to ‘bleed’ – to his Momofuku Nishi restaurant. Earlier in the same year, Impossible Foods competitor Beyond Burger started selling their ‘bleeding’ burger at a Colorado Whole Foods Market, which sold out in under an hour. Popular restaurant chains such as FatBurger, White Castle, and Burger King soon followed suit by bringing these plant-based burgers to their menus to lure in customers, both for the novelty and to provide a delicious meat-free alternative for consumers.

Drivers of the plant-based alternatives market

Today, the plant-based meat market is larger than ever. According to Euromonitor, in 2021, global consumers purchased a record $5.6 billion in retail sales, with a 16.5% one-year growth from 2020 to 2021 and a 75.9% three-year growth from 2018.4 Furthermore, specific products, such as alternative milks and creamers, have become growth drivers for their overall categories.

During 2020, PBMA saw a dramatic increase in sales from $962 million to $1.4 billion in retail sales, according to IRI Infoscan.5 While people were stuck at home during lockdown, they were looking to try new things and searching for new experiences. Despite the phenomenal growth over that initial period of 2019 to 2020, the PBMA (Plant-Based Meat Alternatives) market growth has stalled since 2021.6

A few factors can be contributed to the slight dip in market value for plant-based meats. First, the novelty may have declined as consumers have returned to eating traditional meat-based diets; and second, the downturn in the 2022 economic markets. Around the world, there has been rapid inflation, and with prices rising, consumers are prioritizing their purchases. Many consumers still view PBMA as a premium ‘luxury’ product and therefore may limit consumption to occasional purchases. Going forward, economic conditions may determine the future growth rate of the PBMA market.

Plant-based meat alternative innovations

Nevertheless, we can say that product innovation in the PBMA market will continue to attract new consumers and more flexitarians significantly as we have already seen new products enter and succeed in the marketplace. Globally, plant-based chicken is following in the footsteps of the success of plant-based burgers; major brands and restaurants, such as Kentucky Fried Chicken, have released meat-alternative versions of chicken nuggets, fried chicken, and grilled chicken, not only in the USA but also in major Asian markets such as Thailand & China. In addition, we can expect new PBMA innovations in areas like pork, seafood, and other meat varieties. For example, after its success in many Asian markets, Omnifoods from Hong Kong launched OmniPork in 2018 and rolled out into western markets such as Australia, UK, and the USA.

Similar successful plant-based dairy alternatives

On the other hand, plant-based dairy continued to have exceptional growth in 2021. According to Euromonitor plant-based dairy retail sales reached $20 billion, with a one-year growth rate of 16.5% from 2020 to 2021, and a three-year growth of 17.6% from 2018 to 2021.7

Non-dairy milks dominate the plant-based dairy market globally representing 85% of the total retail sales, driven by Asia with sales of $9.1 billion followed by Western Europe and North Americas with sales of $3.5 and $3.2 billion, respectively.8 For example, the Plant Based Foods Association indicated that non-dairy milk now controls 16% of the total milk dollar share in the United States in 2021, up 20% from three years prior. While almond milk still accounts for most of the entire milk alternative category (59%), oat milk has been a significant driver of the category’s growth, increasing 44-fold between 2018 to 2021, to control 17% of the category sales, second to almond milk.

Good mouthfeel but lacking dairy flavor profile

Oat milk has become a popular alternative for coffee baristas, with a flavor profile that is said to complement coffee and a texture that mimics dairy, making it the perfect choice for milk-based beverages.

Today, major plant-based dairy alternative brands have created a range of products that cover the entire spectrum of creaminess and mouthfeel. Many plant-based milk products mimic dairy mouthfeel but can be improved on a dairy flavor profile. As these products continue to improve their texture and taste to mimic real dairy, consumers will continue to drive demand for ‘milk-like’ non-dairy products leading to the creation of more dairy-alternative applications, such as ice creams, creamers, yogurts, and cheeses.

Innovating for the future

As PB (plant-based) meat and dairy innovation continues, we can expect to see advances in the overall product design that will target and address texture, taste, and nutritional values. While the casual consumer may view PB products as a healthier alternative to red meat and regular dairy products, there are still some shortcomings. Firstly, work continues to improve the texture of PB products with different protein blends and formulations to better mimic real meat and milk. Secondly, flavor companies continue to develop new and innovative flavor systems to provide realistic meat and dairy profiles. And finally, many leading plant-based burgers are higher in calories and sodium than traditional burgers.

As flexitarian consumers begin to scrutinize these products, their healthy-oriented perception of them may change, and they may return to traditional burgers. One example of tackling this problem, Takasago International Corp., a leading global flavor house, has leveraged its Japanese culinary traditions of preparing shojin vegetarian meals to develop Shojin™ solutions, designed explicitly for plant-based foods. Using proprietary Koku technology, they can develop meat and dairy flavors that enhance richness and fullness, and bring harmony to a plant-based diet. Moreover, by learning from traditional vegetarian meals, new technologies can contribute to improving the flavor and tastes of any food, especially PB food designs. In this way, plant-based products can become not just alternatives but tasty and healthy foods for everyone.

References

1. TAKASAGO Global Plant Based Meat Alternatives Flavor TrendSeeds™ Insights 2022 (TrendSeeds is a trademark of Takasago International Corp.).

2. Dairy Products and Alternatives: Euromonitor from trade sources/national statistics. Euromonitor International 2022.

3. Takasago Global Plant-Based Study, 2021.

4. Passport Market Sizes for 'Staple Foods - Meat and Seafood Substitutes'. Euromonitor (2022).

5. IRI Infoscan data, pub. Good Food Institute.

6. Bryant, C. (2022). Plant-based Proteins US, 2022. Market Report, Mintel.

7. Plant-based Dairy in World Datagraphics. Sep. 2022. Euromonitor (2022).

8. Plant-based Dairy in World Datagraphics. Sep. 2022. Euromonitor (2022).