However, sales of soy-based bars (worth $1.6bn in 2013, with a 17% CAGR since 2011); snacks ($85m, 24% CAGR since 2011); cereals ($201m, 20.5% CAGR since 2011 - see new launch protein-packed Cheerios); edamame, or young soybeans (+9% to $84m in 2013); soy sauce (+6.8% in 2013); and beverages with added soy ingredients ($210.5m, 12.5% CAGR since 2011); all grew strongly, pulling up sales in the overall US retail soyfoods market by 4.6% to $4.5bn.

Meanwhile, sales of condiments (such as soy sauce) climbed 6% over 2012 to $292m in 2013, while miso has also found its way onto mainstream grocery shelves and restaurant menus in dressings, marinades, glazes and soups.

Sales of soy spreads ($40.8m) and soy creamers ($32.8m) edged up slightly, while soy yogurt ($29.6m) had a “uniquely challenging year with the industry leader [WholeSoy] temporarily shutting down production, but the brand returned to shelves in 2014 with strong sales”, according to Katahdin Ventures’ new report, ‘Soyfoods in U.S. Retail 2014’.

Sharp rise in sales of soy protein bars, snacks, cold cereals and beverages

Speaking to FoodNavigator-USA about the report, Katahdin Ventures principal Joe Jordan said “specific segments of the soyfoods market have long had very different trajectories”, which makes it hard to make generalizations about consumer attitudes to soy.

For example, while soymilk sales have been steadily losing market share to almond milk and other plant-based dairy alternatives such as rice and coconut milk; sales of beverages containing soy (excluding soymilk) are a bright spot in the sector, growing at a compound annual growth rate of 12.5% CAGR since 2011.

Similarly, while the protein craze would appear to be a key growth driver in the sales of bars containing soy; it is evidently not a key factor in purchasing decisions in the dairy alternative segment, as soymilk is much higher in protein than almond, rice or coconut milk, but has been steadily losing market share to these products, he said.

“It’s pretty well recognized that the most dramatic growth in the soyfoods industry occurred from 1996 through 2003. Sales have increased slowly over the past decade, and the last few years have been especially challenging. However, sales have increased each of the past two years.

“Soymilk is not the only subcategory to lose ground in 2013, but it is the largest and its slide is the most impressive. However, food bars with soy protein have been on such a tear that they’re coving losses in soymilk and meat alternatives to a lesser extent.”

To regain market share, soymilk makers will have to address taste

So what does he make of soymilk’s lackluster performance?

According to Jordan: “The explosive growth of almond milk says that it is not lack of demand for non-dairy white beverages. And it’s not nutrition [as soymilk has a superior nutritional profile, he claims]."

He added: “To regain market share, soymilk makers will have to address taste – perhaps through blending soy with juices (currently the only subset of the soymilk market experiencing growth) or other ‘milks.’

“The other factor is that a segment of the American public feels that soy may have a negative impact on health for a range of reasons. The weight of scientific opinion does not seem to agree, but these persistent positions have definitely created a drag on the sector.”

High-moisture extrusion has the potential to do for meat alternatives what the gable top milk carton did for soymilk

While the drop in sales in the meat alternatives segment might surprise some people, he said, “Longer term, we really feel that meat alternatives have tremendous growth potential.”

He added: “We are excited about the potential for meat alternatives, including soy, because of a long-gestating technology that is now finally hitting the market: high-moisture extrusion.

“This tool, which can create meat analogues that truly resemble what consumers are used to, has the potential to do for meat alternatives what the gable top milk carton did for soymilk almost 20 years ago.”

If Americans do ever figure out tofu, the market could be huge

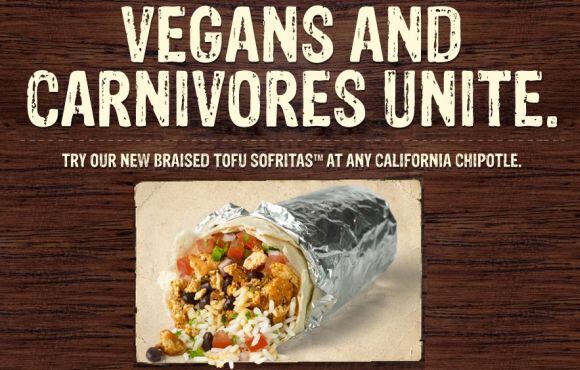

But the ‘dark horse’ of the soy market is tofu, which accounts for a sizeable chunk of the category (sales rose 1% in 2013 to $274m - including foodservice sales), but hasn’t set the world on fire in recent years, he said.

“The most likely path for tofu is incremental 2-3% growth for the foreseeable future. Tofu has been America’s culinary punching bag for decades, and consumers seem to lack a compelling reason to change that opinion.

“Currently, of course, vegetarian protein is a potential angle, but longer term growth will demand a perspective-shifting strategy that appears to still be on the horizon.

"If Americans do ever figure out tofu, the market could be huge.”