“Consumer packaged goods (CPG) industry sales trends are stagnant, with dollar sales growth being largely driven by price increases. Price inflation, in fact, is a major driver of dollar sales growth across the 10 fastest-growing CPG categories.”

On the plus side, however,observes IRI in its report, ‘Private Label & National Brands: Dialing in on Core Shoppers’, “the economic outlook for 2015 is favorable, giving CPG marketers hope for more widespread organic growth in the New Year.”

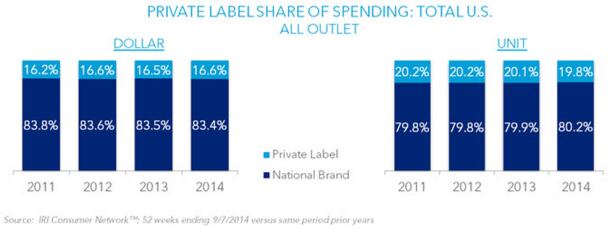

Private label penetration rates have not budged since 2011

So what is happening in the battle for market share between national brands and private label?

On the private label front, packaging is improving, quality is improving and consumers are taking notice, with more than 80% agreeing that retail brands offer as good or better quality compared to their national brand counterparts, says IRI.

However, private label penetration rates have not really budged since 2011, remaining stubbornly at around 16-17% of CPG dollar sales and 19-20% of unit sales.

“In the grocery channel, national brands are holding strong or winning share across a majority of departments… National brands also demonstrated momentum in the dollar channel, taking share from private brand marketers in six key departments.”

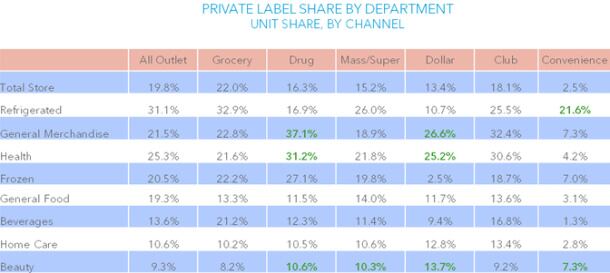

Private label penetration levels vary. In grocery it is 22% of unit sales, in convenience, just 2.5%

However, some retailers are starting to view private label much more strategically, notes IRI.

“Target, for instance, has been focused on differentiation and newness, adding assortment to its upscale beauty selection. The retailer is also looking to solidify its status as a one-stop shop, providing greater selection of dry, dairy and frozen foods, particularly in its P-Fresh format.”

Retailers are also exploring new growth opportunities via multi-tiered private label strategies, experimenting with opening price point products as well as more exclusive premium offerings.

However, both present risks, says IRI, noting that the no-frills approach “could negatively impact the strong quality perceptions they have worked so hard to achieve”, while premium products only work if there is an accompanying level of merchandising and promotional support and they don’t always deliver meaningful volumes.

In the dollar and convenience store channels, private label share of unit sales is well below average

So how do private label penetration rates (% of unit sales) vary by channel?

The highest penetration rates are in grocery (22%) followed by club stores (18.1%), drugstores (16.3%), mass/super (15.2%), dollar stores (13.4%), and convenience stores (2.5%), reveals IRI.

In the mass/super channel, private label penetration declined during the past year, while dollar and unit sales grew. Meanwhile, penetration in the club channel grew, yet dollar and unit sales remained flat.

“In the dollar and convenience store channels, private label share of unit sales is well below average in most departments,” says IRI.

“However, some departments stand out as key private label focus areas. Dollar General, for instance, began to roll out Smart & Simple, an opening price-point line of consumable and non-consumable private brand products, in mid-2014. Results to date have been positive, and the retailer hopes this type of effort continues to elevate messages around affordability.”

Price not the only factor

In general, private label products are around 28% cheaper than their national brand counterparts, although the gap can vary from 10% to 50%.

However, it doesn’t follow that the wider the gap, the better they perform.

In fact, during the past year, notes IRI, “Eight of the 10 private label categories where private label share dropped most precipitously actually widened their average price gap versus nationally branded products… Price plays a role in purchase decisions, but it is generally not a top consideration.”

Refrigerated meat

So where are the opportunities in private label?

The sharpest private label share increase occurred in refrigerated meat (+ 2.2% to 51% of volume in 2014), says IRI.

“Rising meat prices and continued conservative mindsets are driving consumers to consider lower-cost meat solutions. Meanwhile, innovation by private label meat manufacturers is bringing more variety—including sought-after healthier-for-you options and unique flavors—to the marketplace, enticing consumers to invest in store brands.”

Not everyone can emulate Trader Joe’s

So what do other market watchers say?

According to a 2014 report from Hartman Strategy, there are growth opportunities for private label in fresh perimeter categories such as cheese, chilled pizza, ready meals, cut fruit, sushi, prepared salads, and deli items.

But while ‘pure play’ private label experts such as Trader Joe’s and ALDI are making strong gains, and Kroger and Safeway have worked hard to attract more lucrative upmarket shoppers via premium private label ranges, not all retailers can pull off this strategy, argued author Dr James Richardson.

Indeed, more than half of packaged food’s major categories have exhibited flat private label share growth since 2011, “precisely at a period when economic theory would suggest that private label share should be creeping up generally”, he said.

Many shoppers don’t realize that Simple Truth is a Kroger brand

However, Lynn Dornblaser, director, innovation & insight at Mintel, has a more positive outlook, telling us recently that the “percentage of total new products introduced each year that are private label is going up and we are seeing more innovative ‘unique-to-the-market’ products”.

That said, Mintel consumer research revealed that many shoppers “don’t actually realize that Simple Truth is a Kroger brand, or that Archer Farms is a Target brand, whereas everyone knows that Great Value is Walmart, so there are opportunities to build loyalty further by making this connection [between the private label ranges and the retailer] clearer”, she said.

Now we’re seeing some really innovative products that have no national brand equivalent

Rob Miller, CEO at leading private label manufacturer Trailblazer Foods,not surprisingly perhaps, is equally bullish.

He told us:“Retailers … are hiring some very good people and bringing in marketing people that really treat the private label products like national brands. We’re also going to see a lot more activity in better-for-you private label products.”