Due to debut in Whole Foods Market in April – and be in national distribution in the US by the summer – the Annie’s cereal line-up comprises three organic, oat-based products: Berry Bunnies strawberry and blueberry bunny shapes; Cocoa Bunnies bunny shapes with Fair Trade cocoa; and Frosted whole grain oat and wheat flakes.

Each product contains 8 g of sugar per serving and, as with all Annie’s products, are made without artificial flavors, synthetic colors, preservatives and high fructose corn syrup, said General Mills, which has recently extended Annie’s into the soup and yogurt categories.

The news was announced by General Mills at this week’s Consumer Analyst Group of New York (CAGNY) conference in Florida, where it also said its Cheerios gluten-free line-up would be extended with Fruity and Chocolate varieties this summer.

Strong quarter for Cheerios

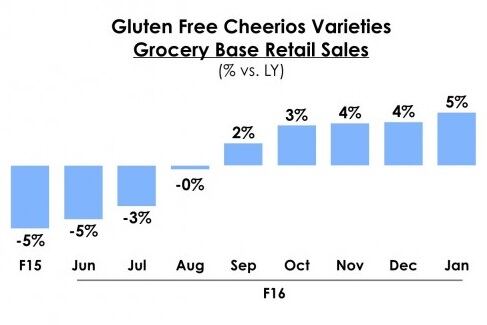

The company told the CAGNY audience that making Cheerios gluten free last summer had already brought “encouraging results”. Top-selling variety Honey Nut Cheerios recently posted its best quarter of growth in almost four years, it added, while overall sales of gluten-free varieties were up between 4% and 5% on 2014 figures in the last quarter of 2015 (see image).

General Mills will be hoping the Annie’s launch can boost its overall performance in the cold cereals market. According to IRI data for the year to 27 December 2015, sales of General Mills cold cereals declined 2.5% to $2.7bn in the US - ahead of the 1.2% value drop in the overall US cold cereals category.

Annie’s previously produced cereals between 2007 and 2012, but then lacked the scale and manufacturing facilities to meet quality levels and price points, according to Annie’s president John Foraker. He said General Mills’ acquisition of Annie’s in 2014 had given it the opportunity to do cereal again.

Competitive price points

“The result is three certified organic varieties with superior ingredient quality, lower sugar content, dramatically better taste, competitive price points, and with the same Annie’s personality parents loved our first go-around,” added Foraker. The new cereals are expected to retail for between $3.99 and $4.99.

General Mills said it worked closely with consumers and the Annie’s team in Berkeley developing the range.

“Not only did we work directly with our colleagues at Annie’s, we also worked alongside some of the brand’s fans throughout the entire development process,” said General Mills marketing manager for cereal innovation Alan Cunningham. “We got feedback on everything from taste, to shape, to packaging, to ensure these new cereals were not only great tasting, but something parents could feel good about giving their kids.”

Annie’s boss: what we learned from failed cereals launch

Annie’s president John Foraker yesterday published an article on Linked In explaining what the business learned from its first foray into cereals between 2007 and 2012. Below are some of the key points from that article – see here for the full version.

Initial consumer excitement and trial was "outstanding", said Foraker, but he added that the businesses ultimately missed the mark on both the product and the target consumer.

He said Annie's learned "a ton" from the experience, which had made the business better and more successful in all its later development.

Key learnings included knowing the important target consumers.

"Our core consumers tend to be more into organic and simple ingredients," said Foraker. "In cereal, prime consumers cared about these too, but with a bigger emphasis on mainstream taste while being more price sensitive."

Foraker added that the business learned to move more quickly and decisively.

"We needed to be faster to make changes when we saw mediocre results, and we needed to exit faster in order to re-allocate resources," he said. "Innovate fast, and if warranted, fail fast."