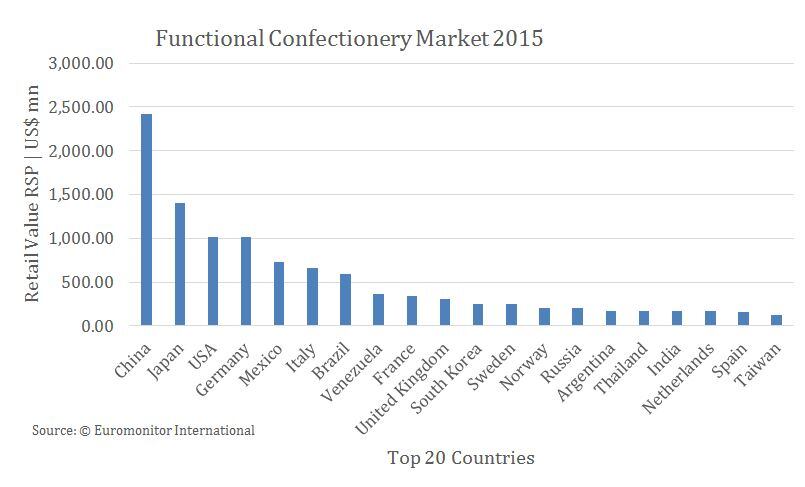

Most of the growth action seems to be concentrated in emerging markets, although impressive value sales increases can be deceptive in some cases.

China stands out for generating solid growth, and will continue to do so, but in order to inject dynamism into the saturated developed markets, some serious new product development activity is the only remedy.

Global growth on the modest side

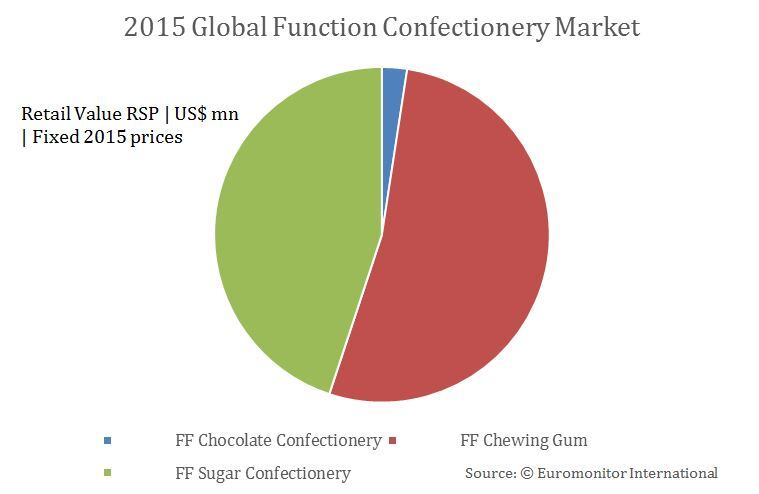

First, let’s take a quick look at the make-up of the fortified/functional confectionery market on a global level. The category achieved retail value sales of $12.9bn globally in 2015.

Chewing gum accounted for 53% of this, with the overwhelming chunk of sales (94%) generated by sugar-free offerings, reflecting consumers’ increasingly negative attitude towards added sugars.

In fortified/functional sugar confectionery, which claimed 45% of fortified/functional confectionery sales, the split between sugarised and sugar-free was much more even, however, not least because consumers expect sugar confectionery to contain sugar.

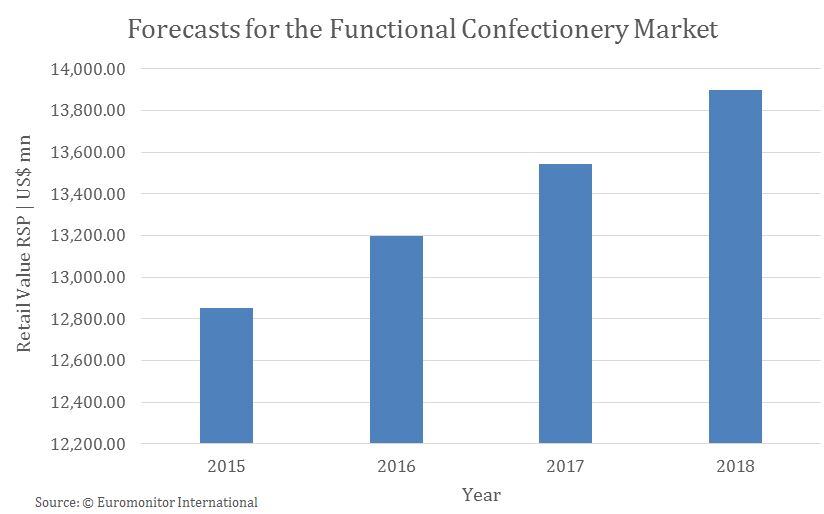

In terms of growth, and based on fixed US dollar 2015 exchange rates and constant prices, the global performance of fortified/functional confectionery was a rather moderate 3%.

This was mainly down to an ailing performance across an increasingly saturated European market. Value sales in Western Europe remained stagnant in 2015, while in Eastern Europe they contracted by 2%.

Emerging markets spearhead growth

As is evident from the graph, it is the emerging markets where fortified/functional confectionery performed most dynamically.

In the case of Venezuela and Ukraine, however, this apparently high growth was due to massive price rises of imported confectionery on the back of local currency devaluations. As a result, volume sales actually declined in the two markets.

The story is a rather different one in China. Despite the palpable impact of the slowing economy on consumer goods, fortified/functional confectionery continued to do rather well in China, delivering a double-digit value growth rate of 10% in 2015.

This is notable, since China is already the world’s largest market for these kinds of products, but saturation seems to be a long way off.

Sugar confectionery is the biggest confectionery category by value in China, owing to its strong cultural significance.

Sugar confectionery products symbolise good luck and hospitality and are thus regarded as essential for wedding celebrations and other traditional festivities.

However, the worldwide sugar controversy has not spared China, where the state of children’s teeth and obesity are the predominant concerns. Confectionery players have reacted by emphasising the health benefits of their products, which is boosting the uptake of fortified/functional offerings.

In particular, it was sugar-free medicated confectionery that saw the most dynamic growth in the Chinese market in 2015, upping its value sales by 12%.

The reason behind this, however, is not more health-conscious partying and gifting or concern over pudgy children, but something altogether more sinister: China’s rampant air pollution – a prime cause of sore throats and respiratory distress. Chinese consumers are resorting to herbal medicated confectionery in an attempt alleviate the unpleasant symptoms.

Outlook: Emerging markets to continue as growth leaders

Euromonitor International predicts that over the 2015-2020 forecast period, China will remain the leading growth market for fortified/functional confectionery with an expected 46% value gain, followed by the United Arab Emirates, Indonesia, Saudi Arabia, Vietnam and India.

To revive the sluggish saturated markets in Europe, North America, Australasia and Japan, some innovative new product developments will be required. Probiotic ingredients, for example, have significant potential in the areas of fighting gum inflammation (periodontitis) and caries.

These properties are highly relevant both for ageing populations and also for children. Today’s probiotic ingredients are suitable for inclusion in virtually all types of confectionery, including sugar confectionery, gum and even chocolate confectionery.