In the past three months, Lidl – part of the Schwarz Group and Europe’s largest retailer – opened 20 stores across North Carolina, South Carolina and Virginia and will add another 80 to this network by mid-2018.

In its white paper: ‘Rethinking Grocery Retailing? Lidl Comes to America’, The Hartman Group looked at what the European retail major had achieved so far, and in particular how its pricing squared up to the competition.

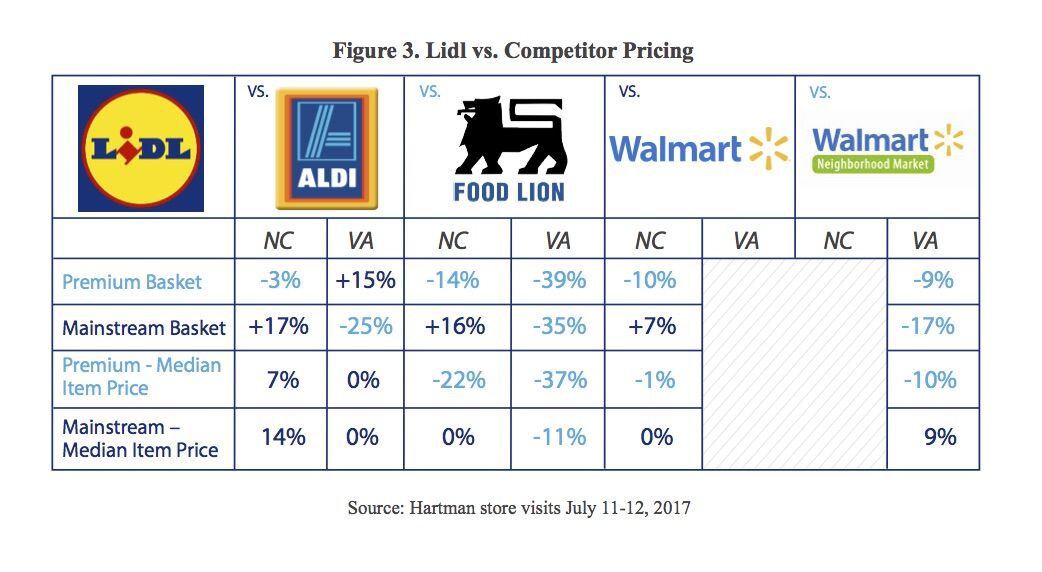

It price-compared Lidl with Food Lion, ALDI and Walmart Supercenter and Walmart Neighborhood Market in two locations – Rocky Mount, North Carolina (the “classic rural town”) and Virginia Beach, Virginia (the “all-American suburb”).

Overall findings showed that while Lidl was unable to price-compete in mainstream goods, it successfully undercut across the board with packaged and fresh premium products.

“Lidl is excelling across all competition at undercutting prices on premium foods, especially organic produce, milk and eggs,” the report said. “We know that these items are literally traffic drivers for shoppers new to the world of premium food; they are major gateway categories and Lidl has the best prices around on them.”

As much as 39% cheaper

The Hartman Group’s price comparisons, based on store visits on July 11-12, 2017, looked at typical ‘mainstream’ and ‘premium’ shopping baskets.

Mainstream items included products like boxed mac and cheese, plain potato chips, Honey Nut Cheerios and ground beef and premium goods included products like organic whole milk, cage-free eggs, organic blueberries and vanilla nonfat Greek yogurt.

Lidl products were compared against the competitor’s private label goods (or lowest-priced name brand if that didn’t exist) and CPG branded items were directly compared in both stores.

Findings showed a ‘premium basket’* at Lidl was 39% cheaper than Food Lion and 9% cheaper than Walmart Neighborhood Market in Virginia Beach. The basket also undercut Walmart Supercenter by 10% and ALDI by 3% in Rocky Mount. And while the premium basket in Lidl Virginia Beach cost 15% more than the local ALDI, the median item pricing remained level.

“Given that they operate in markets without Whole Foods Market or Trader Joe’s (the majority of Lidl’s current locations), they may easily take share in this end of the market,” the Hartman Group said.

‘Overly invested’ in pantry-stocking

However, it said Lidl currently placed too much focus on processed and mainstream foods – an area it was failing to compete in from a price standpoint.

“The chain feels overly invested in being a pantry-stocking destination, with too much square footage dedicated to processed, mainstream foods that it does not have the scale (any time soon) to compete properly on the basis of price. And focusing on this overlap area with ALDI just exposes it to both media and shopper criticism.”

Refocusing towards price-competitive premium goods, it said, would enable Lidl to “very easily” accelerate pressure on local supermarkets.

“It will do so faster than ALDI did, because it appears capable of siphoning off premium, fresh-focused trips that could rapidly chip away at local supermarket dollar share… If Lidl can expand its produce selection, it may be able to create urban or upmarket suburban formats that could go head-to-head with top US grocers.”

Speaking to FoodNavigator-USA, senior vice president at The Hartman Group Shelley Balanko said focusing on competitively priced premium gave the retailer its best chance in US retail.

“What we’re seeing in terms of performance, is that retailers skewing more upmarket and having more premium offerings are capturing consumer attention – the Whole Foods and the Wegmens,” she said.

“…As far as competing with ALDI, [Lidl] has a better shot at capturing premium, especially if they’re doing a good job with private label because they will function more like a Trader Joe’s in the mind of the consumer. With a little bit of tweaking, it would make more sense to target consumers searching premium.”

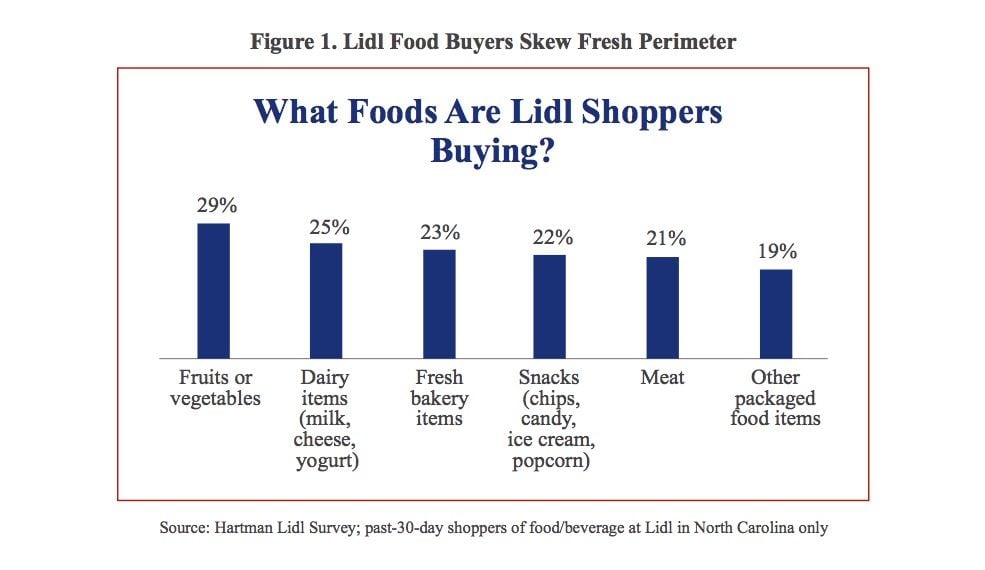

Such competitive prices on fresh produce and premium items had already drawn in consumers with 29% of Lidl shoppers purchasing fruit or veg; 25% dairy items; and 23% fresh bakery items, according to a past 30-day shopper survey conducted in Lidl, North Carolina.

Warning: CPG firms don’t rush!

However, The Hartman Group warned off a rush of consumer packaged goods firms seeking new business with Lidl.

“CPG companies should resist the temptation to simply extend strong legacy brands into this channel, as it will only undermine margins and sales at Walmart and other established channels without any clear brand-equity boost. Lidl is too young to confer equity on a brand for just being there,” the report said.

Balanko added: “Right now, Lidl doesn’t have such a strong brand cache that’s going to add that much value; it’s not carrying a halo to raise perceptions for a brand. Rushing to make another partnership with another deep discounter probably isn’t in CPG firms’ best interest.”

Asked if Lidl’s venture into the US would disrupt the CPG world, she said: “You know, there are so many other things affecting the CPG world, like Amazon for example – that’s going to have a stronger impact than Lidl… Online and e-commerce is going to be a bigger disruptor.”

*Premium Basket Items: organic whole milk (1/2 gal), cage-free eggs (12), organic blueberries, vanilla nonfat Greek yogurt, organic bananas (lb), dark chocolate bar, organic vine-ripened tomatoes, organic baby spring mix.

Mainstream Basket Items: mac and cheese box, bananas (lb), chocolate bar, plain potato chips bag, marinara sauce, spaghetti, bagged spinach, refrigerated hummus, peanut butter (20oz), 2 liter ‘Coke’ soda, 1lb ground beef, 1lb chicken breast, Honey Nut Cheerios (17oz), Pop-Tarts (each), Coke 12-pack.

FOOD VISION USA 2017

Hear from Hartman Group’s Dr Shelly Balanko at FOOD VISION USA in Chicago next month, where she will be weighing on the clean label debate…