True Food Innovations (TFI) president Robert Jones, formerly SVP business development at Chef'd, was speaking to FoodNavigator-USA after acquiring the plant, property, equipment, brand and intangible assets of Los Angeles-based Chef’d from a debtor that took over after it closed, for an undisclosed sum.

TFI – which makes HPP retail meal kits with a shelf life of 30-45 days under the True Chef brand and is developing private label meal kits for retail partners – said he believed retail meal kits have a bright future because they address a real consumer need, but can be distributed through the supply chain in a far more cost efficient manner than kits delivered to consumers’ homes.

He added: “The convenience factor of only purchasing what you need is appealing to consumers…People don’t stock up and do meal planning for the week like my Mom and Grandma used to do. They’re buying for dinner that night.

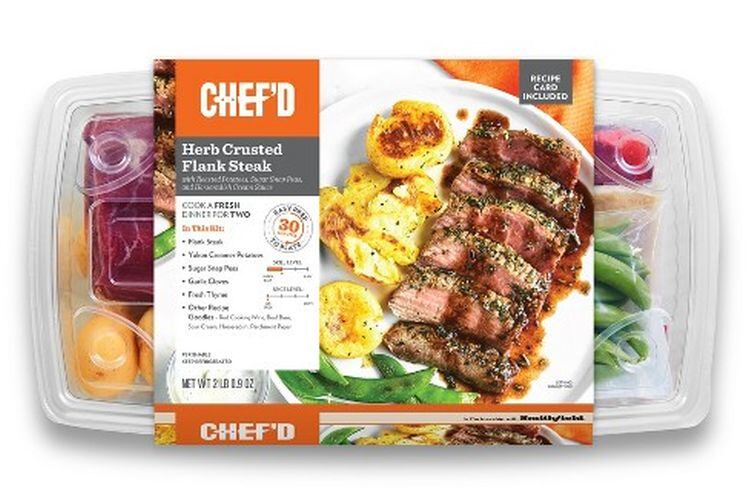

"We’re reaching out to all the Chef’d retail customers [the Chef’d brand is currently in 1,000+ stores] and assuring them that product will be available again in the near future."

There’s a good reason why Amazon Fresh doesn’t service all areas

But does the original meal kit model (delivering meal kits directly to consumers' homes from centralized production facilities) have a future?

Only for "niche products," claimed Jones: “Direct to consumer perishable product is a difficult challenge. There’s a good reason why Amazon Fresh doesn’t service all areas. A lot of the companies in this space operated with the mentality of a dot.com and focused on the exit plan rather than building products with actual margin in them.

“The problem is that when you look at the data, and some of this is public now, Blue Apron turns over 90% of its customer base every six months and you add on negative margin product plus customer acquisition costs and it’s a recipe for disaster.”

It becomes a burden for consumers to have three two or four person meals every week

Consumers, he argued, like the convenience of home delivery, but this is only cost effective for meal kit companies if they ask consumers to commit to something most people are not comfortable with over an extended period of time.

“It becomes a burden for consumers to have three two or four person meals every week on a subscription basis but that was the only way the companies could amortize the cost of shipping and the box, was over that many meals."

Chef'd had tried to tackle the customer acquisition cost problem and consumers' aversion to subscriptions, by setting up scores of partnerships with CPG brands, celebrity chefs, Atkins, and the New York Times (among others), and allowing consumers to buy meals without committing to a subscription. But the business model - promising this much choice and flexibility - remained highly challenging, claimed Jones.

“Some people might argue that scale cures the margin, but companies with scale still have difficulty with margins. The packaging and the shipping makes up the majority of the percentage of the cost of goods sold so it’s such a difficult proposition."

He also claimed that maintaining the cold chain – especially with products sitting outside consumers’ homes for hours at a time - is an ongoing challenge for the meal kit industry.

Retail meal kits, shelf life, and shrinkage

Retail meal kits developed by HPP (high pressure processing) expert True Food Innovations have 30-45 days of shelf life, whereas many other retail meal kit brands have 7-10 days of shelf life, claims TFI president Robert Jones.

“For retailers, if you have a meal kit with 7-10 days of shelf life, basically if you don’t sell it the first weekend that it’s on shelf, it’s going to spoil. You can’t just put your recipes in a clam shell and sell them in stores.”

Chef’d retail meal kits currently have around 14-15 days of shelf life, “which is still a difficult proposition” for some retailers, he said: “We’re going to work with Chef’d so we can overlay our technology to create additional shelf life.”

Chef’d has two facilities in southern California and two in the north east, he said: “We are evaluating each on its own merits and will make decisions in the near future.”

How best can retailers tap into the meal kit trend?

So what does he make of the recent flurry of M&A in the sector, with Albertsons buying Plated and Kroger buying Home Chef? Did these retailers spend over the odds to get a leg up in the meal kit arena, as some commentators have claimed, or was this a smart way to enter the market?

“They would have been better off coming to me,” said Jones, adding: “I was talking to a very large retailer the other day and I said, Please do not go and buy a meal kit company, I’ll build you a private label program so you don’t have to go out and spend $200-300m to basically acquire a brand.”

And while retail kits are not as convenient as home delivery, “the ecommerce side of the bricks and mortar retailers is beginning to ramp up,” he said, “whether via home delivery through Instacart and others, or curbside pick-up. It’s just a different way to tackle the last mile.”

Click HERE to read what Sean Butler, another former Chef’d executive, has to say about the future of the meal kit market.

Further reading:

- Home Chef gears up for Kroger meal kit launch: 'We’ve been solving the dinner next week problem, but not the dinner tonight problem'

- FreshRealm: ‘We want to be the intel inside of the prepared perishables industry’

Plated: In a February 20 presentation about the Albertsons Rite Aid merger, Albertsons CEO Robert Miller said revenues at meal kit brand Plated (which Albertsons acquired last year) were up 50% year on year and that Plated kits would roll out to more than 650 "premium stores" by the end of fiscal year 2018. He also anticipated that the Plated subscriber base and revenues would double in fiscal year 2018.

Blue Apron: Blue Apron posted a net loss of $31.7m on net revenues of $196.7m in the first quarter of 2018, representing a 20% decrease in revenue year on year, but a modest improvement over the previous quarter (+ 5% vs Q4, 2017), reflecting the company’s decision to scale back on marketing last year as it addressed operational issues, which are now being resolved.

CEO Brad Dickerson noted that some key metrics were also improving, with average revenue per customer up from $236 in Q1 2017 to $250 in Q1 2018. And while customer numbers had dropped from over a millions in Q1 2017 to 746,000 in Q4, 2017, they had increased again in Q1 2018 to 786,000, said Dickerson, who expects a net loss for FY 2018 to be between $126-$131m.

Home Chef: Speaking to FoodNavigator-USA in early May, chief revenue officer Rich DeNardis said: "In 2017, Home Chef grew revenue by 150% and with two profitable quarters in 2017 on record, we are targeting full year of profitability in 2018. Speaking to us in late May after Kroger completed its deal to acquire Home Chef, DeNardis said Home Chef meal kits would roll out in selected Kroger stores later this summer in standalone coolers: “The challenge all the meal kit companies have is that we’re all solving the dinner next week problem, but not the dinner tonight problem. It’s about being there whenever and wherever consumers are thinking about dinner.”

HelloFresh: The world’s largest meal kit company, HelloFresh was founded in Berlin in late 2011 and went public in 2017 on the Frankfurt stock exchange. The company - which has 11 fulfilment centers in the US - has 1.88m active customers globally and 1.21m customers in the US (Q1, 2018 data).

Speaking to FoodNavigator-USA in late June, North America president Tobias Hartmann said HelloFresh had recently launched meal kits in 581 Giant Food and Stop & Shop stores and started experimenting with prepared food vending machines in Europe.

“Our core business at HelloFresh is subscription, and you only have to look at our growth rates – we grew 50% in the US in Q1 on top of really significant growth last year and served 27 million meals – to see we are growing that core business, and we have very loyal customers that we keep engaged by helping them discover new things. But given our brand equity and coverage in the US, this [move into retail meal kits] is a very logical and complimentary step for HelloFresh."