The fourth edition of ‘The Why? Behind The Dine’ from the full-service sales and marketing provider Acosta and the consumer research firm Technomic released this month reveals 85% of diners decide what to have for dinner the same day they eat it – a level of procrastination that is driving growth of convenient solutions across almost every category by every generation.

For example, 77% of consumers said they ordered carry-out food from a restaurant in the three months before they were asked in 2017, compared to only 63% in 2015, according the report. Likewise, in 2017, 48% of US diners ordered delivery food from a restaurant versus 42% in 2015.

In addition, 65% reported eating prepared foods at home purchased from a grocery store, while 34% ate in grocery store dining areas and 22% ordered prepared food from grocery stores for home delivery, according to the report.

Eating out is eating into grocery budgets

While consumer fixation on convenience is clearly boosting sales of food prepared outside the home, it is placing some sales pressure on traditional groceries and meal kits – both of which require more time, skill and advanced planning.

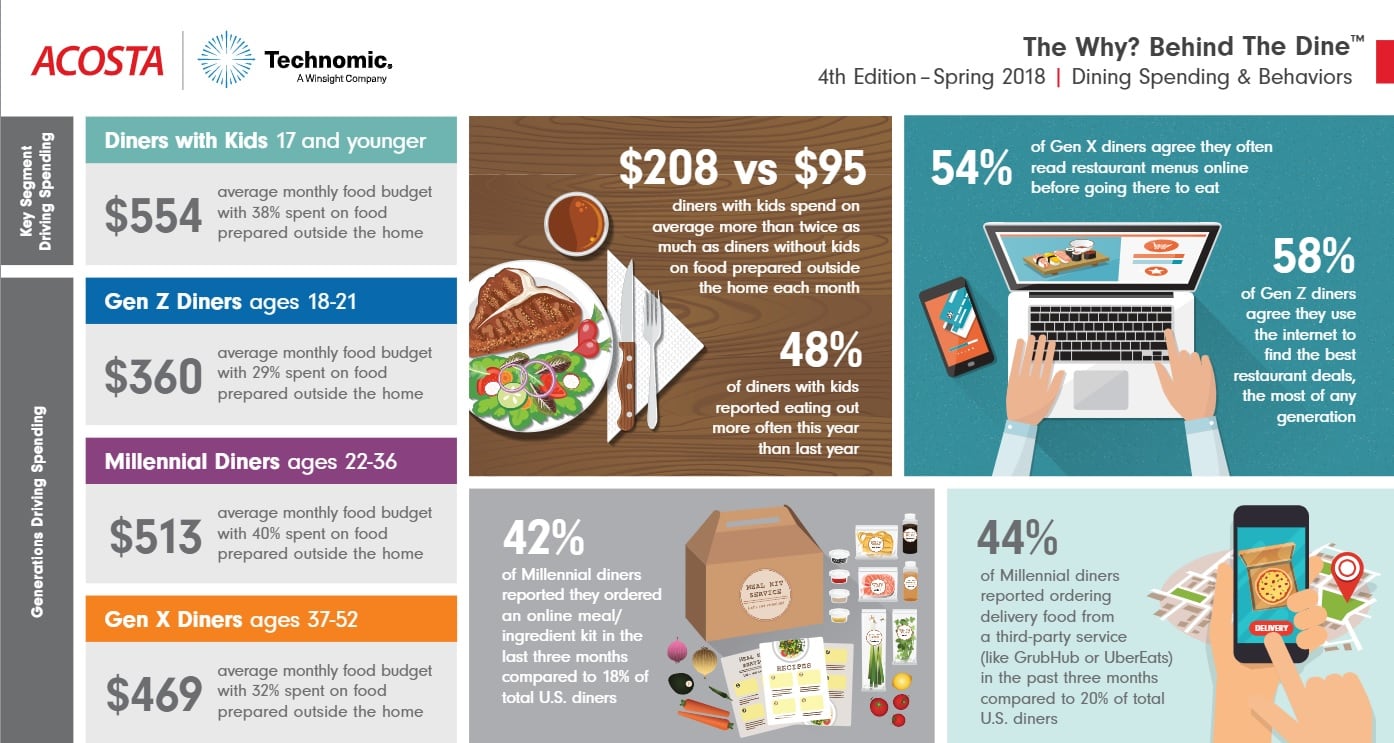

The report revealed in 2017, US diners spend a third of their food budget on options prepared outside of the home compared to groceries. This percentage shot up to 38% among diners with children, according to the report, which added 57% of diners with children 6 to 12 years old say they are eating out more often than last year.

Despite this general shift, a smaller but growing segment of the population are using meal kits as a way to prepare and eat dinner at home more often, according to the report.

It found 18% of US diners ordered a meal or ingredient kit online – up 10 percentage points from 8% in 2015. The report also noted that millennials are more likely than diners with kids to use meal kits with 42% ordering them compared to 37% of those with children.

Other reasons consumers say they order meal kits include a desire to learn how to cook new dishes and to eat healthier, according to the study. But, they acknowledge, these attributes come at the cost of convenience – both in terms of the time and skill needed to prepare the meal kit and in planning ahead to order the kit.

On a scale of one to 10, with one requiring little to no prep time and basic cooking ability and 10 requiring significant prep time and cooking aspiration, the average meal kit buyer says their ideal kit falls at 7.2. Millennials are a bit more willing to tackle more difficult meals, saying their ideal kit would be a 7.5 on the time and skill scale.

Balancing the scales

Recognizing the eating out and the demand for more convenient options is a threat to both meal kit providers and grocery retailers, the two increasingly are partnering as a way to balance that scales and address the threat posed by eating outside the home.

“These gains in brick-and-mortar distribution will provide new opportunities for customer acquisition,” by allowing meal kit providers access to the vast majority of consumers who don’t plan dinner until the same day – making it too late to order a meal kit online for delivery in most cases, according to the report.

Grocery stores also win by bringing “the unique meal kit market features of customization and user experience into the traditional grocery space,” the report adds.

Grocery stores also are picking up some of the slack through increased online orders for in-store pick-up, which increased significantly from 12% in 2015 to 23% in 2017, according to the report, which added that my 2020 70% of shoppers are predicted to buy their groceries online.

Given how quickly consumer demand for convenience is changing the competitive landscape overall, the report recommends that businesses across categories and platforms “align … with solutions that offer diners convenience and speed by expanding on-the-go choices, online menu ordering options or explore opportunities to leverage third-part food delivery services.”