The strongest growth was generated by higher-value ‘next generation’ refrigerated plant-based meat products (+37% to $212m), while frozen plant-based meat sales were up a modest +2% to $582m, according to SPINS data* released by The Good Food Institute (GFI) and the Plant Based Foods Association (PBFA). Shelf stable plant-based meat accounted for the remaining $8m (up around +3%).

Plant-based seafood accounted for $9.4m (1.2%) of plant-based meat dollar sales in the measured channels over the period, said the GFI, which noted that the actual market value for all the categories covered will be significantly higher given that the SPINS dataset excludes several leading retailers that don't share their data, including Trader Joe’s, Whole Foods Market and ALDI.

Plant-based meat now accounts for 2% of dollar sales of retail packaged meat and c.1% of dollar sales of total retail meat (including random-weight meat), said the GFI, which noted that the retail market for plant-based meat could be worth almost $10bn should it follow the same trajectory as plant-based milk (which now has a 13% share of the fluid milk market).

What does the deceleration in growth mean?

But is the deceleration in growth rates for plant-based meat surprising, considering the huge surge of investment, enthusiasm, and media coverage over the past year?

GFI associate director of corporate engagement Caroline Bushnell noted that a lot of the recent growth in the market had been in foodservice (a channel not covered in this data) as brands such as Beyond Meat and Impossible Foods struck high-profile partnerships with leading restaurant chains.

“There has been incredible growth of plant-based meat in food service this year, which isn't captured in this data,” she told FoodNavigator-USA.

GFI: 'We expect category growth [in plant-based meat] to accelerate significantly over the coming 12 months'

She also noted that several leading brands including Sweet Earth (owned by Nestlé) and Impossible Foods are about to introduce plant-based burgers and other products to the refrigerated case, where brands such as Beyond Meat, Lightlife and Uncut now sit alongside conventional meat.

“There are many new plant-based burgers set to launch in retail this year, so we expect category growth to accelerate significantly over the coming 12 months,” predicted Bushnell. “And plant-based burgers are just the beginning.”

The shift from the frozen aisle to the refrigerated meat case “introduces the product to a whole new range of consumers who are looking for their ‘center of plate protein’ and who were unlikely to have sought it out in the often hard-to-find vegetarian section,” she claimed.

“A similar merchandising strategy for plant-based milk (shelving it in the refrigerated dairy case) is a big part of what propelled that category to where it is today.”

US household penetration of plant-based meat is 11.9%

She added: “Consumer appetite for plant-based meat is surging, and this growth will continue as more companies bring next-generation products to market that really deliver on the most important driver of consumer choice: taste.”

11.9% of US households currently purchase plant-based meat, up from 10.5% a year ago, she added, noting that 37% of US households now buy plant-based milk, suggesting a significant opportunity for growth assuming the market follows a similar trajectory to plant-based milks (an assumption some market researchers have challenged).

(Unlike dairy milk sales, which fell 3%, regular meat sales also rose 2% over the period).

Oatmilk sales +222% YoY

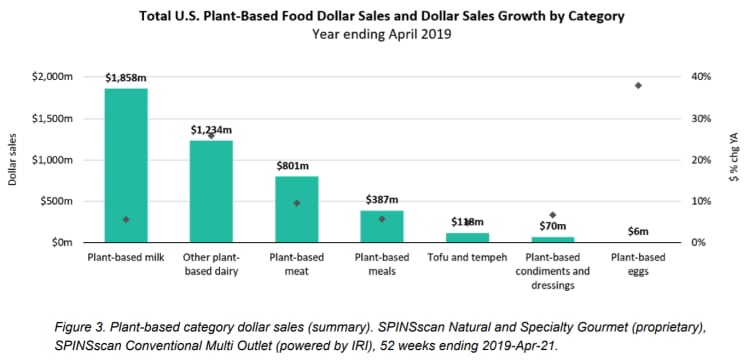

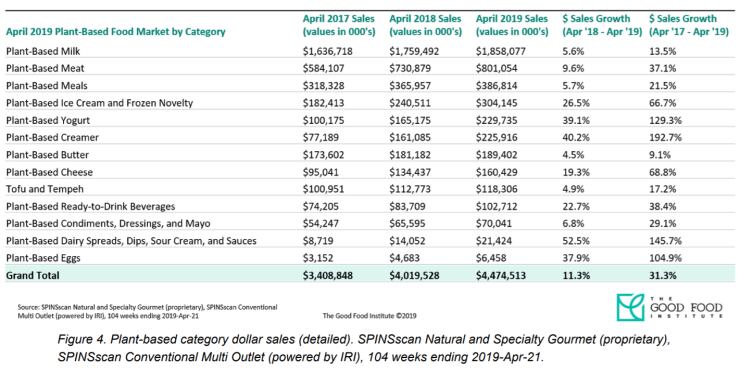

Sales in the overall plant-based foods category (which covers plant-based foods that directly replace animal products, including meat, seafood, eggs, and dairy, as well as meals that contain plant-based alternatives), grew by 11% in measured channels in the year to April 21, significantly outpacing growth in the overall food and beverage market (+2%), said the GFI.

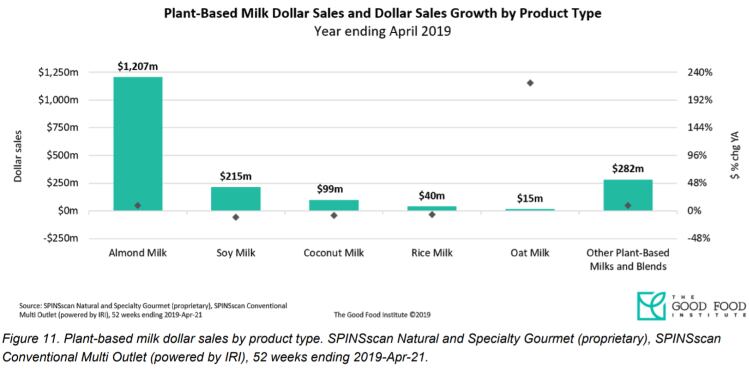

The largest segment within the category is plant-based milk, which has US household penetration of 37% and generated dollar sales growth of +5.6% to $1.86bn over the period, while dairy milk sales fell 3%.

With sales up 222% (albeit off a very small base) in the year to April 21, 2019, oatmilk is the fastest growing plant-based milk, followed by ‘other plant-based milks’ (which spans everything from cashew and walnut milk to pea, hemp, quinoa, oat and flaxmilk, and ‘blends,’ which includes products such as almond-and oat-milk blends, but excludes things such as almondmilk and cold brew coffee blends).

Sales of almondmilk – the top-selling plant-based milk – continued to grow over the period, while soymilk, coconutmilk, and ricemilk experienced declines, said the GFI, which noted that category dollar velocity was up over 9% from last year (as measured by dollar sales per point of distribution in IRI's MULO or multi-outlet channel).

“Refrigerated plant-based milk makes up 89% of all plant-based milk dollar sales, while shelf-stable plant-based milk now makes up just 11%,” said the GFI.

“Dollar sales of refrigerated plant-based milk increased 7% over the past year, while dollar sales of shelf-stable plant-based milk decreased 4% as volume continues to shift toward the refrigerated set.”

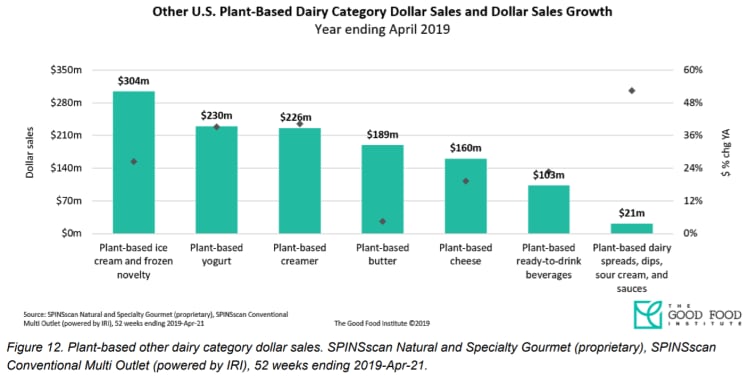

Plant-based yogurt +39.1%, plant-based cheese +19.3%

Some of the greatest dollar growth in the plant-based segment – albeit off a smaller base - is coming from plant-based yogurt (+39.1%), plant-based cheese (+19.3%), plant-based ice cream and frozen novelties (+26.5%), plant-based creamers (+40.2%), and plant-based eggs (+37.9%), said the GFI.

“Emerging plant-based dairy categories are growing even faster as more households are introduced to other plant-based dairy items. In the past year, plant-based yogurt has grown 39%, while conventional yogurt declined 3%; plant-based cheese has grown 19%, while conventional cheese is flat; and plant-based ice cream and frozen novelty has grown 27%, while conventional ice cream and frozen novelty has grown just 1%.”

PBFA: 'We are at a tipping point'

PBFA senior director of retail partnerships Julie Emmett added. “Plant-based foods are a growth engine, significantly outpacing overall grocery sales. We are now at the tipping point with the rapid expansion of plant-based foods across the entire store, so it is critical for retailers to continue to respond to this demand by offering more variety and maximizing shelf space to further grow total store sales.”

*The SPINS data represents retail sales of plant-based foods that directly replace animal products, including meat, seafood, eggs, and dairy, as well as meals that contain plant-based alternatives. This data was obtained over the 52-week period ending April 21, 2019, from the SPINSscan Natural and Specialty Gourmet, and SPINSscan Conventional Multi Outlet (powered by IRI) channels.

KIDS AND THE PLANT-BASED TREND:

How are parents incorporating plant-based alternatives into their children’s diets? And what are the nutritional implications? Hear from Michele DeKinder-Smith at Linkage Research & Consulting at the 2019 FoodNavigator-USA FOOD FOR KIDS summit in Chicago. November 18-20.

Checkout the latest speakers and register before July 31 to get a 20% early bird discount.