While unit sales of regular soda are still in negative territory (down -2.7% in the past year), they edged into positive territory (+0.1% in the last year) for diet soda, said Wells Fargo analysts in a July 23 note on the category.

The figures were released as Coca-Cola issued its Q2, 2019 figures, which highlighted a "positive performance in trademark Coca-Cola driven by double-digit growth in Coca-Cola Zero Sugar and innovation such as Coca-Cola Orange Vanilla" in North America.

Sparkling flavored water, energy drinks, strongest performers

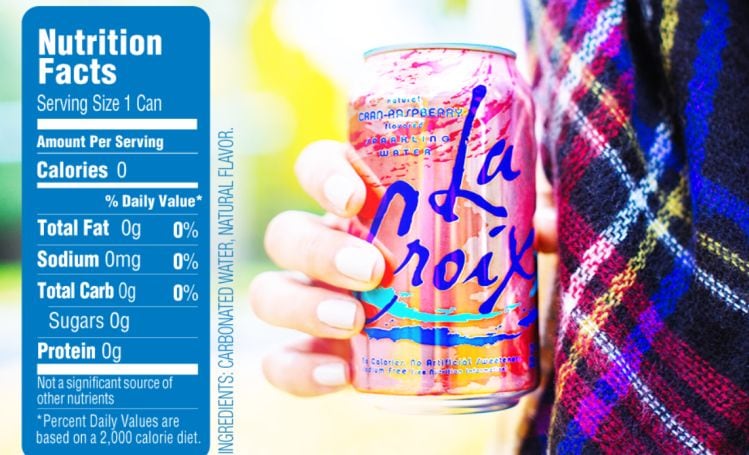

The strongest performers in the non-alcoholic beverages category over the past year have been sparkling flavored water, with dollar sales up +15.4% in the 52 weeks to July 13, although growth has slowed somewhat in recent months, with sales up +8.5% in the latest 12 weeks, and +8.2% in the latest four weeks.

Within the category, Bubly (PepsiCo), Spindrift, and Sparkling ICE have performed well this year, although dollar sales of sparkling flavored water from National Beverage Corp (which owns the LaCroix brand) have experienced significant declines, with sales down -0.3% in the latest 52 weeks, down -15.7% in the latest 12 weeks, and down -16.9% in the latest four weeks.

PepsiCo: Bubly could be one of our next billion dollar brands

"On Bubly, we’re super happy really with this opportunity... I think the personality of the brand is fun, is modern, is young... Bubly has doubled velocity per point of distribution in the last three, four months after the Super Bowl with this new advertising.

"We’re going to be innovating in this brand not only [with] flavors but other occasions that I think we can attack. You’re going to see mini cans, you’re going to see larger cans. It’s going to be a no plastic brand and I think that is a very good positioning that we can have for this brand going forward for the modern consumer, the millennial and the younger mother that I think is adopting this brand for her kids. So we’re feeling very good about this brand. This could be one of our next billion dollar brands."

Ramon Laguarta, chairman and CEO, PepsiCo, Q2 earnings call July 9, 2019

Energy drinks also put in a solid performance this year, with dollar sales up +9.9% in the latest 52 weeks, +8.4% in the latest 12 weeks, and +8.3% in the latest four weeks.

"The initial results [for Coca Cola Energy] are encouraging. In Spain, the first market where Coke Energy was launched, [it] has already captured a 2% share of the energy category... We are currently in 14 countries [including Japan, Australia and South Africa], and by the end of 2019, we expect to have Coke Energy available in 20 markets [including Mexico and Brazil, although the firm has not said whether the US will be on that list].

"Clearly, we're thinking about the US market and when would be the right timing for Coke Energy."

James Quincey, chairman and CEO, Coca Cola, Q2 earnings call July 23, 2019

Still flavored water posts modest gains, bottled water growth tailing off

Still flavored water posted modest gains, with dollar sales up +4.1% in the latest 52 weeks, +1.2% in the latest 12 weeks and +3.1% in the latest four weeks.

However, bottled water sales have trailed off this year, with 52 week sales up +3.7%, but 12 week sales flat, and four week sales up just +0.5%.

Juice: A lackluster year

Juice had a lackluster year, with refrigerated juices and drinks down -1.2% in the 52 weeks to July 13, down -1.1% in the 12 weeks and down -0.2% in the four weeks.

Shelf-stable juice was down -0.7% in the 52 weeks to July 13, -2.7% in the latest 12 weeks and -1.7% in the latest four weeks.

Frozen juices and drinks remained in the doldrums, with dollar sales down -13.2% in the latest 52 weeks, down -14.5% in the latest 12 weeks, and down -14.8% in the latest four weeks.

Sports drinks: Underwhelming

Sports drinks sales were up +3.1% in the latest 52 weeks, but growth has been tailing off, with sales down -2.7% in the latest 12 weeks and down -2.3% in the latest four weeks.

Ready to drink tea and coffee growth declining steadily

Liquid tea – once a strong performer in the category - has also posted steady declines in growth over the past year, with 52 week sales down -0.7%, 12 week sales down -4.1% and four week sales down -3.6%.

Liquid coffee has followed a similar downward trajectory, albeit from a stronger starting position, with dollar sales up +7.3% in the 52 weeks, up +4.1% in the 12 weeks and up +2.9% in the latest four weeks.

* Nielsen Total US xAOC including convenience stores, collated by Wells Fargo Securities.