“It is a really exciting time to be in the grocery ecommerce space, as you can imagine, the customer needs are changing very, very rapidly and technology solutions to deliver on those needs are also changing very rapidly,” Albertsons’ VP of eCommerce Business Kenji Gjovig told attendees late last month at the Digital Food & Beverage conference in Austin, Texas.

He explained that Albertsons is making strides to improve its technology to enhance shoppers’ online experience, but the real potential to help consumers while also expanding the retailer's and food and beverage brands’ sales online is to work directly with brands to better promote the products that consumers want.

To do this, Gjovig said, Albertsons has created a four-prong framework that is focused on content enhancement, search optimization, seasonal merchandising events and category growth projects.

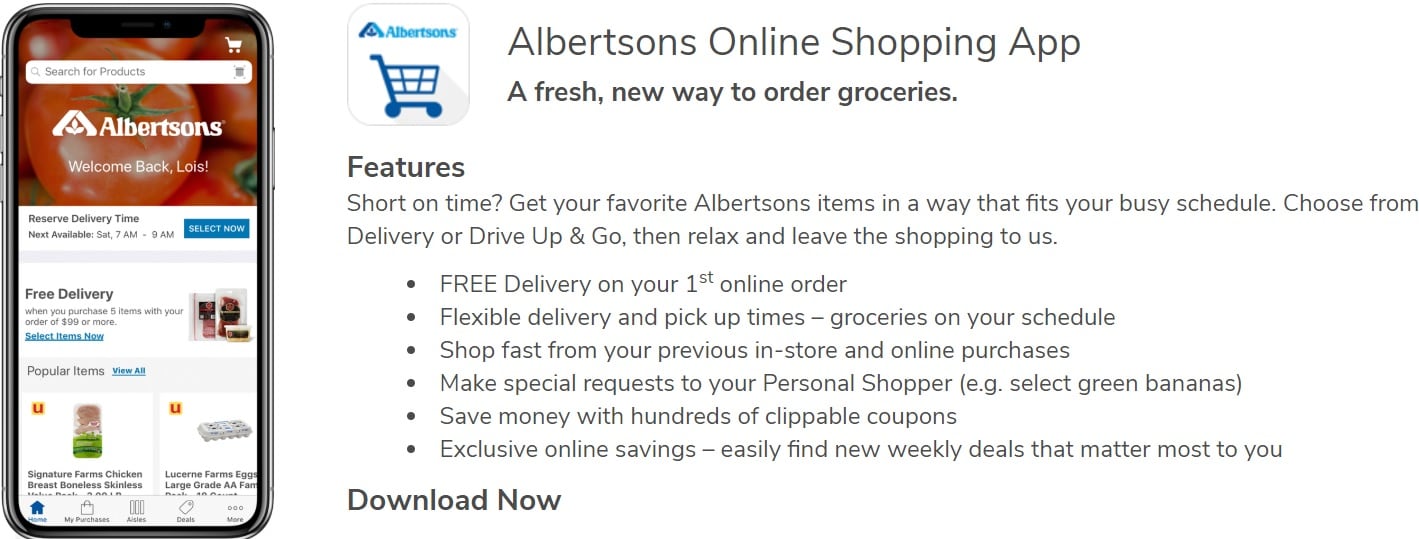

In terms of content enhancement, Gjovig explained that Albertsons is working with brands to improve their product detail pages and in particular the image included on that page.

“Our current catalog has limitations of only allowing us to have one image in the catalog at the item level. And so, if we only have one image, that image has to work really, really hard for us to tell a story to the customer so that they know what they are getting on the product,” he said.

Specifically, he recommended brands supply cleaner pack shots with higher resolution imagery and simple text that makes it very clear what is inside the package, including product count, flavor, size and other key information.

Gjovig said the goal is images that quickly convey all the necessary information consumers want so that they do not have to read the description or details but rather can more quickly and more comfortably add a product to their cart based on a quick review of the image.

If brands do this, he added, they can expect a substantial lift, Gjovig said, noting that one brand saw a 10 point lift above the baseline growth of the category simply by making these changes.

Search optimization

Last October, Albertsons launched a new search engine that uses artificial intelligence and machine learning to optimize search results on an ongoing basis.

“As the customers engage with search results, it learns so that the next time it can optimize you further,” he explained.

Within months of updating the system, Gjovig said that Albertsons saw “significant improvements in our search performance,” including the number of null searches drop to zero and an increase in products added to carts from searches as well as an increase in search conversion and a reduction in page load time.

The new platform also optimized what products are offered based on search results and purchases. For example, Albertsons previously sold individual bottles of water on its website, but after implementing the new search engine it switched to offering full cases of water, which is much more in line with how consumers use grocery ecommerce, Gjovig said.

Seasonal merchandizing events

A core component of Albertsons’ go-to-market strategy in ecommerce is seasonal merchandising events that cut across multiple online channels to entire consumers with timely offers and inspirational ideas that then drive them back to the retailer’s website, Gjovig said.

He explained a year and a half ago the retailer began offering CPG partners the opportunity to “invest added dollars in various channels, including display networks in social media,” which brings consumers either to brand landing pages, to Albertsons’ digital gallery or to shoppable locations on the company’s ecommerce site where consumers can add a product right away.

The display networks focus on customers’ needs based on their calendars, he explained. For example, the retailer recently created one around grilling for the summer and included several brands that offer products for cooking out, such as meat and condiments. The images used are similar across channels, such as in emails and on Albertsons’ website so that the customer experience online matches offsite and onsite, he said.

Other ways that Albertsons is creating promotional opportunities for CPG brands is through sponsored searches, sponsored cross sell and shoppable recipes.

Gjovig explained that sponsored searches allow brands to buy search words that when used will place their item at or near the top of the search results. For example, Kraft Heinz used sponsored search for the term ‘cheese’ and as a result saw and eight to one return on investment.

Sponsored cross selling allows CPG brands to cross the images they use on the product detail page to other locations on the retailers’ website, such as the landing page or homepage. Keurig Dr Pepper used this feature and saw a five to one return on investment, Gjovig said.

Category growth projects

The final way that Albertsons is helping to drive online sales for brands is through category growth projects, in which CPG brands team with the retailer to create “category solutions” that will benefit not only their brand but the category as a whole.

One example is a partnership with Coca-Cola where Albertsons created a special landing page for its drive-and-go program, which allows consumers to order groceries online and pick them up in the store. In this case, the special landing page asked shoppers if they wanted to add an cold beverage to their order to enjoy on the ride home from the store.

Another example that Albertsons is piloting is a supplier data package, which provides CPG brands with deeper insights into the performance of its products in terms of sales, unit velocity, profitability and out-of-stocks, Gjovig said.

Looking forward, he said, Albertsons is working on new navigation and filtering options that will make it easier for consumers to shop a category and more specifically how to shop one category differently than another category.

“Over the next several months, we are going to be selecting leaders in the supplier community to help us identify in a particular category what are the top facets and filters about how customers shop that category so we can make sure our navigation, our taxonomy are appropriate so they find the products they want quickly,” he said.

While Albertsons is making strides online, Gjovig said it stills has a long way to go to make the online shopping experience better for consumers and to meet their rapidly changing needs. With this in mind, he encouraged attendees in the room to think of how they can help engage online shoppers and help retailers better reach them through partnerships for growth.