New research shows that the total cannabinoid market in the US [which includes THC, CBD, etc etc] will reach $45bn by 2024. To put the market opportunity cannabinoid-infused products represents into context, the current US snacking market delivers roughly $40bn in annual revenue.

This number highlights the impact cannabis (hemp and marijuana) products can have on the CPG industry, which has traditionally struggled to grow annual revenues more than a few percentage points. Manufacturers have an exciting opportunity to increase revenue and market share, though significant challenges remain that brands must evaluate and overcome.

Consumer preferences are taking shape

Trends on cannabis-related products are emerging, along with a wealth of data on consumer preferences and behaviors. A few highlights:

- ~50% of cannabis consumers are heavily influenced by the convenience of cannabinoid product formats, such as edibles and topicals.

- 44% of cannabis edibles consumers prefer low doses of THC (<10mg), with these low dose products achieving staggering growth in year-over-year dispensary sales. Consumers are looking for trusted and controlled experiences.

- 54% of consumers have chosen edibles products based on the CBD content; many selecting products that are at a high CBD:THC ratio (10:1 or higher, thus minimal intoxicating effects). Consumption is multi-faceted, multi-purposed, and functional.

Seventy-one percent of cannabis consumers turn to these products for recreational and social reasons, 56% for health or medical reasons, and 32% for both.

Among those consuming cannabis products in fully legal US cannabis markets, 57% prefer inhalables, 31% prefer edibles and 12% prefer topicals.

However, behaviors among consumers selecting just CBD products, preferences shift largely towards ingestibles (sublinguals and edibles) and topicals (creams, balms, salves, lotions).

"56% of the US population is unsure of the difference in the effects of THC versus CBD and almost 60% still believe any product derived from hemp will have an intoxicating or psychoactive effect."

Education is an opportunity

As the conversation around legal cannabis and cannabinoids evolves from marijuana and THC to marijuana-derived, hemp-derived CBD and several other cannabinoids slowly gaining attention (CBN, CBG, THC-A, THC-V, etc.), the confusion among US consumers is understandable. The lack of consistency or specified guidelines in hemp-derived product labeling certainly does not help the situation.

To illustrate this confusion, only 22% of US adults 21+ understand the meaning of the term 'cannabinoids' and can articulate the definition.

Further, 56% of the US population is unsure of the difference in the effects of THC versus CBD.

Almost 60% still believe any product derived from hemp will have an intoxicating or psychoactive effect.

As cannabinoid-infused products gain distribution among mainstream retailers, the need for consumer education has undoubtedly grown. The dispensary channel has provided a good model for consumer education through the function of their employees, also known as 'budtenders.'

The primary customer service responsibility of these individuals is to work with the potential consumer in understanding their needs, the experience they are seeking and what product forms they are open to using. In turn, budtenders provide recommendations as well as insight and guidance on dosage.

Channel distribution is shifting

The 2019 CBD market by revenue will total ~$4bn with dispensaries continuing to lead channel distribution with 51% market share. E-commerce and pharmacy follow, each with 14% share; natural/vitamin and convenience/grocery stores trail with 5% and 4% market share, respectively.

As manufacturers and retailers hone their strategies and as CBD products become more available, market share will diversify. By 2024, dispensaries are still expected to lead the pack in the projected $20bn CBD market, but with a 26% share ($5.2 billion), followed by e-commerce with 18%, pharmacy at 11%, grocery and mass/superstores with 9% each.

Even with the expansion of CBD product sales through diversified channels, dispensary dollar growth is still expected to increase by 2.5 times by 2024. As CBD (hemp and marijuana derived) product availability grows, consumers seeking the benefits of CBD will have to make decisions on where and how they buy these products. The availability of THC infused products allows the dispensary channel at least one benefit over other channels, however, the convenience of purchasing CBD products at grocery, mass, or drug stores cannot be ignored.

FDA cracks down on claims

While the 2018 Farm Bill removed hemp as a controlled substance, the FDA will continue to regulate products containing CBD [editor's note: while the FDA is focusing enforcement activity on companies making 'egregious' health claims about CBD, the agency's official position is that CBD is not a legal dietary ingredient in foods, beverages and supplements because it was first investigated as a drug].

The agency is actively warning manufacturers against listing their products as possessing medicinal and healing properties for specific diseases and ailments. In April, the FDA issued warning letters to three companies it believes made such claims.

By 2024, dispensaries are still expected to lead the pack in the projected $20bn CBD market, but with a 26% share ($5.2 billion), followed by e-commerce with 18%, pharmacy at 11%, grocery and mass/superstores with 9% each.

Strategies for manufacturers

Launching any new CPG product is a risky venture. Given factors such as its history and continued regulation, launching CBD products can be especially tricky. Below are five strategies that will help ensure success:

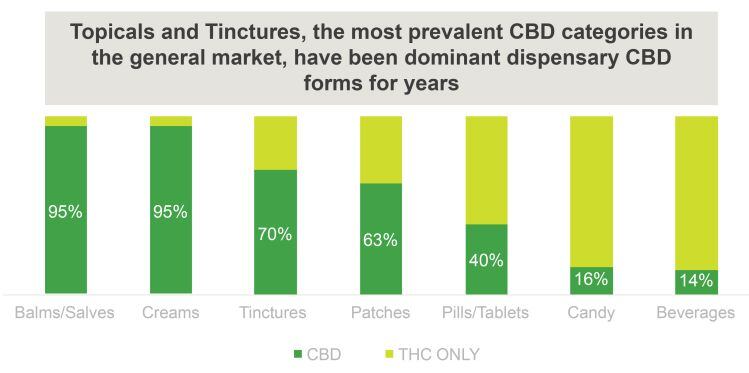

Learn from dispensaries – Consumers of CBD products represent a cross-section of the American shopper, spanning age, income, gender and race. The established dispensary channel offers manufacturers insight on leading trends, including product form, method, flavors, pack size and dosage. Dispensaries remain the leading indicator of where this complex market is going, and dispensary shoppers tend to be the most educated on cannabinoids and cannabinoid-infused products.

Fill the education gap – Shoppers’ lack of correct information surrounding cannabinoid products creates an opportunity for manufacturers to collaborate with retailers in building shopper loyalty through educational initiatives. The customer service provided by many dispensary employees, or “budtenders,” is focused on guidance and knowledge of available product options. Creative manufacturers might work with select retailers to offer a similar service. Trust and reliability are important to consumers.

Opt into retail channels selectively – Channels offering CBD products will shift considerably over the next five to 10 years. Understand the shopping behavior of the consumers the brand is targeting when selecting retail channels. While pharmacy will only make up 11% of total CBD sales by 2024, if a significant majority of the brand’s high-value shoppers turn to this channel for their CBD product purchases, it may make sense to drive penetration there. In addition, consumer interest in CBD products may vary by channel; e.g., topicals may be the best-selling category in the drug channel, while edibles might be most popular in supermarkets.

Be careful about claims – As with many food and beverage segments, the FDA is increasingly scrutinizing claim information. Ensure any product claim receives a thorough review prior to the product going to market. It is worth noting that brands and products available in the dispensary channel are highly regulated in one capacity or another, such as content and pesticides, but they also have greater flexibility when it comes to labeling.

Look for cross-promotional opportunities – There are opportunities to co-market CBD products with other already-established and well-recognized brands. Cross-promotions can attract new consumers to CBD products as well as increase consumption among existing CBD shoppers. Further, consumers are looking for a positive and reliable experience. As such, established brands may provide the confidence consumers seek in trying new products.

Dispensary channel brands will continue to be a source of new competition within mainstream markets — New competition is coming from products currently sold in dispensary channels but making their way to mainstream markets. A perfect example of this is the Select brand, which has been sold in Colorado dispensary markets for years but can be now found in various Walgreens drug stores in the Rocky Mountain State.

The dynamics of the cannabinoids market are evolving rapidly, which creates outsized opportunities for manufacturers that can analyze the market and roll out new products swiftly, rapidly shift their product mix as preferences change, and develop creative approaches to rising above the increasing market noise.

Larry Levin is EVP market & shopper Intelligence at Chicago-based data and insights provider IRI.

Jessica Lukas is SVP at cannabis market data and insights provider BDS Analytics.