Founded in Berlin in November 2011, HelloFresh went public on the Frankfurt Stock Exchange in November 2017. The world’s leading meal kit company, it now operates in the US, the UK, Germany, the Netherlands, Belgium, Luxembourg, Australia, Austria, Switzerland, Canada, New Zealand, France, Sweden and Denmark.

FNU: How has COVID-19 impacted the way customers are using HelloFresh?

UV: With consumers spending more time at home, we have seen an increased need and desire to cook and this extends beyond just dinnertime… Many customers have been cooking with HelloFresh meal kits during the pandemic for comfort, enjoyment or the ability to spend quality time around the dinner table eating home cooked meals with family.

On a global level, the number of orders and meals delivered in the third quarter more than doubled year-over-year. The same growth held true in the US, where we totaled nearly 10 million orders in the third quarter and more than 72 million meals delivered.

FNU: Have you attracted many new consumers during the pandemic?

UV: HelloFresh experienced accelerated customer growth throughout 2020, reaching an all-time high of 5 million active customers globally in the third quarter across the HelloFresh Group. In the U.S., we served nearly 2.5 million active customers during the third quarter.

FNU: What is your confidence in retaining them in the longer term once the pandemic is under control?

UV. Regardless of the initial reasons a new customer may have been drawn to trying HelloFresh, our customers continue using our service once they enjoy the experience of cooking with us. Positive customer feedback and engagement metrics indicate that customers are appreciating the convenience, quality, taste and variety of our meals across all of our brands, and therefore will continue to order meals through HelloFresh at high rates.

FNU: Who uses HelloFresh?

UV: From a product offering perspective, we offer something for everyone. With EveryPlate, consumers can enjoy the convenience of having fresh ingredients and recipes delivered to them at a $5 price point. For those seeking organic, diet-friendly options, Green Chef will offer the most appealing menu. Both of those customer groups look slightly different than our HelloFresh customer that caters to a wider demographic on meal selection and price point.

FNU: How has COVID-19 impacted your supply chain and internal operations?

UV: While we experienced substantially higher demand throughout 2020, our supply chains, which have been honed over the years, were designed to support this rapid growth. This allowed us to adapt quickly and take on new customers in only a matter of weeks.

FNU: How challenging has it been to cope with increased demand and keep facilities running and employees safe?

UV: Our distribution centers, which are SQF (Safe Quality Food) certified, have always adhered to the strictest standards for food and employee safety. At the beginning of the pandemic, we immediately began implementing a catalogue of additional safety measures, following guidance from the CDC, FDA and local health departments. These new measures include strict social distancing, health screenings for anyone entering the building, daily deep cleanings, facemasks and PPE for all employees and the installation of new HEPA filters across all of our facilities.

FNU: Can you provide an update on capacity?

UV: We had substantial scalability built into our capacity, but had to expand capacity quickly to accommodate faster than expected growth.

In the US, we have added new distribution centers in Newnan, Georgia and recently, Totowa, New Jersey. The new Totowa facility supports the production and distribution of EveryPlate, our rapidly growing brand focused on value, customization and convenience. Both the Newnan, GA and Totowa, NJ facilities are now operational and actively serving customers.

We’re also building out a new 375,000 square foot distribution center in Irving, Texas, which will be our largest production and distribution site.

By mid-2021, we will have expanded our capacity to support US consumers by roughly 50%.

FNU: Do you think there is a significant percentage of consumers that buy into the meal-kit concept, but don’t want to commit to a subscription?

UV: There is a certain level of education required to ensure consumers understand the options available to them. For instance, our customers have the option to pause their subscriptions, at no charge, to accommodate their schedules and lifestyles as needed.

FNU: How environmentally friendly are meal kit services?

UV: When it comes to sustainability, meal kits are a more environmentally friendly way to get groceries than supermarkets and other traditional food retailers. HelloFresh sees less than 1% of all purchased ingredients go to waste in our facilities, and we are constantly innovating to refine the way we package and ship food to customers – providing them exactly the amount of food they need to limit waste in their own kitchens, too.

FNU: Why do you think HelloFresh has been more successful than some other meal kit companies in the US?

UV: As a global meal kit company, we have the ability to leverage learnings and best practices across our 14 markets, which is unique in the meal kit sector and a competitive advantage for HelloFresh. We have been tirelessly focused on improving our business across all facets of the value chain. Our investments in technology, product, marketing, brand and operations have been instrumental in building HelloFresh into the global meal kit category leader. We are diligent about the investments we make, and our team brings deep expertise in how to scale businesses into successful– and profitable – business models that we build year over year.

FNU: What is your focus for 2021?

UV: In 2021, we will focus on three key pillars for growth: expanding products in existing markets, launching new geographies and new brands to reach more consumers, and expanding our offerings for existing customers.

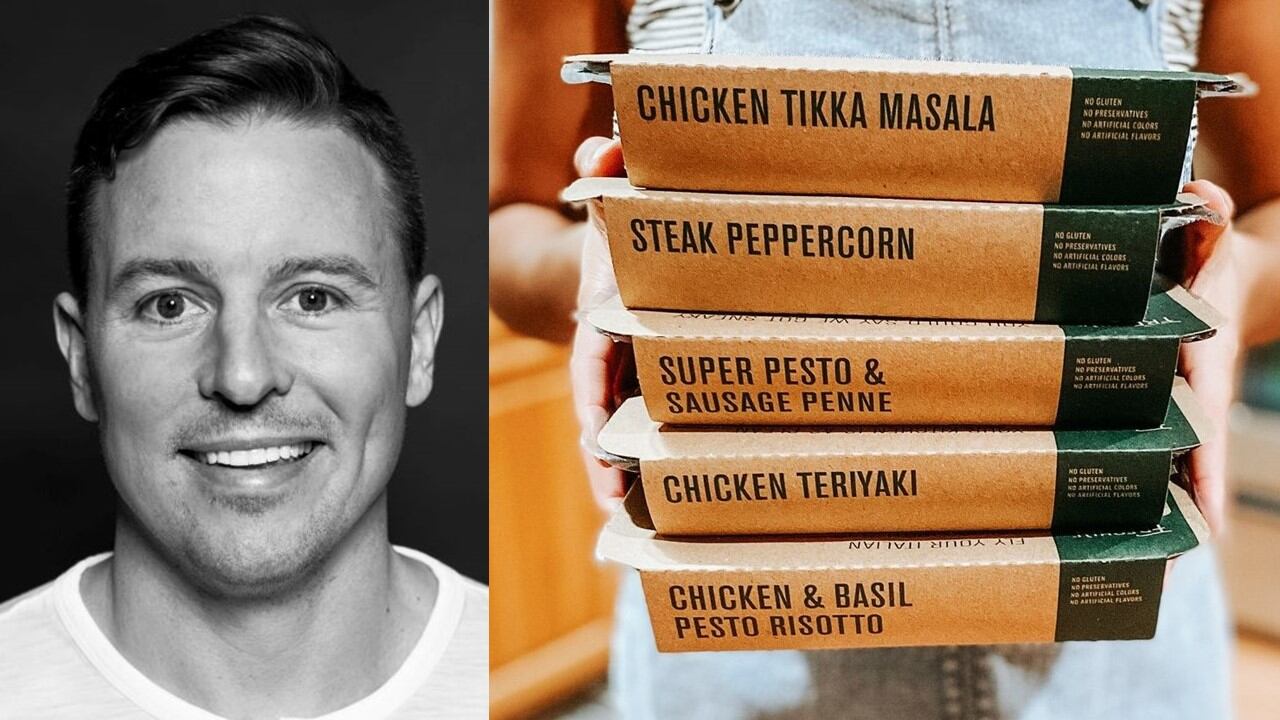

FNU: You recently moved into the fresh prepared meals delivery space with the acquisition of Factor75. Why?

Our recent acquisition* of [Batavia, Illinois-based prepared meal delivery company] Factor [generating 2020 revenues of around $100m] offers increased optionality to both new and existing customers who may be seeking ready-to-eat meal solutions.

The addition of Factor strengthens our position as the category leader and expands our total addressable market with new customer segments, along with increased capacity.

* The total purchase price was up to $277m, of which $177m was payable upon the closing of the transaction with the remaining $100m structured as a performance-based earn-out, guaranteed by HelloFresh, and ongoing management incentives.

HelloFresh posted a 113.5% year-on-year surge in US revenues* in the third quarter to €526.3m ($621.6m), despite capacity constraints, with a 68.7% increase in customer US active customers in Q3 to 2.49 million. Group sales were up 120.2% to €970.2m ($1.15bn) and earnings before interest and tax topped €92m ($108.8m).

Blue Apron posted a 13% increase in revenue to $112.3m in Q3, driven by higher average orders and higher numbers of orders per customer, although customer numbers declined from 386,000 in Q3, 2019, to 357,000 in Q3 2020, a 7.5% drop. Net losses topped $15m in the quarter.

Kroger does not separate out Home Chef figures in its financial results, but Kroger CEO Rodney McMullen told analysts on the Q2 earnings call in September 2020 that Home Chef had had “an incredible quarter both in sales growth and profitability.”

*124% growth in constant currency