“Before the pandemic, we aligned on a new strategic framework to drive the next chapter of growth for General Mills. This plan, which we call Accelerate, sets clear priorities for where we play, how we win and how we’ll drive superior returns for our shareholders over the long term,” CEO Jeff Harmening said.

Predicted to help General Mills grow organic sales 1-2% in fiscal 2020 before the pandemic was declared, the plan instead helped the CPG giant meet increased global in-home food demand and generate an 8% increase in organic sales with adjusted operating profit and adjusted diluted earnings per share up double digits, Harmening said.

“We’re also outperforming our peers and household penetration gains and generating repeat rates that outpace those of our categories. We’ve continued to execute our Accelerate strategy through the pandemic – taking actions to maintain our momentum,” Harmening said.

These efforts, and the four pillars of Accelerate, include boldly building brands, increasing innovation, leveraging General Mills’ scale and “advantage capabilities” to drive growth and efficiency, and “being a force for good.”

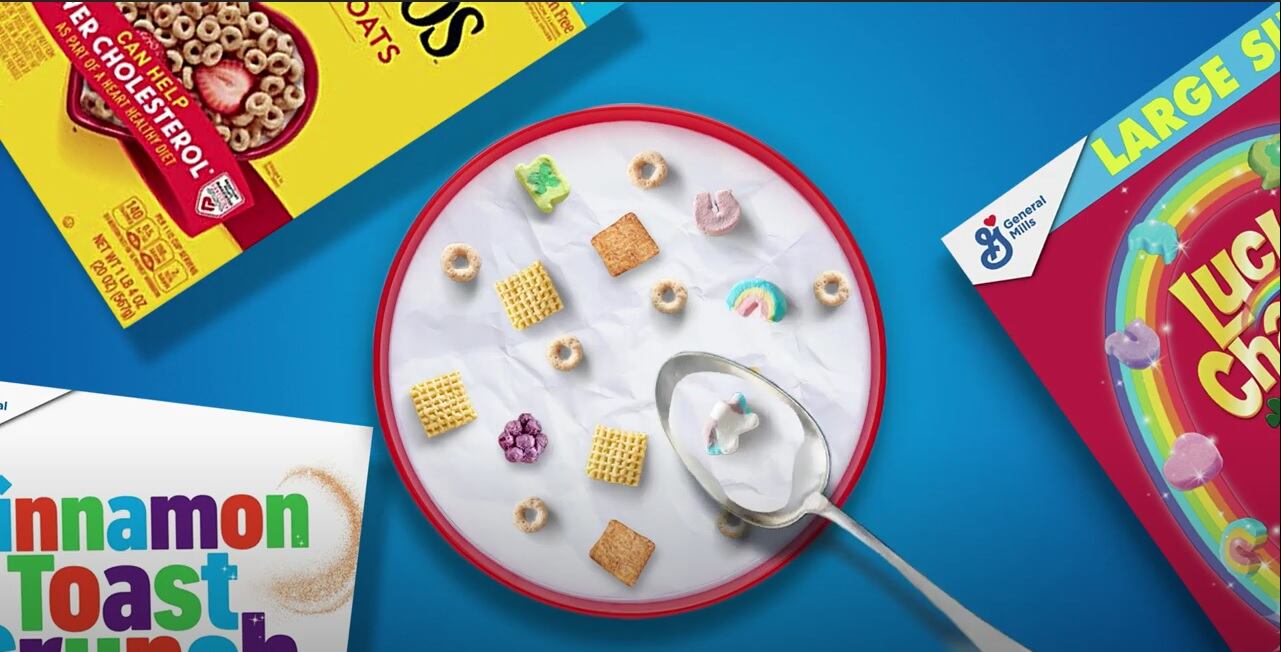

General Mills will focus its effort and the impact of these four pillars in its eight core markets, with special emphasis placed on North America as the “number one priority,” and within five global platforms, including cereal, ice cream, snack bars, Mexican food and pet food, Harmening said.

Reinventing the marketing playbook

Even with a portfolio of iconic brands that are household names, General Mills no longer is taking brand recognition and loyalty for granted and is making brand building one of the four main pillars of its Accelerate strategy.

“We’re reinvesting in a reinvented marketing playbook. Our marketing strategy is built on the core belief that brands matter, big ideas count and execution is crucial. And while we have always known this to be true, the pandemic has only reinforced our view that nurturing vibrant brands with big ideas and outstanding execution really delivers tremendous results,” Chief Marketing Officer Ivan Pollard said at the conference.

He explained that after a period of declines, General Mills in recent years began reinvesting in media spend – bumping it up 15% in fiscal 2020 and expecting an addition increase in the mid to high-single digits in fiscal 2021, “even with one fewer week in our calendar.”

Pollard stressed it is not just the investment amount that matters, but how it is used, which he said is evolving to better align with consumer shopping habits.

“We are significantly ramping up our e-commerce media investment and growing the proportion we spend in other digital vehicles while maintaining a strong presence on the old vehicles like television,” he said.

Often the two are used together, as in the case of supporting Wheaties cereal, he added. He explained that the athletes featured on boxes and in ads now double as influencers through their social media accounts, which often have broader reach than individual games or matches in which they play.

Relentless innovation

Even as General Mills continues to invest behind its iconic and top-performing brands, Harmening noted it is not shy about investing in new brands and is bringing innovation to market faster than before.

“We’ve revamped our entire innovation process with a focus on getting new products into the hands of consumers faster. Now we can measure the time from an idea to a first consumer transaction in weeks rather than months or years, resulting in more experimentation with greater efficiency,” he said, adding the company has “structured our organization to foster continued development” through its recently created internal startup accelerator G-Works and its investment arm 301 Inc, which makes minority investments in emerging, high growth brands.

This change is paying off with the sales contribution from new products increasing 30% in recent years, he added.

Unleashing scale

The third pillar of General Mills’ Accelerate program takes advantage of the company’s scale by “aggressively investing in data and analytics to drive differential growth and efficiency across our enterprise,” Harmening said.

For example, General Mills’ recently digitized its Box Tops for Education program so that instead of asking parents to cut out and send to schools the Box Tops for Education logo to reap rewards for schools, they now scan their grocery receipts into an app that automatically tabulates and sends the “tops” to the school of choice. At the same time, General Mills gathers receipt-level data, which while anonymized shows deeper insights into consumer purchasing habits in adjacent and complementary segments.

“We’re also leveraging our scale to enhance our core capabilities, including our holistic margin management productivity program, our strategic revenue management initiative, and e-commerce through the pandemic,” he explained.

A force for good

The last pillar of General Mills’ Accelerate program is to “win by being a force for good,” Harmening said, noting that the company has reported on corporate responsibility efforts for more than 50 years while keeping goals relevant and impactful.

“Six years ago, we became the first company to publish a climate goal approved by the Science Based Targets initiative,” Harmening noted, adding that “today our force for good efforts are focused on advancing our four critical priorities: regenerating our planet, improving food security, strengthening our communities and advancing inclusion.”

In terms of sustainability, he said, the company is focused sourcing ingredients from more farms practicing regenerative agriculture practices and reducing greenhouse gas emissions by 30% across the full value chain by 2030 and reaching net zero emission levels by 2050.

The company is keeping this effort in front of the consumer with Nature Valley’s Feb. 16 launch of the first plastic snack bar wrapper that is approved for store drop-off recycling.

Overall, as General Mills executes its Accelerate strategy to deliver on its purpose and drive growth, Harmening said he is feeling “bullish about our future outlook” and the company’s ability to drive long-term value and “superior” shareholder returns.