Advance US retail sales data released yesterday shows retail and foodservice sales for May surged 8.1% from a year ago but slipped 0.3% to $672.9bn from April after a weaker than expected March to April, which the US Census Bureau simultaneously revised down from a previously projected increase of 0.9% to just 0.7%.

A closer look at where consumers spend their food dollars shows a slight uptick of 1.2% in seasonally adjusted sales at grocery stores from April, after coming in flat the previous month. At food service and drinking places, seasonally adjusted sales also climbed – but only 0.7% from April – the lowest month over month increase in 2022.

While the sales in retail and food service are still rising, all of the increase likely comes from inflation, which continues to climb.

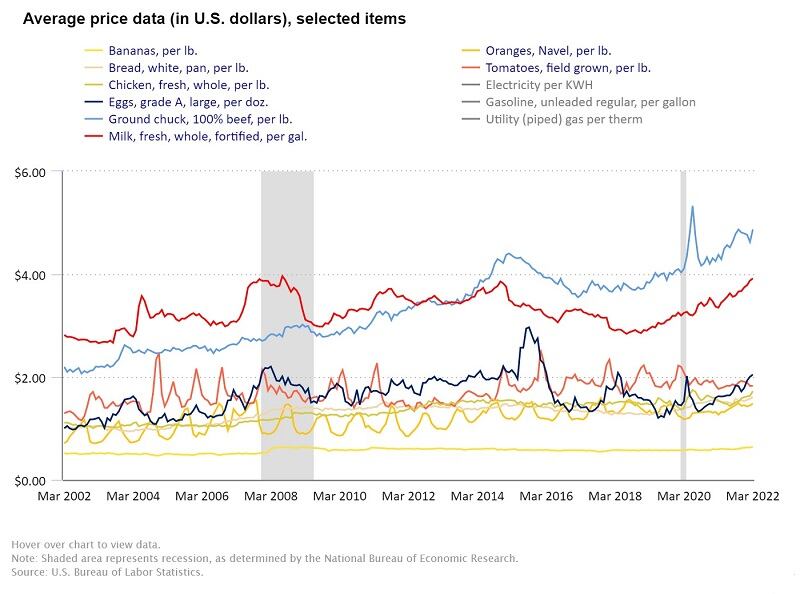

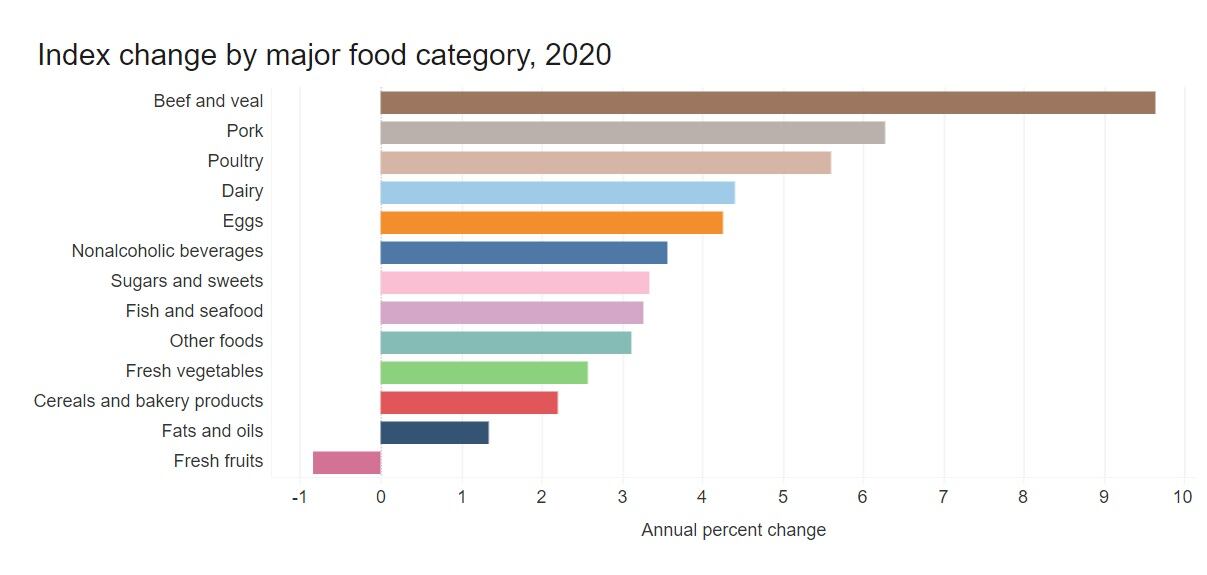

According to data from the Labor Department released earlier in the month, the consumer price index was up 8.6% for all goods and a staggering 10.1% for food in the past 12 months. Within food, prices for products consumed at home far outpaced those eaten away from home at 11.9% compared to 7.4%, according to the Bureau of Labor Statistics.

In an attempt to curb inflation, The Federal Reserve announced yesterday that it will raise interest rates an aggressive three-quarters of a percentage point – significantly higher than the expected half percentage point. While this is the first hike of this size since 1994, it may not be the last, with the Fed cautioning additional raises of the same size are on the horizon; however it is not clear when or how often.

With interest rates rising and consumer spending lowering, companies that might need additional financing or credit to soften the potential of economic difficulties in the coming year, should act fast to secure it, eCapital Asset Based Lending CEO Jennifer Palmer recently told FoodNavigator-USA’s Soup-To-Nuts Podcast.

The worst may be yet to come

These numbers likely will continue to fall before they rebound, suggest analysts who argue retailers and brands should plan now for the worst while still hoping for the best.

“Grocery sales will likely continue to remain flat due to the economy cooling down and potentially heading into a recession,” said Chip West, a retail and consumer behavior expert at Vericast.

He predicts that as this happens, consumer brand loyalty will erode as more shoppers trade down to more budget-friendly options and look for deals, fueling increased competition from private label, dollar stores and discount stores.

But, he adds, as consumers rethink their purchases and shopping habits, there is also an opportunity from stores and brands to attract new consumers if they strategically leverage promotions and effectively communicate their value proposition, which isn’t restricted to price.

Consumers have the money, but need a reason to spend

Mike Graziano, a consumer products senior analyst at RSM, agrees, noting that while consumers are concerned with the cost of goods today, their underlying financials remain strong, for now, which suggests they have the money to spend, but need a reason to do so.

“There needs to be a reason to drive them to shop: elevating the consumer experience, potentially discounts, something that is enough of a reason for a consumer to overlook some of the price pressures today,” he said.

He added that leveraging customer loyalty programs is one way to do this which could also build long term relationships.

Retailers, brands should recalibrate inventories

Graziano also stressed that retailers and brands need to offer products that consumers want, and the numbers released this month suggest they currently are not.

“These numbers will likely put more pressure on retailers with elevated inventory levels to be able to move inventory in order to restock their stores for back to school and holiday shopping season,” he said.

He added: “Over the long term, these numbers mean retailers will need to rethink their projections and potentially their promotional plans through the summer.”

To help them do this, he again pointed to loyalty programs, which not only engage consumers but “allow companies to source critical customer data to better prepare