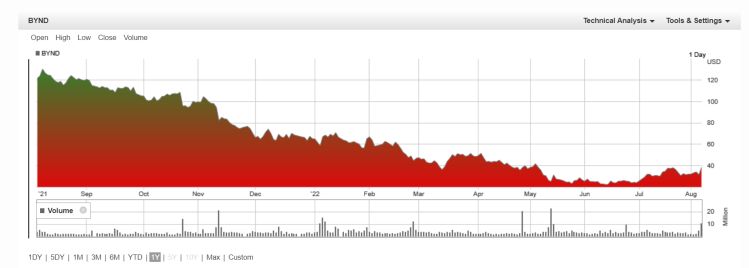

Beyond Meat Q2: CEO under pressure as firm posts $97.1m loss on sales -1.6% to $147m, lowers guidance

Unlike plant-based milk brand Oatly, which just announced a $72m net loss on sales of $178m in its latest quarter, but saw sales growth of +21.8%, Beyond Meat’s Q2 sales declined -1.6% year-on-year.

Despite the grim results, Brown teased the future launch of a "delicious and convincing strip of steak" and continued to insist that if the products improved and prices came down, the “transition to mass market consumption will occur."

He added: "I believe the rise of plant based meats to a prominent role in the global diet is inevitable.

"[But] we recognize progress is taking longer than we expected… Our transition to mass market consumption will occur as we actualize our vision: providing consumers with plant-based meats that are indistinguishable from, understood as healthier than, and at price parity with their animal protein equivalents.

“With the recent, dramatic, decline in consumer buying power, the importance of delivering on our price parity targets is magnified.”

The McDonald's US trial 'Tests are done for all kinds of reasons'

Asked about the results of Beyond Meat's recent US trial with McDonald’s, he said: “I just can't comment on the McDonald's stuff… but I wouldn't necessarily argue the US market is not ready…

"Tests are done for all kinds of reasons. They're done to determine pricing. They're done to determine the build, they're done to check out incrementality, and they get the results, and then they make assessments. So I think there's a lot of noise in the system, in the media, right now about what's actually going on.”

In a note issued Friday, Peter Saleh, managing director, restaurants, at BTIG, said "extensive channel checks" with McDonald's and KFC franchisees indicated "that while neither test was a wild success, the products are too important to the brands' ESG commitments to ignore."

He added: "We expect McPlant will be tweaked and retested at some point in the future, but don't expect a national launch this year as the recent market tests in Dallas and San Francisco proved underwhelming. For KFC, we believe the product sold well enough to earn a spot on the menu, but the higher product cost negated franchisee profits. We believe both products could return to their respective menus following changes that make them more appealing to franchisees."

Beyond Jerky: 'Velocities are now trending below initial forecasts'

Beyond Meat Jerky, the first product to emerge from the ‘PLANeT Partnership’ joint venture between Beyond Meat and PepsiCo, has been a success with sales of $15.9m in Q2, but had not met the firm's very high initial expectations, acknowledged Brown.

"Although Beyond Meat Jerky has approximately quadrupled the size of the plant-based meat snacks subsegment, we had very high expectations for this product and velocities are now trending below initial forecasts.

"The build may happen more slowly than we thought, but it's a great product. It's really great to see it out there in the marketplace and people like it."

Saleh at BTIG noted: "Management stopped short of providing a roadmap or game plan to reaccelerate the sales trends when asked, leaving us to believe there is no obvious solution to improving the product's appeal."

'Our transition to mass market consumption will occur ...'

Blaming disappointing dollar sales on price cuts in the EU, changes in foreign exchange rates, and increased trade discounts, Brown said total volume sold increased 14.6% year-on-year.

US retail net revenues were up 2.2% YoY in the quarter primarily driven by sales of Beyond Meat Jerky, while new revenues in the US foodservice channel dropped -2.4%.

International retail net revenues slumped -17% due to list price reductions in the EU, unfavorable foreign exchange rate impact, and increased trade discounts; while international foodservice net revenues rose +7%.

Fresh plant-based meat, US retail: 'It got kind of disorganized and disjointed as a category'

Drilling into the dynamics of the US retail market for meat alternatives, Brown said: “Beyond Meat really pioneered that [getting plant-based meat into the fresh meat case]. We had the beef products, the burger, sausage... And then a number of brands came in, and it got kind of disorganized and disjointed as a category, particularly in the fresh space.

“And so there'll be some brands that fall away, there'll be consolidation and things of that nature. But let's get back to a really clearly identifiable brand block in retail. So reinvesting in the retail space to strengthen our retail lines is something that we're really going to focus on.”

Bernstein: 'The outlook is murky here'

In a note issued Thursday evening, analysts at Bernstein said: "While the company is clearly now very focused on managing operating expenses to mitigate losses, the question remains about how the company gets back to the growth needed to generate operating leverage to turn the corner on profits.

"Unfortunately the outlook is murky here, with consumers trading down to cheaper animal meats and private label alternatives amidst the broader economic slowdown in the developed markets. And with the cash burn still running hard and fast, it begs the question of when and how the company might address the need to raise further capital in 2023."

'Perhaps a trade buyer might be interested in stepping in?'

They added: "We are hopeful that over time, new innovations including cultivated animal fats and alternative ways to emulate the texture of whole cut meats with plant-based options will lead to ongoing developments of the category over time, but we worry that over the next several quarters, the going will remain tough for Beyond Meat given the current product line up.

"Over time, we wonder whether the company might eventually consider partnering with or acquiring new technologies being developed by other start-ups in the space that offer step changes in product quality... or perhaps a trade buyer might be interested in stepping in (although the cash burn and current margin dynamics may preclude this)."

Cheaper pea protein isolate?

Progress has been made on cutting procurement costs in some areas, said CFO Phil Hardin: "On the last call we said we were in the process of attempting to qualify products made from pea protein isolate supplied from lower cost providers. We were successful and now have the capability to produce many of our products from 100% low-cost pea protein isolate.

"We recently secured reduced prices on certain packaging components [as well]."

Plant-based meat by numbers, US retail: June 2022

According to 210 Analytics, which analyses IRI data in measured US retail channels, dollar sales of plant-based meat edged up +1.1% in June 2022 vs June 2021, although volumes dropped -4.5%.

The growth was entirely driven by frozen products, however, helping to offset double-digit declines in refrigerated meat substitutes:

- Refrig. meat alternatives, June '22 vs June '21: Dollars -14.3%, volumes -13.5%

- Frozen meat alternatives, June '22 vs June '21: Dollars +6.4%, volumes -9.7%

- Conventional meat, June '22 vs June '21: Dollars +5.7%, volumes -2.7%

The price of conventional meat has surged over the past year, while the price of refrigerated plant-based meat has gone down slightly, but there is still a large gap between conventional and plant-based products:

- According to IRI data, the retail price of meat alternatives averaged $8.17/lb in June 2022, well above the price of conventional meat products: Fresh beef ($6.00/lb), ground beef ($4.74/lb), fresh chicken ($2.90/lb), fresh pork ($3.23/lb).

According to Nielsen data crunched by analysts at Bernstein, Beyond Meat has experienced sharp declines in retail sales of most of its core products in recent weeks with the exception of frozen patties and its new Beyond Jerky, developed with PepsiCo.

12 weeks to July 16, 2022, vs same period previous year:

- Fresh patties: -35%

- Dinner sausages: -25.9%

- Fresh ground meat: -17.1%

- Breakfast sausages: -7.6%

- Frozen patties: +240.4%