GUEST ARTICLE: Don’t believe your year-over-year comps

For startups, though, annual YOY comps are the default periodization in which scanner data gets sold to them. They often have nothing better because finer-grained periodization costs significantly more to obtain. There is nothing wrong with YOY comps when your brand is prominent and slow-growing. How slow growing? At or below long-term inflationary trends. 3% or less.

However, early-stage brands that capture media attention tend to be fast-growing businesses with 50% annual growth. When growth occurs this quickly, deceleration can also happen quickly. When the brand is small, fast growth can also decline with a single chain delisting. The early-stage world is full of topline volatility.

YOY comps can obscure understanding of performance and mislead investors and the public

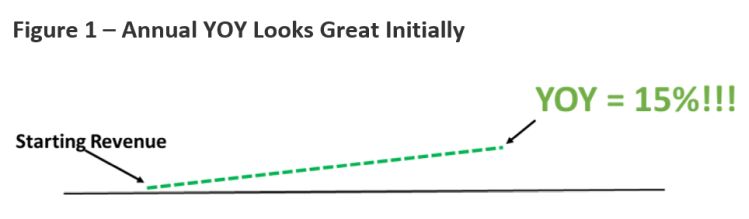

Figure 1 below shows an apparent uptick in annual growth that looks good when using a past 52-week YOY comp:

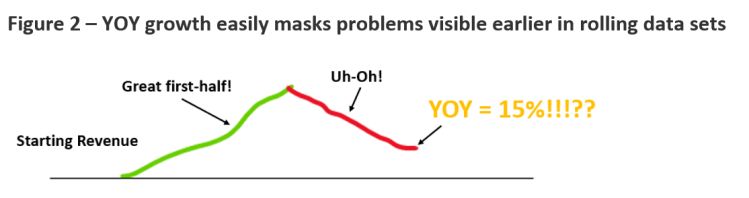

Yet, underneath this apparent ‘growth’ was much more significant growth followed by a mid-year decline, due to persistent out-of-stocks at a new account, for example (see figure 2 below):

This is where YOY comps obscure an entrepreneur’s understanding of their performance and misleads investors and the public, and it comes down to the structure of the data being used.

Identifying problems early

Public firms buy weekly datasets on large retainers from IRI and Nielsen to monitor their largest brands’ performance in ruthless detail.

Big brands do this not because they are worried about annual topline trends but because they are concerned about seasonal or other sub-quarterly fluctuations in volumes that affect earnings.

Quarterly decks sent up the chain may focus on YOY comps, but that is not how general managers operate these businesses. Today’s brand manager is fluent in multiple data periodizations and how they reveal different things to management.

Early-stage founders, however, are often very late in understanding the difference between annual periodization that skews toward the optimistic (i.e., for pitch decks) vs. weekly or quad-week periodizations that let you see problems early.

The larger the early-stage brand team, annual revenue, and account complexity, the easier it becomes for aggregate topline ‘dashboards’ to mislead founders when they look at YoY comps, even quarterly YoY comps.

‘Rolling raw sales data in 1-week or 4-week periods points the viewer toward the future’

For not much more money, a better dashboard view is a rolling set of YOY comps in declining periods (52, 26, 12, 4). The latter method is how retailers look for growth or decline. However, it too can cause a six-month delay in discovering a problem that a rolling quad-week or weekly rolling data set would surface much quicker.

Rolling raw sales data in 1-week or 4-week periods points the viewer toward the future and has enough data points to help you model the structure of the curve itself.

When done with smoothing on a multi-year dataset, founders can see a downward problem very quickly, even at the account level, often with just 12 weeks of recent data. Quickly enough to make a diagnosis of what’s going on beyond a possible seasonal decline in sales, which will show up rhythmically in your rolling sales data.

Upgrading to rolling quad-week datasets is well worth it as soon as possible so you can take advantage of the agile executional advantage of being an early-stage company.

Dr. James Richardson is the founder of Premium Growth Solutions, a strategic planning consultancy for early-stage CPG brands. As a cultural anthropologist turned business strategist, he has helped nearly 100 CPG brands with their strategic planning, from Hershey and General Mills to Once Upon a Farm and Rebel Creamery. The author of ‘Ramping Your Brand: How to Ride the Killer CPG Growth Curve,’ he also hosts the podcast Startup Confidential.