While some high-profile players including Chobani, Maple Hill and Organic Valley have recently jumped in – and then out* – of the ultra-filtered milk category, with Chobani observing in April that “We have come to the tough conclusion that it does not make sense for Chobani to be in the dairy milk business at this time” – fairlife is enjoying “mid-double-digit” growth across its portfolio, VP commercial, Colin Schriver told FoodNavigator-USA.

“fairlife continues to drive the category growth and we've been fortunate to grow mid-double-digits across the space in which we compete from a total portfolio perspective in 2022.

“Demand is at an all-time high across our portfolio and we've reached over 30 million US households purchasing a fairlife product, which is about a quarter of all US households. The vast majority of our consumers are existing category buyers ['trading up' within the category], but qualitatively we often hear consumers say we ‘brought them back’ to milk.”

Coca-Cola – which took full ownership of fairlife in 2020 - doesn’t share sales of its sub-segments, which now include yogurts, light ice cream, milk [13g protein/8oz serving], DHA-enhanced milk, Core Power protein shakes [26g protein/14oz bottle], and Nutrition Plan meal replacements drinks [30g protein/11.5oz bottle – launched in early 2021], said Schriver.

However, “the top three products are our 52oz ultra-filtered milk, which competes in the broader value-added dairy space, and our two protein beverages that meet distinct needs: Core Power for post-workout muscle recovery, and Nutrition Plan, which is a great tasting meal or snack on the go,” he said.

What is fairlife ultra-filtered milk?

Regular dairy milk has 8g protein, 12g of naturally occurring sugar (lactose), and around 300mg of calcium per serving (source: USDA), while fairlife dairy milk has 13g protein, 6g sugar, and 380mg calcium.

Instead of adding protein powders to increase protein content, fairlife uses a membrane filtration process, which separates out different components of milk based on molecular weight, and then recombines them to create ‘designer’ products with >50% protein and 50% less sugar.

The membrane filters out most of the higher molecular weight lactose and then adds lactase enzyme so any remaining lactose is broken down into easily digestible simple sugars (accounting for the 6g sugar listed in the final product). Image credits: fairlife

fairlife lactose-free yogurt: ‘Incremental to the category’

When it comes to innovations, they have generally been incremental for the brand, meeting different needs and usage occasions (for example milk in coffee or cereal in the morning, Core Power after a workout, Nutrition Plan as an afternoon snack or mini meal on the go), said Schriver.

As for routes into the fairlife brand, he said, “The majority of consumers typically come in through our fairlife ultra-filtered milk but we have unique consumers that find out about fairlife because they buy Core Power after a workout or they’ve tried Nutrition Plan and find out we make ultra-filtered milk.”

The latest innovation – fairlife yogurt with 14g protein and 7g sugar, debuting in January 2022 – is one of a handful of lactose-free offerings in the dairy yogurt segment (along with brands such as Green Valley Creamery, Chobani Zero Sugar, Fage Best Self and Yoplait lactose-free) and is “resonating well with consumers,” claimed Schriver.

“It's also been incremental to the category, which is great to see. Yogurt is a large space and we're definitely looking at other spaces adjacent to where we play today. Obviously, the category would need to be attractive to make the right types of investments, but the first question we ask is can we deliver a product with great taste and great nutrition that meets a distinct consumer need?”

fairlife Nutrition Plan shakes – launched in early 2021 – are generating “rapid growth” and are expected to “contribute significantly to our growth in the future,” he added, while fairlife lactose-free light ice cream – launched in mid-2020 at the height of the pandemic – has also been a success, said Schriver: “Our consumers love it and it’s in an attractive segment within that space.”

fairlife milk with the long chain omega-3 fatty acid DHA – launched in 2018 - is also growing, said Schriver: “It meets a distinct need specifically for families with kids looking to support brain health.”

fairlife Good Mood lactose-free milk and fairlife creamers failed to set the world on fire

While fairlife has had more hits than misses on the innovation front, however, not everything the brand has touched has turned to CPG gold, with two recent launches – fairlife creamers (launched in early 2020 on the back of a consumer insight showing that many fairlife buyers were adding the high protein milk to their coffee) and fairlife Good Mood lactose-free milk (launched in early 2021) – failing to set the world on fire. Both were phased out in January of this year.

In the case of Good Mood, which contained the same amount of protein (8g) as regular milk, and 25% less sugar (9g rather than 12g), with ‘lactose-free’ the key call-out on pack, fairlife ultimately withdrew the product because it became clear that it was already meeting this key customer need via its main brand, said Schriver.

“With any of the innovations we launch we have to ask do we have a right to win and could we meet those needs within our [existing] portfolio?”

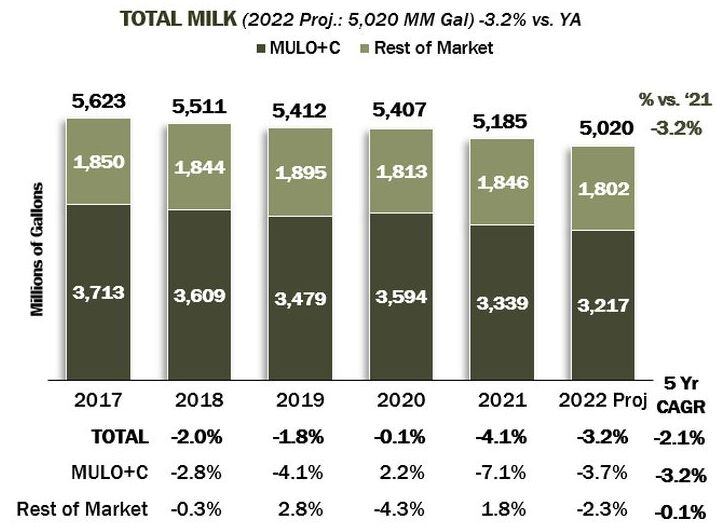

Volumes of fluid dairy milk (total milk sales in gallons, retail and foodservice combined) have continued to fall over the past five years, although dollar sales are up this year owing to surging inflation.

However, value-added segments of the market are continuing to grow in volume as well as dollars, with white lactose-free milk (non-organic) now accounting for 6% of all milk volume in tracked US retail outlets and 10% of the dollars, according to MilkPep: “This segment will very likely exceed organic in gallons before the end of 2022.”

Chart: USDA, IRI & Prime Analysis via MilkPep

‘The simple 50:50 messaging is really resonating with consumers’

When it comes to messaging, an ill-judged ad campaign to mark fairlife's national launch featuring naked ‘50s-style pin-up girls doused in milk was dubbed “tediously sexist” by one commentator. However, the brand has since hit its stride with messaging that homes in on less sugar and more protein.

As for packaging, fairlife has played around with different designs and callouts for its main ultra-filtered milk line over the years, although the core message of milk, only better, has continued to resonate with shoppers, who like the fact that fairlife is offering more protein and less sugar without adding any ingredients, said Schriver.

“We take this wonderful superfood that is milk and we can bring them more of what they want: protein, vitamins, minerals, that are naturally found within milk.

“But the 50% less sugar 50% more protein - simple 50:50 messaging - is really resonating, and then conveying that rich, creamy taste.”

Pricing: ‘We haven't seen an impact volumetrically’

While prices have gone up, he said, “We haven't seen an impact volumetrically as at-home consumption continues to be strong and there’s been a resurgence in the at-home breakfast occasion, and then as things have opened up [as pandemic restrictions ease] we have got a single serve 14oz product that's great for people on the go or going back to the office, so that's helped balance our growth as well.”

Domestic growth opportunities

Although fairlife has wide distribution in the US, there are still opportunities to grow, he said: “Consumers are looking for nutritious products on their health journey, so as you think about milk and dairy and the broader nutrition space overall, we believe there's tons of opportunity in existing channels across our product lines.

“And then we’re also working with the broader Coca-Cola system to get reach in terms of putting our products on display, continuing to grow our assortment in a way that helps our retail partners grow their categories, and then leveraging brick and mortar and e-commerce so we reach consumers wherever and whenever they're shopping.”

International growth opportunities: ‘fairlife has been well received in China’

On the international front, fairlife has a manufacturing plant in Peterborough, Ontario, Canada, processing milk from Canadian farmers to supply the Canadian market, and has also made a move into China via KeNiuLe Dairy Co Ltd, a joint venture with Chinese dairy giant Mengniu, launching its first products in late 2021, said Schriver.

“fairlife has been well received in China where our value proposition remains the same: more protein, less sugar and lactose-free.”

*Organic Valley told us: "Our ultra-filtered line was discontinued at the beginning of the pandemic when we were focused on our products such as the four white milks and butter," while Maple Hill said its ultra-filtered zero sugar product was pulled owing to supply issues but that it hopes to bring the product back.

Founded by Indiana dairy farmers Mike and Sue McCloskey in 2012 as a joint venture between The Coca-Cola Company and Select Milk Producers (a co-op of 99 family-owned farms started by the McCloskeys in 1994), fairlife rolled out nationwide in December 2014 and was fully acquired by Coca-Cola in 2020. In 2021, retail sales topped $1bn.

Multiple class action complaints were filed against the company in 2019 after non-profit animal welfare group Animal Recovery Mission released harrowing videos from an undercover investigation of Fair Oaks Farms in northwest Indiana - owned by Sue and Mike McCloskey – showing animals being mistreated, which prompted fairlife to suspend deliveries from the farm and step up audits at all of its milk suppliers.

Coca-Cola has since resolved the lawsuits through a $21m settlement which included an agreement to work with two unnamed nonprofits to “implement significant injunctive relief” that would “create a monitoring and compliance program, aimed at ensuring their cows receive humane treatment.”

Based in Chicago, Fairlife operates processing plants in Michigan, Arizona, Ontario (Canada), and Bengbu, Anhui Province, China (as part of a JV with Chinese dairy giant Mengniu).

Image credit: fairlife