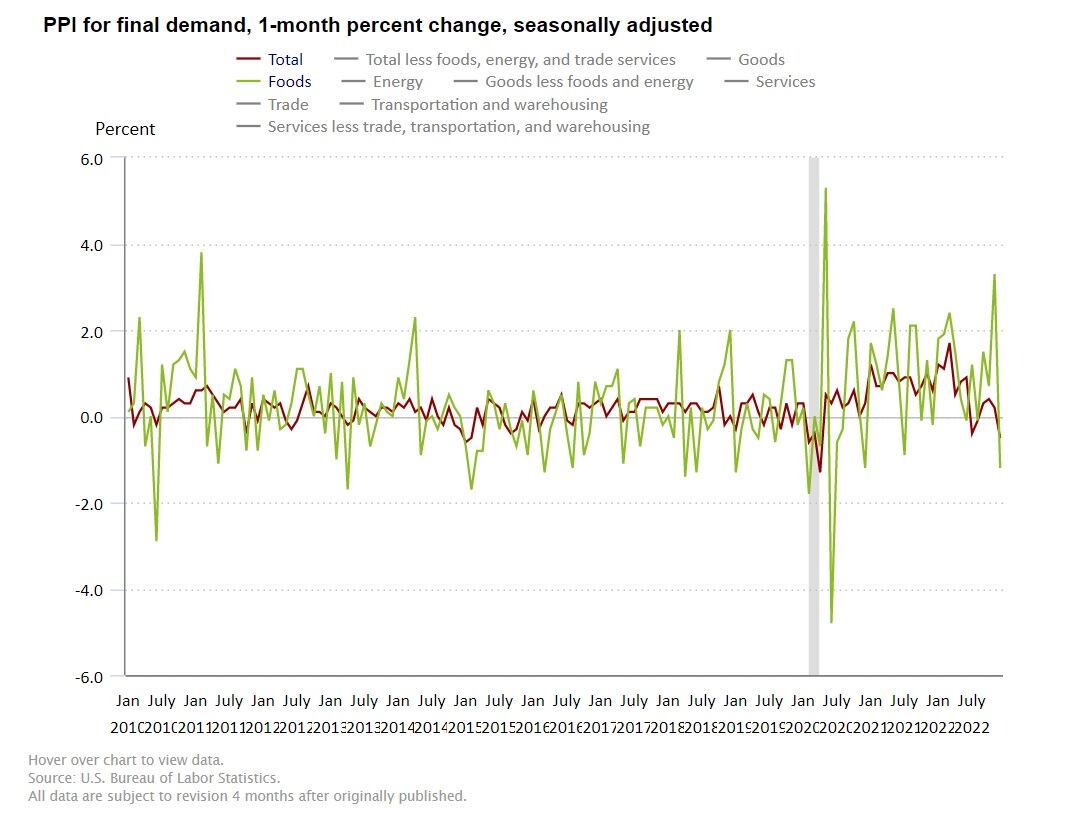

Prices for final demand foods fell 1.2% in December, helping to bring down the overall price for final demand goods by 1.6% in the period – the largest month over month decrease since July when prices fell 1.8%, according to the most recent Producer Price Index published yesterday.

In the same period, the energy index fell 7.9 in December, including a 13.4% decline in gas prices, and the final demand for transportation and warehousing services fell 0.9%, driven primarily by a 2.5% drop in air transportation and freight, which helped offset a 0.6% increase in rail transportation and 0.7% increase in truck transportation, according to the Bureau of Labor Statistics.

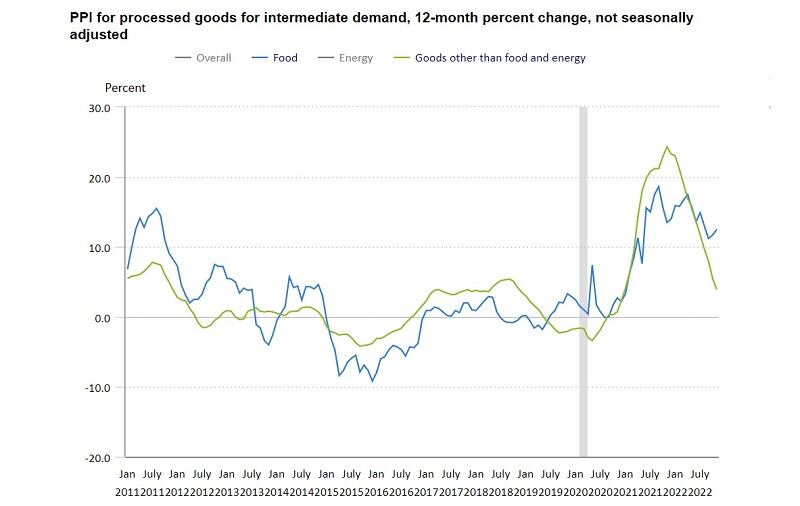

While these figures are encouraging, the Consumer Brands Association notes the CPG industry, including food manufacturers, continues to pay significantly more for inputs and key ingredients than before the pandemic.

Indeed, the final demand for food not seasonally adjusted for the year remained up 14.3% in December – far higher than the overall PPI, which is up 6.2% for the full year.

Within food, the price of fresh eggs, processed turkeys and roasted coffee increased the most in December at 24.5%, 0.7% and 0.4% respectively (vs November). The prices for most other foods fell in the month, though. The most notable decreases were for fresh and dry vegetables (down 9.4%), fresh fruits and melons (down 7.8%) and grains (down 5.9%).

CBA seeks tariff relief to ease input costs, supply chain resiliency

In a continued effort to help reduce input costs for CPG companies, the Consumer Brands Association remains focused on improving supply chain resiliency and performance.

This includes actively monitoring the Department of Transportation’s new Multi-Modal Freight Office, funding for which was included in the 2023 government spending package revealed late last month.

“This was a key step to adding resiliency to the supply chain and complementing private sector efforts to ensure consumers have access to the essential items they rely on,” CBA Vice President of Supply Chain Tom Madrecki said in a statement.

He explained the Multimodal Freight Office will oversee and coordinate supply chain policy, and explore ways to boost security and efficiency of federal supply chain efforts, including the recently launched Freight Logistics Optimization Works.

Madrecki added CBA also is pushing for the review of tariffs that it says are contributing to input price costs and seeking ways for food, beverage and other CPG companies to carve out exclusions on packaging and ingredient materials “with no national security application.”