After raising prices 15.2% overall in 2022 and pushing a few more increases through early in 2023, Kraft Heinz saw fourth-quarter sales volume drop 4.8% over the same period last year – prompting executives in February to announce the convenience food and condiment maker would hold off on further price hikes.

Others in the industry quickly followed suit – leaving Kraft Heinz out in front on pricing for many of its products with little hope that competitors would close the gap by raising their own prices. But despite the vulnerability this created for Kraft Heinz’s market share, executives say the company will not offer steep discounts to entice consumers at the expense of its margins.

“You’re not going to see us do things that are about going deep in discounting where it no longer makes sense. And we’re not going to return back to 2019 levels in which we were going to do these deep promotions that many times actually returned negative ROI,” Kraft Heinz executive vice president of North America Carlos Abrams-Rivera told analysts gathered last week at Deutsche Bank’s annual Global Consumer Conference.

Instead, Abrams-Rivera said Kraft Heinz has elevated marketing and R&D and is significantly investing in both in a bid to convince consumers its products are worth the extra money – a decision that is already paying off with the average ROI on its promotions up 10 percentage points year-over-year and up 15 percentage points since before the pandemic.

He explained that as part of a larger business remodel, the company moved marketing and R&D up in the org chart.

“Marketing was reporting two levels down from me, with people who probably have the right capabilities for what [we wanted] the company … to be. So, we now have those reporting to me directly. R&D was also reporting two levels down. We have brought in new people to lead R&D [and the] now report directly to me,” Abrams-Rivera said.

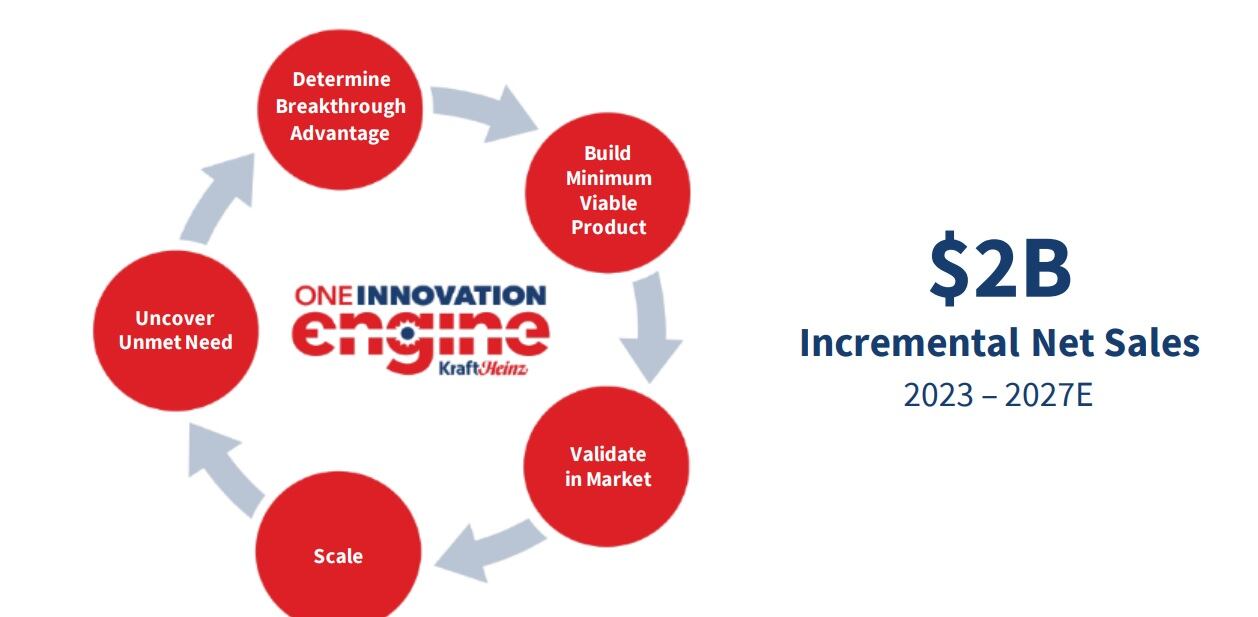

The company also increased their budgets so that it was placing an additional $100m to $150m in R&D on top of what was already built into its plan – taking it to a double-digit market investment on a year-over-year basis, said Andre Maciel, executive vice president and global chief financial officer for Kraft Heinz.

This investment reflects the company’s emerging “marketing-centric” mindset in which it targets different types of consumers or tribes with bespoke, tailor-made products and messages, added Rafael de Oliveira, executive vice president and zone president for international markets.

Kraft Heinz leverages AI to improve promotions

To ensure promotions and innovations are accurately and appropriately targeted, Kraft Heinz is investing more in technology and AI, Abrams-Rivera said.

For example, it is exploring how AI can create automatic calendars for promotions, said Maciel.

“We have invested … millions of dollars in developing our own trade promotion system. We have visibility in real-time for 100,000 promotions that we run per year in the United States. And we have been using technology to improve the quality of our elasticities, which have unfolded, untapped a lot of opportunities in order to get the promotions,” he said.

‘Value’ is central to consumer communication

Abrams-Rivera added that Kraft Heinz also is working more closely with retailers to communicate the value of its products to consumers.

“What customers want to do is show how they add value to their consumers. Ultimately, that’s what this is all about. And I think the benefit that Kraft Heinz had is that we have the scale to bring value in different ways.

“In the US, we’re going to be able to celebrate July 4th. That’s an opportunity for us to say to the consumer, we can bring the bundle of solutions that if you want to grill, we can sell you everything from the Kraft Singles to the hot dogs to the Heinz ketchup that you’re going to [need] for grilling with your family,” he said.

The company also is working to pair its branded condiments, like Kraft mayonnaise, with private label items, like canned tuna, to create a full meal on a smaller budget but without compromising the taste and experience, he added.

“So, those are the conversations we’re having with the retailers – how do we continue to bring those bundles of value that allow you to kind of continue to drive the traffic in the stores that you want to make,” he said.

Price point remains powerful influencer

While the company is shunning deep price promotions, it recognizes price point is a powerful influencer for shoppers on a budget, which is why it is improving its product mix to meet their needs without squeezing its own margins.

“We are introducing new pack sizes at good price points as a mechanism to get to the price … [in] a smarter way,” Maciel said.

Ultimately, Maciel said, these strategies – while not all unique to Kraft Heinz – are not always fully appreciated, but have a positive impact on the business by breaking down silos, realigning incentives and elevating core capabilities, like marketing and R&D, to the forefront of the company.