The bulk of the loss was concentrated in cold cuts, which suffered supply constraints last year, cream cheese and Kids Single Serve beverages, which together accounted for more than 40% of share loss in the first quarter, CEO Miguel Patricio said in a management discussion about the company’s first quarter earnings reported yesterday.

“We expect gradual year-to-go share improvement coming from sustainable, profitable commercial strategies, in addition to solving our remaining supply chain challenges,” he said. But, he added, “we will be selective about where to compete to protect profitability. We do not want to simply chase share, but rather invest purposefully in the areas most-aligned with our strategy.”

In the US, this means focusing on two of the company’s three GROW platforms identified during a reorganization in 2020. These include the “most attractive areas of our business,” and now account for 65% of the company’s total North American retail business, Patricio said.

“Within GROW, Taste Elevation and Easy Meals are expected to drive the bulk of future profitable growth,” he said, adding they are already off to a strong start by growing “significantly faster than the rest of the US retail business” at 15% and 13% respectively over the first quarter of 2022. Overall, the GROW platforms in the US grew a combined 8.1%.

Within these segments, Patricio said, Kraft Heinz will initiate a four-prong strategy to drive share.

Improved merchandising to reclaim ‘fair share’ of shelf space a top priority

The first prong focuses on improving merchandising and shelf space by working more closely with retailers to reach objectives agreed upon in signed joint business plans.

“On Mac & Cheese, we are focusing on increasing feature and display for our Liquids portfolio. Kraft Mac & Cheese Delux and Velveeta Shells & Cheese have higher revenue and profitability per unit, and also offer consumers a premium taste and gooeyness that provide a sense of comfort,” Patricio said.

The company also committed to earning feature and display merchandising in key windows, such as for cream cheese around the holidays. It also plans to expand distribution of formats that boost consumption, such as with its Lunchables 5-pack, Philly soft 2-packs and Capri Sun Variety packs.

Double-digit marketing increase should stabilize share by end of Q2

The second prong includes a double-digit increase in marketing spend to drive incremental sales and stabilize share by the end of the second quarter.

Focus areas will include Philadelphia cream cheese’s “one-of-a-kind” point of difference and recently launched plant-based option, and the Liquids Mac & Cheese portfolio through a focus on comfort and indulgence, Patricio said.

[Editor’s note: Interested in learning more about the plant-based dairy segment in which Kraft Heinz’s Philadephia brand now plays? Tune in May 17 for a free 1-hour webinar examining the segment’s potential and challenges. Find all the details and register HERE.]

Disruptive innovation and consumer-driven extensions

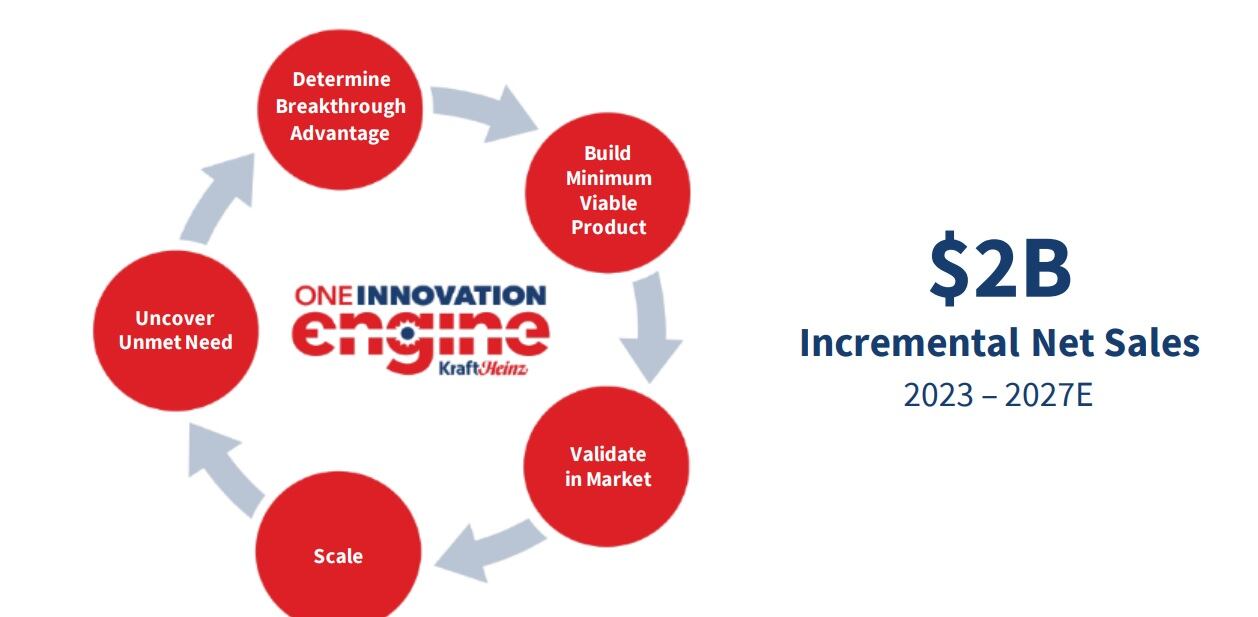

The third prong of Kraft Heinz’s strategy to reclaim lost market share includes ramping up innovation and consumer-driven line extensions to drive incremental sales.

Examples of upcoming innovations include “Crispy Microwavable ‘Grilled Cheesies’ sandwiches that are ready in just 60 seconds” and the recent launch of NotMayo – a plant-based version of the popular condiment made in collaboration with NotCo, Patricio said.

Responding to consumer requests, the company will launch a trio of Heinz Spicy Ketchups all featuring different peppers, Country Time Lemonade in a pouch and IHOP branded dry coffee roasts and K-Cup pods, he said.

Supply chain enhancements

The final prong of Kraft Heinz’s plan is to address lingering supply chain challenges.

Overall, the company’s supply chain challenges have largely been solved with fulfilment for most products in the mid-90s and many at the target range of the upper 90s, but a few sticking points remain, Patricio said.

Among these is residual fallout in cold cuts from labor shortages at one of Kraft Heinz’s plants last year, which has been resolved so that the company now expects recover by the end of Q3.

A bad potato crop has created another supply challenge for Kraft Heinz, which is leaning on its partnership with Simplot to gain more inventory. But in the meantime, it will move up planned downtime for capital improvements from the third to the second quarter so that it is well positioned to support the potato business in the second half of the year when supplies are more accessible, Patricio said.

While there is no silver bullet to reverse the market share loss Kraft Heinz has suffered, Patricio says he is confident that through this combination of strategic initiatives the company will “drive gradual share improvement as we move through the year.”