In the first 45 minutes of our Gluten Free in Perspective Forum, our expert panel explored gluten-free market trends and growth opportunities; the science behind celiac disease, gluten sensitivity and wheat allergy; the technical challenges of formulating great-tasting gluten-free products; and the latest consumer research.

The final 15 minutes was devoted to Q&A. Checkout FoodNavigator-USA shortly for highlights!

ALESSIO FASANO, M.D., Director, Center for Celiac Research

World-renowned pediatric gastroenterologist and research scientist Dr. Fasano founded the Center for Celiac Research in 1996. (The Center moved from Maryland to Massachusetts General Hospital in 2013). In 2003, he published the groundbreaking study in the Annals of Medicine that established the prevalence rate of celiac disease at one in 133 people in the US.

TJ MCINTYRE, EVP Natural Brands, Boulder Brands

Boulder Brands has a dominant position in the US gluten-free market with the Udi’s and Glutino brands, which are growing at an explosive rate. If the firm’s initial focus was on retail, it is now aggressively going after drug, club and foodservice as well, says TJ McIntyre, who became EVP of the firms Natural brands including Earth Balance, Glutino and Udi’s in September 2012.

DAVID SHELUGA, PhD, Director commercial insights, ConAgra Mills

Dr. Sheluga has held senior consumer research roles at Keebler, Quaker Oats, NPD Group and ConAgra Foods, and is a recognized expert in what makes consumers tick.

TOM VIERHILE, Innovation Insights Director, Datamonitor

With more than two decades of experience in consumer packaged goods analysis and reporting, Vierhile spends “countless hours scanning store shelves for new products along with myriad trade show visits in search of new products and trends.”

WHAT WILL WE COVER?

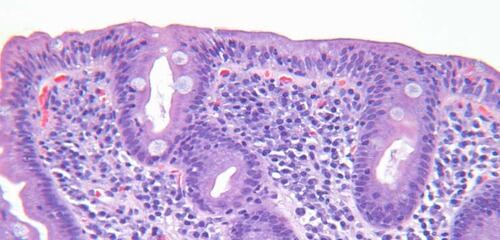

1 – The science:

What is celiac disease and how many people have it? One in 133? Is there a validated biomarker of gluten sensitivity, and if not, how do we know 6% might have it? Where does wheat allergy fit in, and how many people have it? Is the incidence of these conditions on the rise, and if so, why? Can humans cope with gluten, and are books such as ‘Grain Brain’ and ‘Wheat Belly’ making a useful contribution to this debate?

2 - The gluten-free market:

How big is the gluten-free market? How fast is it growing and how is it evolving? Which brands and companies are driving the market? Which products and categories have the most potential and where do store brands fit in? Where are the new growth opportunities in gluten-free? Drug? Club? Foodservice? And most importantly, can the meteoric growth continue?

3 - The gluten-free consumer:

According to Packaged Facts, the “conviction that gluten-free products are generally healthier is the top motivation for purchase,” with 35% of consumers who buy gluten-free products saying they do so because they are "generally healthier,” 27% "to manage my weight,” 21% because they are "generally low-carb" and 15% because a member of the household has a gluten or wheat intolerance. Just 7% of consumers surveyed buy gluten-free products because a household member has celiac disease. So who is the gluten-free consumer?

4 - Formulating gluten-free products:

Is the gluten-free toolkit getting better? Are gluten-free products healthy? And do consumers now expect them to be non-GMO and ‘all-natural’ too? What new products are out there? Where are the gaps in the market?

This debate was sponsored by Ingredion - a leading global supplier of starches, sweeteners, texturants and nutritional ingredients to major food and beverage manufacturers across the globe.

To watch this unique event on demand, click HERE to register for free.