West Africa is running out of land and perhaps patience to grow more cocoa, according to the World Bank. Climate change may also mean many areas in the two main producing countries – Ghana and Côte d’Ivoire - will become less suitable for cocoa growing. Not good news for chocolate makers as cocoa demand rises 2% per year.

Asia – along with Latin America - is well-suited to pick up some of the slack. It already boasts the world’s third largest cocoa producer in Indonesia and governments in countries such as Malaysia, and Vietnam have plans to get behind the commodity.

Moving East?

Ghana is the world’s number two cocoa producer and accounts for 20% of global supply. However, the World Bank’s senior agricultural economist Johannes Jansen said at the Asia Choco Cocoa Congress last week that although cocoa accounted for 7% of the country’s GDP, the crop had gotten a bad name and with relatively few areas left that haven’t been deforested, the government does not want to expand into new land at the expense of forests.

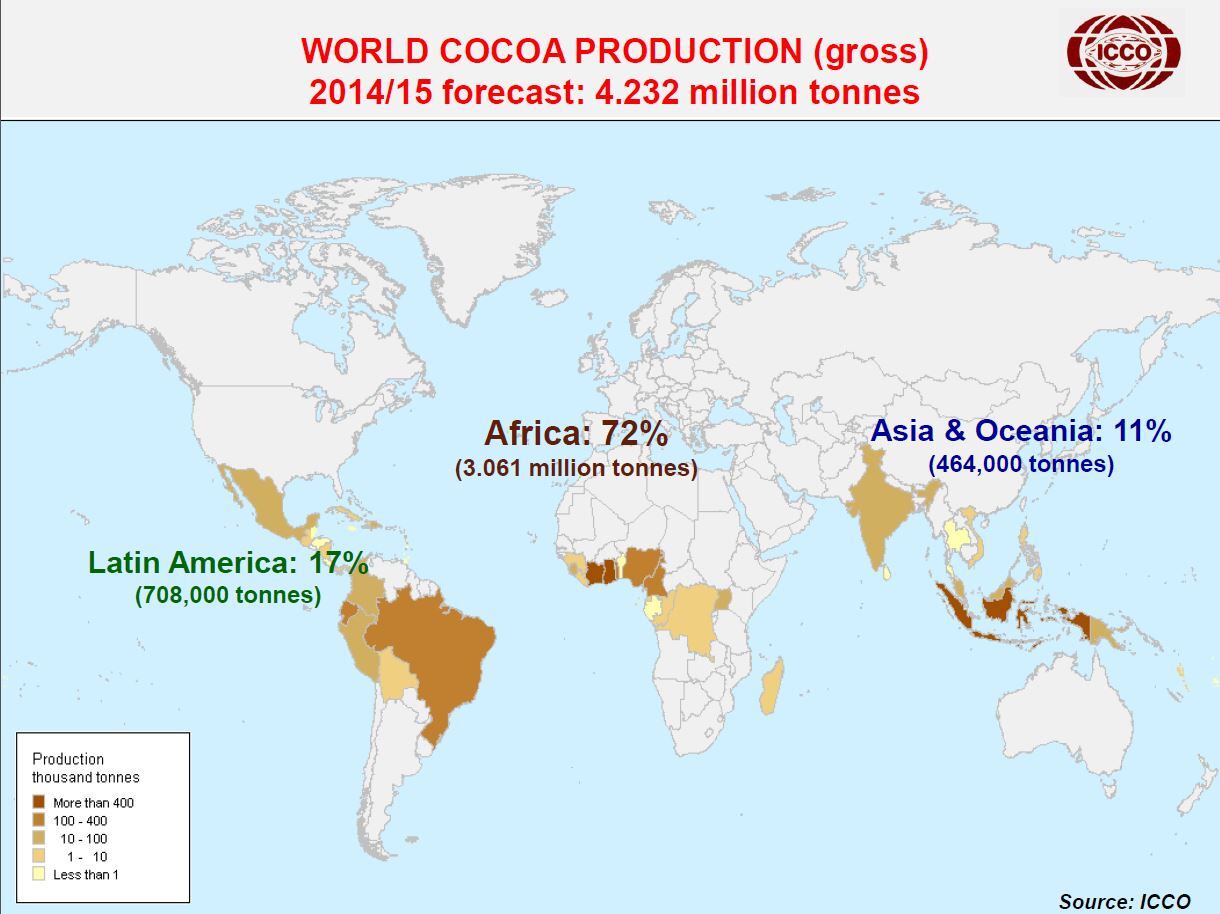

Asia & Oceania currently accounts for 11% of the world’s cocoa supply with 72% coming from Africa, according to the International Cocoa Organization (ICCO).

‘Opportunity in Indonesia is tremendous,’ says Mars

Fay Fay Choo, Asia cocoa director at Mars, said: “I think Asia is where growth is going to be for the next 10-20 years….the opportunity in Indonesia is tremendous….we cannot let Indonesia fail.”

Mars is exploring mechanization to help get Indonesian cocoa farmers produce two metric tons (MT) per year on two hectare plantations, helping the country reach 1m MT cocoa production a year. Currently, the average sized farm in Indonesia of 0.7-0.8 hectares typically yields 700 kg per hectare a year.

Dr. Soetanto Abdoellah, chairman of the Indonesian Cocoa Board, said Asia was well-placed to cater for future cocoa demand and could better reward farmers.

“I think West Africa is not a good example, except the quality. We know the Ghanaian cocoa quality is very high, but the farmers’ income in Ghana is much lower than in Indonesia. Farmers in Asia still have more benefit than farmers in West Africa.”

But he said Asian farmers should be better rewarded for producing quality cocoa to match Ghanaian standards.

‘Does anyone care?’

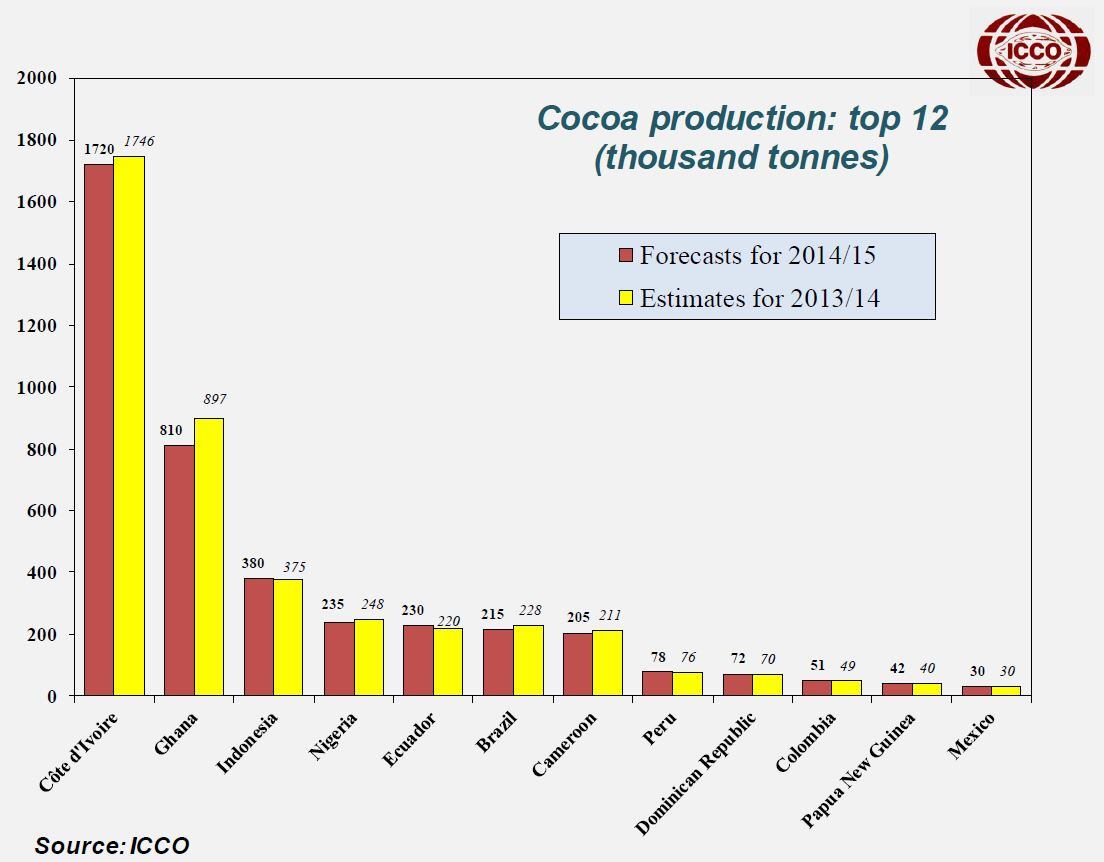

Indonesia produced 375,000 metric tons (MT) of cocoa in 2013/14, according to ICCO estimates. The crop was previously at around 600,000 MT in 2010, but tree diseases, particularly cocoa pod borer (CPB), vascular streak dieback (VSD) and blackpod plighted the output. The government is working on programs to provide disease resistant clones and encouraging farmers to modify the environment so it becomes unsuitable for pests to survive.

However, cocoa is not a significant contributor to the country’s GDP compared to other crops. “Is this important enough to get attention in national governments?” Joshua Tosteston, senior vice president of programs at Rainforest Alliance asked. “It’s important to the industry, but does anyone care?”

What about other Asian origins?

Vietnam: Vietnam’s cocoa production could rise from 3,500 metric tons (MT) annually to 50,000 MT in eight to ten years, says Puratos Grand-Place as state-owned companies convert coffee and rubber plantations to cocoa.

Philippines: The country is aiming to produce 100,000 MT of dried cocoa beans by 2020 and the government recognizes cocoa’s potential to alleviate poverty and boost sustainable agriculture, says Jennifer E. Remoquillo of the Department of Agriculture.

Malaysia: Malaysia’s annual cocoa production was at 250,000 MT in 1990, but has fallen to 10,000 MY today due to labor shortages. “In terms of production we hope last year was the lowest and we expect things to rebound,” says Dr. Lee Choon Hui, director general of the Malaysian Cocoa Board.

‘Too many grinder companies’

Also Indonesia’s cocoa imports have risen dramatically in the past few years to 100,000 MT per year. Abdoellah said this was “there are too many grinder companies”.

The country has many local brands and multinational grinders such as Cargill and Barry Callebaut help make it the world’s fifth largest cocoa grinder with 322,000 MT of cocoa processed in 2013/14.

Proximity to developing chocolate markets: Big issue?

The ICCO expects annual world cocoa consumption will rise 2.2% from 2013/14 to 2018/19, but consumption in China & India is forecast to grow 7.9% over the same period. But this doesn’t necessarily mean the industry will gravitate towards sourcing cocoa in Asia rather than West Africa because it’s closer. Industry experts say many manufacturers use blends to achieve a specific taste, so are likely to source from multiple origins anyway. Chocolate taste preferences in China in particular are not yet well developed, so until Chinese consumers develop that taste preference it’s not known where the bulk of cocoa for their chocolate products will come from, they say.

No sustainability platform in Asia

The World Cocoa Foundation has mobilized the world largest cocoa and chocolate companies such as Mondelēz and Nestlé in CocoaAction, a platform to align cocoa sustainability. However, programs are currently limited to Ghana and Côte d’Ivoire. “Right now we don’t have a sustainability network in Asia,” said Marc Donaldson, senior partner at On The Ball Consulting. This could potentially inhibit Asia’s ability to meet future cocoa demand.

Mondelēz International’s Cocoa Life Director Cathy Pieters said during a session at the Asia Choco Cocoa Congress that she believed in an Asia cocoa sustainability platform, but was concerned about huge variations in volumes throughout the region.

Annual production volumes in Malaysia are around 10,000 MT, 5,000 MT in the Philippines and 3,500 MT in Vietnam, according to estimates by the respective governments.