Now with quarterly growth routinely topping 50% and a growing following among tea drinkers and 'utility' coffee drinkers alike, the founders of Zest think their super-charged teas could change the face of hot beverages.

“There are a lot of tea drinkers looking for something stronger energy-wise,” co-founder James Fayal told FoodNavigator-USA. “But there are also a lot of habitual coffee drinkers without a strong affinity for the drink other than what it provides when they wake up. Suddenly there’s an alternative, and they don’t have to sacrifice their daily caffeine. We’re finding that Zest appeals to both.”

I always felt like I was making a compromise

An avid tea drinker himself, Fayal first had the idea for a higher-caffeine tea while working in a seed-stage venture capital firm. No stranger to 12- to 16-hour days, he would start each day with tea, but would often resort to higher-caffeine alternatives like mediocre office coffee or sugary energy drinks when the need struck for a late-afternoon boost.

“I always felt like I was making a compromise,” Fayal said. “I was switching from a drink I enjoy drinking and love for its taste and health benefits to something I didn’t love as much purely because I needed more energy.”

He was surprised to find that no high-caffeine brewed teas existed, but talks with fellow under-caffeinated tea drinkers indicated he wasn’t alone. So he and a former college roommate—with the help of some master blenders—began testing methods of infusing teas with caffeine to achieve levels comparable to coffee, which contains anywhere from 95 to 200 mg of caffeine per 8-ounce cup.

Proprietary process

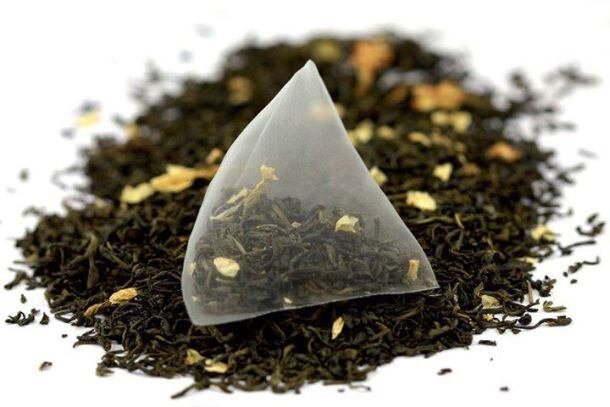

They developed a proprietary process through which a green tea extract is evenly distributed among tea leaves (Zest uses whole leaf tea, not crushed) so it doesn’t add bitterness. Zest’s black tea blends have 155 to 160 mg caffeine per cup, while the milder green tea has about 140 mg per cup.

Tea also naturally contains an amino acid called L-theanine, which is thought to help reduce stress and improve cognitive clarity. (Fayal also claims it slows down the absorption of caffeine, preventing the jitters and crash coffee drinkers get.)

Zest launched a crowdfunding campaign in the summer of 2013 through Venture for America, a fellowship program for recent graduates looking to launch their careers as entrepreneurs (of which Fayal was a member). The $10,000 raised from the crowdfunding campaign was enough to fund the first production run “and prove the marketability” of the product.

They also gave crowdfunders a vote in deciding from eight possible flavors, which they whittled down to the four that would ultimately hit the market: Earl Grey Black, Apple Cinnamon Black and Blue Lady Pomegranate Mojito Green.

“The theory with voting was we were pretty sure the preferences of our customer base were not the same as the larger tea market. It was very much proven correct in that process because some of the most popular tea blends in the US like English breakfast were dead last in the voting.”

Tea is “hot”

An already massive market, tea in the U.S. is growing—and evolving. According to the Tea Association of the USA, Americans consumed more than 80 billion servings of tea last year, amounting to about $10 billion in sales—a 10.7% increase from $9.8 billion in 2012. The organization anticipates tea sales will double in the next five years, thanks in part to millennials’ growing affinity for tea.

Indeed, a 2015 study from YouGov found that although coffee still holds sway with older Americans, coffee and tea are now equally popular in the 18-29 age group (at 42% each) and 27% in this age group reported that they drink tea exclusively.

Millennials largely responsible for the early success of Zest

Fayal noted that millennials are largely responsible for the early success of Zest.

“The cool thing with the millennial generation when it comes to tea is almost all the growth is on the high end,” he said. “It’s no longer the Liptons or Bigelows—it’s these companies at higher price points producing better tea. Millennials prefer premium flavored teas and unique combinations and options for flavors.”

Fayal and co-founder Rickey Ishida rolled out Zest to the direct-to-consumer market in January 2014. Later that year, the brand expanded into corporate selling, which now accounts for about 40% of overall business. (The other 60% still comes from DTC.)

“We decided early on that the better market for us given our product and price point [$12-$13 for a tin of 16 sachets] was to skip over mass retail and direct sell to corporate offices such as tech companies and banks,” Fayal said.

Consumers educating consumers

One corporate relationship with an office of 500 each year is the equivalent of roughly 20 or 30 retail locations, with one and a half times the margins and far less maintenance with typically one monthly buyer, Fayal said. Moreover, the corporate and DTC selling models enable Zest to grab and keep the customer’s attention, particularly for a novel product in an already crowded market.

“On the retail shelf, if you catch the consumer’s catch eye at all, you have it just long enough so they can figure out what product is. And not many people are looking for high-caffeine teas—not because they’re not drinking it, but because they don’t think it exists.

"If we get somebody in an online setting, there’s more of a chance for education. And at an office it’s even better: your cubicle mate starts drinking it, falls in love with it and then talks about it. It’s a high density of people educating people.”

Education the biggest challenge

A nod for Best New Product at this year’s World Tea Expo helped raise Zest’s profile, but Fayal said education is still the biggest challenge for the brand, particularly as it eyes eventual moves into traditional retail outlets and new product realms such as the red-hot ready-to-drink tea.

“Staying where we are for the moment has allowed us to build our supply chain, distribution, start to scale the company, as well as build a brand,” Fayal said.

“Like Tazo and a lot of these other companies built their brand before making the jump into heavily saturated areas like retail or RTD. Hopefully this will help us break the saturation of that market, as well as get the idea of a healthier, energy drink-like choice out there. It’s something can you feel good about rather than regret because of the sugar and caffeine high.”