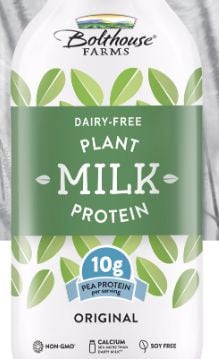

The product – which has 10g non-GMO pea protein per 8oz serving (2g more than Ripple), 5g cane sugar (1g less than Ripple) and added calcium (50% more than dairy milk), vitamin A, B12, D and E – will be available in original, unsweetened, chocolate, and vanilla flavors, with an SRP of $1.99 for a 12oz bottle and $4.99 for a 48oz bottle.

The launch is planned for this summer, but visitors to Expo West (booth #4339) can get a sneak preview, Suzanne Ginestro told FoodNavigator-USA.

“We explored a bunch of protein sources and felt pea was the best up and coming protein. The non-dairy milk category is expected to double from $2bn to $4bn in the next few years, and this is a logical place for us to look and start thinking about how we can meet the needs of consumers [according to Mintel, household penetration of non-dairy milks grew from 27.3% in 2013 to 55% in 2016].

“While almond milk has been growing like crazy it’s not the best substitute for dairy milk as it typically only has 1g of protein whereas dairy milk has 8g. So consumers are a bit confused because they think of almond milk as having more protein as it’s made with almonds [something Ripple has addressed in its recent marketing campaign].

“I think almondmilk brands are recognizing this and adding more protein now, but we think there is incremental growth to be had by offering more options in the category as more consumers move away from dairy milk.”

Ingredients (original flavor): Water, Pea Protein, Contains Less Than 2% Of Sunflower Oil, Vitamin/Mineral Blend (Calcium (Tricalcium Phosphate), Vitamin A (As Palmitate), Vitamin D2 (Ergocalciferol), Vitamin E (D-Alpha-Tocopheryl Acetate), Vitamin B12 (Cyanocobalamin)), Sea Salt, Sunflower Lecithin, Natural Flavor, Gellan Gum, Carob Bean Gum, Dipotassium Phosphate

Protein exploration

Asked how the company had managed to get 10g of pea protein into a serving without negatively impacting flavor,Ginestro said the C-Fresh division had already amassed considerable experience of working with plant and dairy proteins in beverage formulations for the Bolthouse brand.

It has also experimented with pea protein, launching a line of organic protein beverages in April 2016 containing almond milk, soymilk, and pea protein under the 1915 brand, which were later withdrawn, but will be relaunched in the fall, said Ginestro.

“But these are very different kinds of products. The 1915 products contain a blend of sources and they are protein drinks, whereas Bolthouse plant protein milk is a milk substitute.”

Unlike Ripple, the brand does not contain the long-chain omega-3 fatty acid DHA, because it was not key to the proposition, said Ginestro. "However, if consumers ask for it we could certainly consider adding it in the future."

What's in a name? Peas milk vs plant-based milk

So how do you talk to consumers about pea protein?

While the label features the callout ‘10g pea protein per serving’ on the front of pack, Bolthouse Farms – like Ripple - is not calling this product ‘pea-milk,’ and instead uses the term MILK surrounded by the phrase ‘plant protein,’ coupled with the ‘dairy-free’ disclaimer.

According to Ginestro: “We talked to consumers and tested a lot of different label hierarchies and they didn’t care so much about the source of the protein as long as it was ‘plant-based’ protein and free of dairy and nuts.”

We’ve had a rocky road over the past year

Overall sales in the C-Fresh division – which encompasses Bolthouse Farms beverages, mayo and dressings, 1915 beverages, the fresh carrot business, and the Garden Gourmet salsa, hummus, fresh soup and dips and chips business – were down 8% in the second quarter to$260m driven by lower sales of carrots, Bolthouse Farms refrigerated beverages, and Garden Fresh Gourmet, which were only partly offset by gains in refrigerated soup.

However, the fundamental drivers underpinning the business – consumer demand for more fresh, but convenient food in the store perimeter – haven’t changed, she said.

“We’ve had a rocky road over the past year but we are clear that the strategy is intact; the issues were around execution.”

There are also plans to enter new fresh categories either via in-house innovation (such as MAIO – the new yogurt-based mayo range, currently being tested in 200 Safeway stores) or via acquisition, she said.

“We have a lot of people focused on the base business and I lead a whole team of individuals focused on new category expansion and new platforms in categories we are not in today.”