Over the past couple of years, however, the narrative has changed, as anonymous sources briefed Business Insider about a ‘cult of delusion’ at a ‘food company masquerading as a tech company,’ and Bloomberg published a steady stream of highly damaging articles alleging fraudulent product buyback schemes, boardroom squabbling, food safety issues and financial problems.

And even those who are impressed by the San Francisco-based firm's achievements and acknowledge that its latest venture, cultured meat, is potentially disruptive, argue that the staggering sums Tetrick raised in the early days from Silicon Valley based investors gave them pause.

The bottom line, one corporate finance source told FoodNavigator-USA, is that “Hampton Creek is not a tech company with a 95% gross margin… It led to ridiculous valuations because they were trying to get a tech valuation for a food product company.”

Another told us: "He's a phenomenal pitch man, he's one of the best capital raisers in the business, but all of their products, other people could make, and it really comes down to that. The business is growing fine but it's not anything monumental relative to the amount of capital that's been raised."

So what’s going on? Does the emperor have no clothes or can we attribute the recent bad vibes to sniping from ex-employees, bolstered by schadenfreude on the part of some industry stakeholders who feel Tetrick has over egged his egg-free pudding?

‘The facts are radically different from what is reported’

Speaking to FoodNavigator-USA on Thursday, Tetrick would not give out any figures, but said, “We’re growing, and not by an insignificant amount. In a major retailer our cookie dough is #1. In a top two retailer, only one mayo is growing, and it’s us. In a number of others, our mayo is outselling the biggest brands such as Kraft.

“We’re in 100,000 points of distribution, and we’ve recently expanded to Mexico with Walmart Mexico. We’ve sold north of 90 million individual cookies and we’re aiming to launch Just Scramble before the end of Q1 next year.”

Flagship product Just Mayo grew 40% year on year over the past 52 weeks, said Tetrick, while Hampton Creek's products "surpassed some of the largest food manufacturers, both in velocity and gross dollar sales."

Asked if Hampton Creek would run out of money within six months unless it raised new capital, a claim made by an anonymous source to Bloomberg last month, he responded: “No, the answer is no… The facts are radically different from what is reported; we have a great network of investors that have stood by us, we’re in a good financial position with competent financial leaders, a strong operations team, and products that millions of people buy, so we’re very fortunate.

“Consumers – people that actually buy our products – and the folks that are building this company every day, are able to separate fact from fiction, and the team here is pretty clear eyed about what we’ve built and we’re very proud of it.

“What I’ve learned is that you just have to focus on what you’re here to do, to make something that really resonates with people and have an impact, and not get distracted. Everything else falls to the side.”

Asked about the recent exodus of senior executives amid reports of boardroom power struggles and disputes over the strategic direction of the business, Tetrick said: “If you look at any company, Apple, Nike, Tesla, they hired lots of people when they were growing fast, and those people left, the exact same story could have been written about any of those companies.”

It’s also easy to forget that Hampton Creek is not even six years old, added Tetrick, noting that “five and half years ago I was still sleeping on the couch with about $3,000 in my bank account. Then I got to work with these amazing people across a wide range of technologies doing things that hopefully wind up having a big impact one day, and when you do that, you learn about the right people to hire, the DNA that works well here and there’s a certain kind of DNA that works better here than others.”

Buybacks accounted for <0.5% of sales between 2013 and 2015

But what about the alleged buybacks? Did Tetrick send out legions of independent contractors to buy back truckloads of the company’s own products in 2014 under the auspices of a quality assurance program in order to give retailers and investors the impression that it had generated stronger sales than was in fact the case?

“When you separate these things out, it [the narrative that the company is lurching from one crisis to the next] begins to fall apart,” claimed Tetrick.

“So take the buyback issue, we have said publicly that we bought the products for QA [quality assurance] and QC [quality control] and also to see if we could stimulate sales momentum. We happen to spend more on QA and QC than on sales momentum. The third party auditor took a look at Bloomberg’s numbers and found they were incorrect.

“The perception was a thousand miles from reality. The reality is that they [a big four accounting firm, the DOJ and the SEC] and our investors looked at this, and they found that it [the sum spent on buybacks] was immaterial. There was no there, there, case closed. The amount spent on buybacks was less than half a percent of sales between 2013 and 2015.”

From a standing start in 2013, Hampton Creek’s products – from plant-based mayonnaise Just Mayo to cookies, cookie dough and salad dressings - have now reached 100,000+ points of retail and food service distribution, including 3,300 K12 schools, 500+ universities and colleges, fortune 500 cafes, stadiums, athletic arenas, government agencies, says the San Francisco-based company.

Target: There was no ‘there’ there

Asked about Target –which abruptly dropped Hampton Creek products earlier this summer after receiving anonymous information alleging food safety and labeling issues - the FDA had looked into the matter, and agreed that there was no case to answer, he said.

“The FDA looked into it and determined that there was no there there, and the matter was closed. All of our other customers got in touch with us and determined that there wasn’t an issue, but the [Bloomberg] article [which quoted allegations made in anonymous letters sent to Target and other retailers] is still out there, but that’s life.”

(Since our conversation with Tetrick, Target has confirmed to FoodNavigator-USA that it will not, however, be bringing Hampton Creek's products back to its stores, although it confirmed that the FDA has no safety concerns at this time.)

"Earlier this summer, we received specific and serious food safety allegations about Hampton Creek products. We immediately shared this information with the FDA out of an abundance of caution for our guests, pulled all of the company’s products from Target stores and Target.com. Recently, the FDA closed its file on Hampton Creek products. Although the FDA is not pursuing this further, we used the opportunity to review our portfolio, as we regularly do, and decided to reconsider our relationship with Hampton Creek. We are not planning to bring Hampton Creek products back to Target and have openly communicated our decision with the Hampton Creek team."

Jenna Reck, senior communications manager, Target

"With Target telling the media they stopped selling our products because of food safety issues, we felt there was a necessity to share the FDA’s conclusion, so we did. We shared a simple message: The FDA has no safety concerns, and the matter is closed. We shared it for our consumers, for partners, and for our team. We’ve received tens of thousands of messages from consumers (many from folks who do not shop at Target) asking about this issue, so we shared it widely. To our surprise, Target informed us that sharing with the public the FDA’s conclusion that our products are safe somehow violated Target's vendor communication guidelines. Target told us this is what drove their decision to end our relationship, in spite of their pledge to bring back the products once the FDA confirmed their safety.

"Target represents a fraction of overall sales, a single digit percentage of sales, we're in 20,000 retail doors) including Walmart, ShopRite, Publix, Safeway, HEB, Ahold, Kroger, Whole Foods, Amazon (so many others). Retail is less than 50% of our overall business."

Josh Tetrick, CEO, Hampton Creek

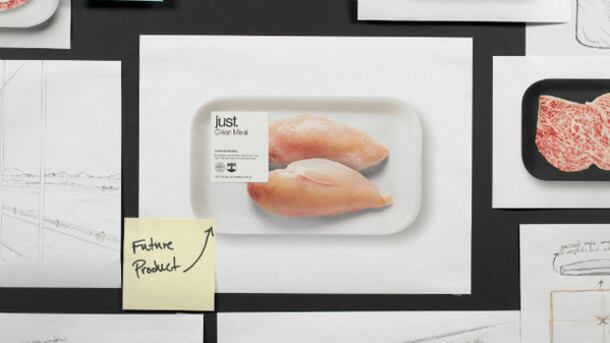

Clean meat: ‘You can’t just go and find a co-packer…’

As for Hampton Creek’s recent move into cultured (a.k.a. ‘clean’) meat, is this a bold move into a logical adjacency for a company looking to disrupt the food system and take on industrialized animal food production, or is it a risky distraction?

First of all, while clean meat clearly requires a new skillset, Hampton Creek already has other capabilities that standalone clean meat companies do not have, said Tetrick.

“If you were starting a clean meat company from scratch, you’d say we need analytical chemists, process engineers, product developers, chefs, plant biochemists who can work with plant materials to find alternatives to fetal bovine serum. And then you need to sell, distribute and market the product … we already have these capabilities …”

As for the actual manufacturing, he said, Hampton Creek has no plans to build its own commercial scale production facilities, and says meat companies are obvious partners in that while they are no experts in cellular agriculture, they do have expertise in handling, packaging, distributing, selling, and marketing meat.

‘We’re talking to upwards of 10 of the largest meat companies around the world. So the model is that we will create production facilities that we will jointly own with partners and then we’ll provide them licenses for a particular category for a particular period of time; we’ll also get royalties from their sales.”

While Hampton Creek works with co-packers to produce all of its finished products (mayo, dressings, cookies, cookie dough), the set up for clean meat would be slightly different, he said.

“Because of the significant proprietary technologies involved and the fact that there is not an existing infrastructure for clean meat production at scale, you can’t just go and find a co-packer.”

Building a team around clean meat

So who's working on 'clean' meat at Hampton Creek? According to senior director of communications Andrew Noyes: "Our cellular agriculture team leadership is well respected in the fields of molecular biology, bio-processing and genetics. They're part of our 60 member, multi-disciplinary R&D team. We're also actively hiring for a number of roles specific to cell agriculture. A few key leaders:

- Jason Ryder, interim CTO (oversaw manufacturing of 400,000L bioreactors at Amyris)

- Eitan Fischer, director, cellular agriculture (Yale University, Stanford University)

- Aparna Subramanian, senior scientist (UCLA, Stem Cell Biology)

- David Bowman (Rockefeller University, Virology)

- Thomas Bowman (Michelin star chef, Zagat 30 Under 30)

- Ishai Padawer, senior bioprocess engineer (drug development)

- Vivianne Lanquar, director, biochemistry (Carnegie Institution, Stanford)

- Meng Xu, Director, bioinformatics (PhD, computational biology)

- Hernan Jaramillo, VP, special projects (serial entrepreneur)."

‘We completed an acquisition to own foundational global IP around clean meat’

But if Memphis Meats doesn’t envisage launching higher-end clean meat products until late 2019, and won’t be in grocery stores until 2021, how is Hampton Creek – which only started looking at cultured meat last year – confident it will be able to bring products to market as early as 2018?

Has it cracked the code of finding a cost-effective plant-based alternative to fetal bovine serum? And has it proved that its clean meat technology is viable at a commercial scale?

Tetrick said he could not provide more details at this stage, but had identified a partner to work with on the initial clean meat launch, and had “bought in” some IP, although he could not share any more details: “We completed an acquisition to own foundational global IP around clean meat, and are developing additional IP around the media, cell line development and scaling up.”

Right now, Hampton Creek “has a handful of cell lines fairly close to the point where we could put them in a commercial facility and create products at a cost within 30% of a more premium product in the avian family,” he said, but stressed that the first move into the market would be small scale: “There won’t be clean blue fin tuna in every Walmart next year.”

Mung bean protein isolate

Another strategic focus for the business right now is the mung bean protein isolate that forms the basis of Just Scramble, a vegan alternative to scrambled egg (to be available as a liquid product and as a patty) that Tetrick says is set to launch by the end of Q1 next year.

“We’ve signed two term sheets with a couple of the biggest CPG companies in the world to enable them to use this mung bean protein isolate as an ingredient system in their products.”

While Hampton Creek has pilot facilities in its San Francisco HQ, it’s not planning to manufacture the protein on a commercial scale, and is working with an unnamed third party manufacturer to produce the spray dried protein powder using its technology via a tech transfer agreement, he said.

“So we’ll be sourcing the raw mung beans, running them through a proprietary protein process at [the third party manufacturer] and selling the ingredient to CPG manufacturers. We’ll also get royalties for every sale that they make when they use our ingredient system, plus we’ll also show them how it works in any given system, whether it’s ice cream or butter.”

Secret sauce

So what is Hampton Creek? A CPG company? A sales and marketing company? A technology company? An ingredients manufacturer?

“At the end of the day,” said Tetrick, “We’re solving problems. To consumers we’re a food company. To a General Mills, we’re a hybrid food tech company that offers them an important solution for their food products.”

But could anyone else make the products that Hampton Creek makes (via its network of co-packers) using commercially available ingredients, or is there secret sauce in all of these products that utilizes all the cool plant-screening technology and know-how that the firm keeps highlighting in media calls?

“There are some other ingredients in the products we have some IP around aside from yellow pea protein,” said Tetrick. “They might not jump out at being relevant for functionality, but we’ve sourced and have a role in processing them and they make the difference between these product working and not working.”

How does Hampton Creek decide what to pursue next?

As for new ingredients and finished products that could emerge from Hampton Creek’s technology platform, he said, there are very clear criteria.

“For finished products, we ask, is it beating the premium incumbent on a holistic sensory test? Do we have a pathway to see $150m in sales in five years? Is the gross margin upwards of 40-50% so that we can do it profitably? Is it intrinsically having a social and environmental impact? Does it feel like us? So gourmet yogurt isn’t us. Does it have the ability to expand the category rather than just taking market share?”

When it comes to ingredients, such as new plant-based proteins, he said,“We ask questions like, What’s the environmental footprint of the plant? Is it cultivated on a large scale and can we control the sourcing? What’s the yield of the protein?

“Is there a market for the co-products? So for example, we don’t want to manufacture tons of mung bean protein if there’s no market for the starch [the bulk of what’s left over after the protein has been extracted]. So we’re looking at the functionality of the starch because we don’t want to throw it away.”