In an online poll of 1,000 US adults conducted in August by Lincoln Park Strategies for the International Food Information Council supported by Danone North America PBC:

- 75% said soymilk and almondmilk did not contain cow’s milk, with 16% unsure and 9% believing they did contain cow’s milk.

- 74% said coconutmilk did not contain cow’s milk, with 18% unsure and 8% believing it did contain cow’s milk.

- 73% said ricemilk did not contain cow’s milk, with 20% unsure and 7% believing it did contain cow’s milk

- 70% of consumers said cashewmilk did not contain cow’s milk, with 20% unsure and 8% believing it did contain cow’s milk.

Levels of confusion about dairy milk equally high

However, a significant minority of consumers were equally unsure if dairy-milk products contained cow’s milk, with 22% unsure if ‘nonfat milk’ contained cow’s milk or believing it doesn't; 26% unsure if ‘skim milk’ contained cow’s milk or believing it doesn't; and 15% unsure if ‘chocolate milk’ contained cow’s milk or believing it doesn't; and more than half of respondents not sure if ‘lactose-free milk’ actually contained cow’s milk or believing it doesn't.

NMPF: ‘Close to 30% of people don’t know or incorrectly assume origins of plant products labeled as milk’

The level of confusion about both sets of products arguably just reflects the fact that if you ask consumers a question about the provenance of any product you immediately sow seeds of doubt in their minds (the question was: Of the products below, which do you think contains cow’s milk?)

However, the data does not support the oft-used argument that ‘no one is confused about what’s in plant-based milks,’ argued the National Milk Producers Federation.

“Close to 30% of people either don’t know or incorrectly assume the origins of plant products labeled as ‘milk,’” Chris Galen, SVP communications at the NMPF, told FoodNavigator-USA.

“That is hardly an acceptable level of uncertainty or confusion. Although NMPF has not been making the argument that consumers are confused about the source of plant ‘milks,’ this research indicates that it’s actually a legitimate concern.”

Survey didn’t ask about nutritional equivalency

More importantly, argued Galen, the survey failed to ask consumers about the nutritional merits of plant-based vs dairy milks, an area in which the NMPF argues that misconceptions abound.

“This survey does nothing to address the underlying concern we have expressed – and importantly, that the FDA itself has raised – about whether consumers understand the nutritional inconsistencies between real milk and the imitators, and how the plant foods are frequently deficient in many nutrients offered by milk.”

He added: “It’s puzzling why Danone, a company that makes both dairy foods and plant-based imitations, would not ask questions about whether consumers understand the level of nutritional disparities between the categories. I suspect they didn’t want to be confronted with the answer.”

PBFA: 78% of cow’s-milk drinkers agree that ‘milk’ is the most appropriate term for products such as soymilk and almondmilk

Plant-based brands however say that the whole debate has nothing to do with consumer confusion and everything to do with dairy farmers trying to protect their turf.

In a comment to the FDA – which has promised to “provide greater clarity on appropriate labeling of plant-based alternatives,” the Plant Based Foods Association said its research showed that “78% of cow’s-milk drinkers agree that the word ‘milk’ is the most appropriate term for products such as soymilk and almondmilk.”

It added: “Our use of the term is not meant to diminish the value of cow’s milk produced by dairy farmers, but rather to use terms that have been understood and accepted in the marketplace as the common and usual name for more than 30 years.”

North Carolina agriculture commissioner Steve Troxler, however, berated the FDA for failing to enforce federal standards of identity for milk (which limit the term to the lacteal secretions of cows – although some courts have concluded that modifiers before the word ‘milk’ such as ‘almond’ or ‘soy,’ coupled with disclaimers such as ‘plant-based’ or ‘non-dairy’ clear up any possible confusion).

He added: “The absence of consistent enforcement allowed deceitful marketing to become commonplace and FDA is responsible for the current misinformation among consumers. Mislabeled plant-based beverages enjoy the halo effect of real milk and because of its well-known nature, the health benefits of milk are falsely conferred upon such products.”

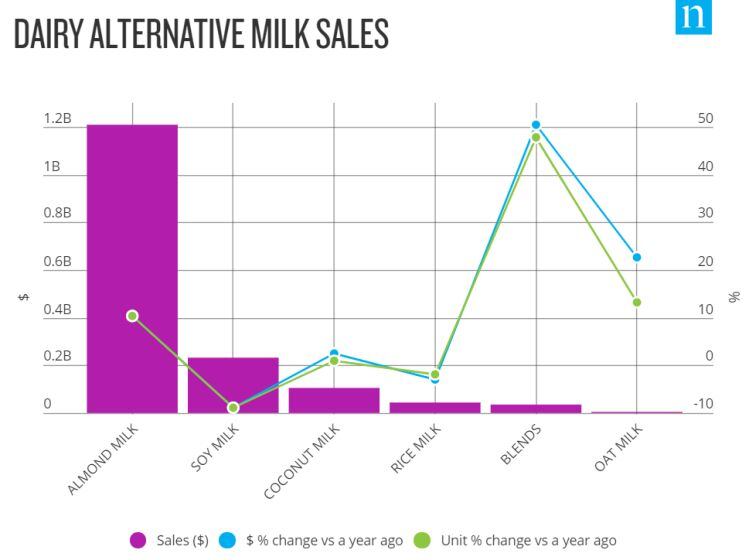

Califia Farms on almondmilk industry sales: 11% growth in the grocery world is a rocketship

According to Nielsen data shared with FoodNavigator-USA for the 52 weeks to August 25, 2018, US retail sales of milk alternatives (all outlets combined, excluding c-stores) were up 9.2%, with almondmilk – by far the largest segment - up 11.5%, blends up 45.4%, oatmilk up 35.5%, coconutmilk up 1%, ricemilk down 2.3%, and soymilk down 7.9%.

Dan Mader, SVP sales at Califia Farms, which makes a variety of almondmilks and almondmilk blends, told FoodNavigator-USA: “11% growth in the grocery world is a rocketship. The velocities are there, the margins are there, the category has a lot of momentum behind it.”

Califia – which sells 10.5oz single serve products including probiotic drinkable yogurts, cold brew coffee and almondmilk blends, and protein infused almondmilks as well as multiserve milks for grocery – has also been pushing aggressively into the convenience channel over the past 12 months, picking up business at nearly 9,500 gas stations, c-stores and drug stores nationwide, including Rite Aid, 7-Eleven, ampm, CVS, Circle K, and Chevron ExtraMile, said Mader.

“They know they need to stay relevant for Millennial consumers, and they don’t want the same brands they were buying 10 years ago. It’s not that they are specifically looking for ‘plant-based’ beverages, they just want new health and wellness products – so we’ll be stocked in the grab & go fresh deli case alongside boiled eggs, salads, juice, and cold brew coffee, or in the main beverage vault by waters, juices, kombucha, cold brews and so on – or in both sets. We’re a premium, but attainable, brand.

“The great thing about the convenience channel is that it drives trial of the brand, and that helps build the rest of the business in other channels as well."

‘This is not about consumers being harmed or deceived, but a legacy industry defense’

While Califia’s pea- and brown rice protein infused Choc-a-maca and Maca-Vanilla almondmilk SKUs were performing well at chains such as 7-Eleven, the idea that plant-based milks in general were nutritionally deficient because they contain less protein than dairy milk was a misnomer, he argued.

“You’d be hard pressed to find a doctor that telling people that Americans are protein deficient. The bigger issue is sugar.”

Asked whether he was losing sleep over the prospect of a possible FDA crackdown on plant-based ‘milk’ labeling, Mader said: “I don't see it having a material impact. You can’t put the genie back in the bottle. Ultimately, this is not about consumers being harmed or deceived, but a legacy industry defense.”